Xero Referral Code

Click the Xero referral link above or here and signup for Xero Accounting and get your first 6 months with 75% discount. Discount will be automatically applied by following the referral link.

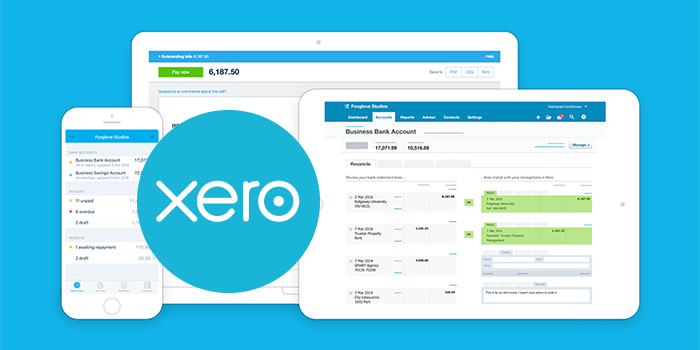

Healthy businesses need healthy bookkeeping. And Xero can help busy organisations keep their accounting in the best shape possible. Xero is an accountancy software suite that lets you manage your finances in real-time to save you time and money. And to help you save even more, signup to Xero by following this Xero referral link to get 75% off your subscription for 6 months.

In reality, Xero Accounting offers more than just accountancy software. It helps companies manage their everyday business – from paying bills, and completing returns to expense claims and so much more. And with over 3.5 million subscribers and growing, we know they’re a software service that’s tried, tested and trusted.

Xero works for small businesses, accountants, and bookkeepers but there are features to support many types of users and subscription plans to match. But let’s look more closely at some of Xero’s features to show you how it can streamline your own business.

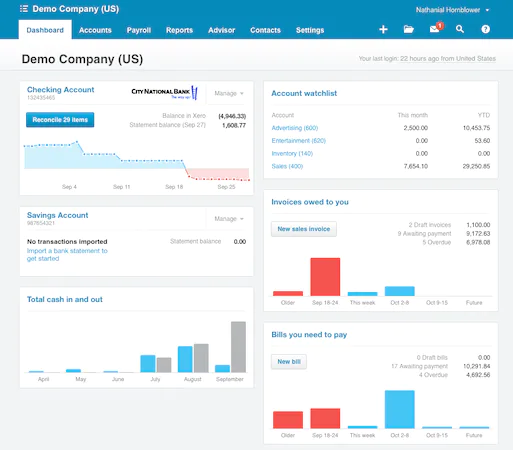

If paying your bills in a timely manner is something you’d like to prioritise, Xero can help. You can track and pay bills on time and get a clear overview of accounts and cash flow. It also allows you to batch payments and schedule them in advance. And if you ever need to check a bill payment, or get an overview of unpaid bills, expenses, and purchase orders, you can do so online from anywhere using the Xero site or app. Plus, Xero can help you get on top of your cash flow and avoid late fees.

Let’s face it, VAT returns are a headache, but Xero can take some of the strain off your shoulders by calculating VAT and filing VAT returns directly and securely with HMRC. It almost sounds too good to be true, but we can assure you it’s not. Xero uses HRMC-compatible software to calculate the VAT on transactions and also populates and submits VAT returns online in a clear, easy-to-understand layout. You can then accurately track, manage and make adjustments to VAT on invoices and bills.

And if that didn’t sound impressive enough, Xero can capture expense claims. This allows you to check and manage your employee’s expenditure in an efficient way through the easy-to-use expense management tools. Employees can submit paperless expense claims while they’re on the go by scanning receipts into auto-filled expense claims, tracking and recording mileage, and then Xero allows managers to review and reimburse this expenditure quickly and efficiently. It also helps with financial forecasting and budgeting to allow a greater handle on your business’s cash flow.

But that’s not all. Xero connects with your company’s bank to set up feeds, allowing transactions to flow straight into Xero for access to your financial overview in a safe and reliable way. By connecting with Stripe, GoCardless and others, you can accept payments online through Xero’s ‘Pay now’ button. Xero also helps users track projects by quoting, invoicing and getting paid for jobs with their project and job tracker software. Tools like that really help when you have an overview of the costs and profitability of a project when making key decisions.

And that’s not all. Xero has a raft of other features, such as payroll, bank reconciliation, contact management, data capture, file organisation, reporting and inventory, and purchase orders, and it can provide instant conversions to help you get paid in over 160 currencies.

The best part of Xero? You don’t have to be an accountancy whizz or computer nerd to understand it. Colleen from Evansdale Cheese Company says, ‘Xero is fantastic. The last software we had was so expensive and hard to use.’ And with subscription plans starting from only £7 a month for 6 months, we couldn’t agree more.

And since we’re on the topic of money management, don’t forget to sign up for Xero by following this Xero referral link to get 75% off your subscription for 6 months.

Recent Comments