Freetrade Free Share

Click the Freetrade referral link above or here and once you have registered and deposited at least £50 into your account you will get a free share worth up to £100 within 7 days.

WHEN YOU INVEST YOUR CAPITAL IS AT RISK

Freetrade: The UK’s Leading Commission-Free Investing Platform

Freetrade is one of the UK’s most popular commission-free trading platforms, offering users an easy way to invest in stocks, ETFs, and more without paying hefty fees. Since launching in 2016, it has democratised access to the stock market, making investing more accessible to beginners and experienced traders alike. Whether you’re looking to build a long-term investment portfolio or dabble in trading individual shares, Freetrade offers a user-friendly platform to help you get started.

Why Freetrade Stands Out

- Commission-Free Trading

Freetrade offers commission-free trading on (a subset) of UK and US stocks, which is a major plus for those who want to invest without paying high fees for each transaction. This makes it a great option for beginners or anyone who wants to invest smaller amounts without worrying about losing money to commissions. - Fractional Shares

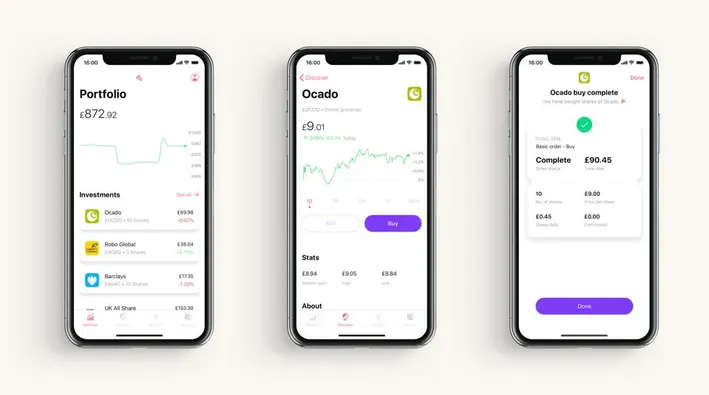

For those who can’t afford or don’t want to buy whole shares of expensive companies like Amazon or Tesla, Freetrade allows you to purchase fractional shares. This means you can invest as little or as much as you want, allowing more flexibility in your investment strategy. - Simple and Intuitive Interface

Freetrade’s app is designed with simplicity in mind. The platform is clean, intuitive, and easy to navigate, making it perfect for beginners who may feel intimidated by other complex trading platforms. - Wide Range of Investments

Freetrade offers access to thousands of UK and US stocks, ETFs, and investment trusts. Whether you’re looking to invest in major companies or diversify your portfolio with ETFs, there are plenty of options available. - ISAs and SIPPs

Freetrade also offers tax-efficient investment accounts, including Stocks and Shares ISAs and Self-Invested Personal Pensions (SIPPs), so you can grow your investments while minimizing tax liabilities.

The Exciting Freetrade Free Share Offer: How to Claim Your Free Stock

Freetrade has a fantastic offer for new users: sign up using the referral link and you’ll receive a free share worth between £10 and £100. This is a no-brainer for anyone who is thinking about getting into investing, as you are essentially getting free money just for opening an account.

Here’s how it works:

- Sign Up – Use the referral link to sign up for Freetrade.

- Fund Your Account – Once your account is created, you’ll need to deposit at least £50 to be eligible for the free share.

- Receive Your Free Share – After your account is funded, Freetrade will credit your account with a free share randomly selected from a pool of popular companies like Apple, Tesla, or even UK stocks like Greggs or Fevertree.

This free share can be worth anywhere between £10 and £100. It’s a great way to kickstart your investment portfolio and get a feel for the platform without having to commit large amounts of money upfront.

Benefits of the Free Share Promotion

- Low Barrier to Entry

One of the biggest advantages of this offer is that the entry point is extremely low. You only need to deposit £1 to receive your free share, which makes it accessible for virtually anyone. - Diverse Pool of Stocks

The free share you receive is randomly selected, but it’s always from well-known and established companies. This means your free share could potentially grow in value over time, giving you a head start in your investing journey. - Immediate Investment Experience

For those new to investing, this offer provides an opportunity to see how investing works firsthand. It’s a risk-free way to begin learning about the stock market while building your confidence as an investor.

The Freetrade Plus Subscription

While Freetrade is free to use, they also offer a premium service called Freetrade Plus for £9.99 per month (if paying yearly). With Freetrade Plus, you get access to additional features such as:

- A wider range of stocks, including more small-cap and AIM-listed companies.

- Access to a Stocks and Shares ISA for tax-free investing.

- Priority customer service.

- Higher interest rates on cash balances held in your account.

For serious investors, the Plus subscription may be worth considering to unlock even more features and investment opportunities.

Is Freetrade Right for You?

Freetrade is designed primarily for individual investors who are looking for an easy and low-cost way to invest in stocks, ETFs, and other assets. Its target audience spans different levels of investors, including:

- Beginner Investors:

- Freetrade’s Basic plan (free) is ideal for people new to investing. The platform provides a straightforward, user-friendly app that simplifies buying and selling stocks without overwhelming users with too many advanced features. Beginners can invest small amounts (through fractional shares) without worrying about commission fees.

- Casual Investors:

- Freetrade caters to casual investors who want to grow their portfolios over time without paying high fees. The commission-free trades and basic market data make it accessible for people who want to occasionally invest without complex research tools.

- Long-Term and Tax-Efficient Investors:

- With the availability of a Stocks and Shares ISA and a SIPP in higher plans (Standard and Plus), Freetrade is designed for people focused on long-term investments. These tax-efficient accounts appeal to individuals looking to invest for retirement or grow their savings without paying capital gains or dividend taxes.

- Mobile and Tech-Savvy Users:

- Freetrade’s app-based platform is perfect for users who prefer managing their investments on the go. With a clean, intuitive mobile interface, it is designed for those comfortable handling their finances digitally.

- Cost-Conscious Investors:

- Freetrade is aimed at investors who are keen on keeping their investment costs low. The absence of commission fees on trades, combined with relatively low subscription fees, makes it a good option for those trying to avoid the hefty fees typically associated with traditional brokers.

Freetrade’s range of plans and features, from the free basic option to advanced tools in the Plus plan, makes it a versatile platform suitable for a wide range of investors—from casual to more experienced.

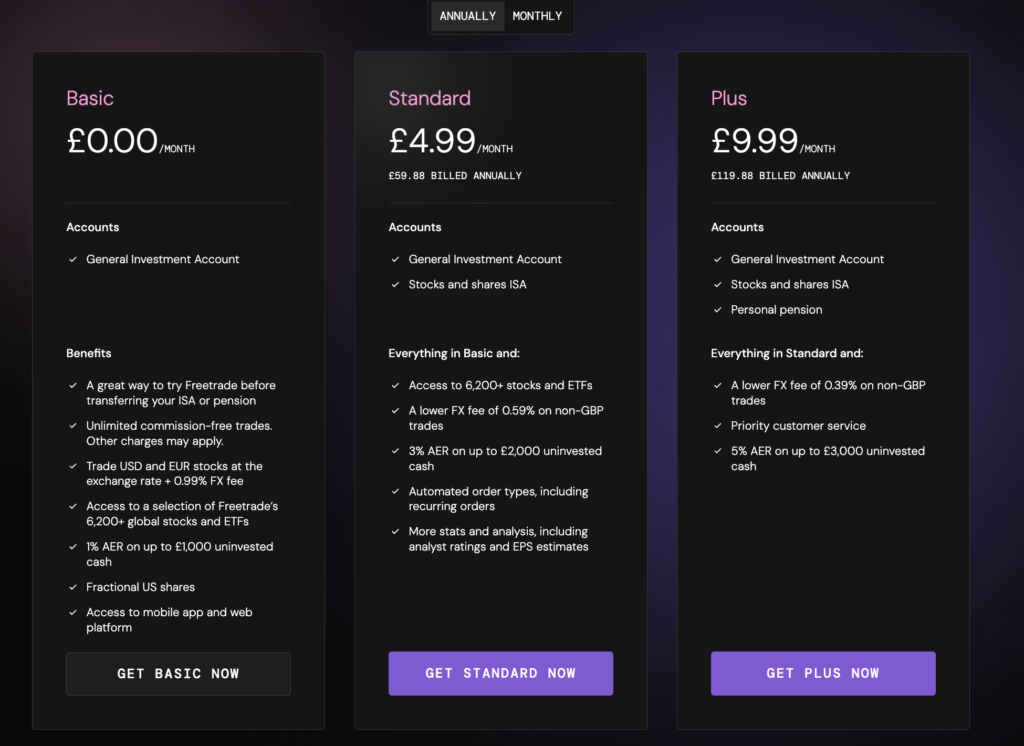

Freetrade pricing options

Freetrade offers three pricing plans designed to suit different types of investors. Here’s a breakdown of each plan’s features and costs:

- Basic Plan (Free):

- Cost: £0/month

- Features:

- Access to a General Investment Account (GIA).

- Unlimited commission-free trades.

- Foreign exchange (FX) fee of 0.99% on non-GBP transactions.

- 1% interest on uninvested cash (up to £1,000).

- Access to a selection of over 6,200 global stocks and ETFs.

- Basic investment features via the mobile app.

- Best for beginners looking to try out the platform without commitment.

- Standard Plan (£5.99/month or £59.88/year):

- Cost: £5.99/month (or £59.88 annually for a 17% discount).

- Features:

- All the benefits of the Basic plan.

- Access to Stocks and Shares ISA.

- Lower FX fee of 0.59% on non-GBP trades.

- 3% interest on uninvested cash (up to £2,000).

- More detailed stock analytics, including analyst ratings and earnings estimates.

- Automated order types like recurring orders.

- Ideal for investors looking to maximize tax-free savings through an ISA.

- Plus Plan (£11.99/month or £119.88/year):

- Cost: £11.99/month (or £119.88 annually).

- Features:

- Includes everything from the Standard plan.

- Access to Stocks and Shares ISA and a Personal Pension (SIPP).

- Even lower FX fee of 0.39%.

- 5% interest on uninvested cash (up to £3,000).

- Priority customer support and additional tools for advanced trading, including desktop platform access.

- Best suited for advanced investors seeking more features, including tax-efficient pension options and priority support.

These pricing options provide flexibility based on the investor’s needs, from free access for casual users to enhanced benefits for more serious traders and long-term investors

Freetrade Sign Up Process

To sign up for Freetrade and ensure you receive the free share (valued between £10 and £100), follow these steps:

1. Use the Referral Link

To qualify for the free share, you must sign up through a referral link. Here’s a working referral link: Freetrade ReferralLink. Make sure to click on this link to begin the sign-up process.

2. Download the Freetrade App

Freetrade is a mobile-first platform, so after clicking the referral link, you’ll be prompted to download the Freetrade app on your iOS or Android device. Install the app before proceeding.

3. Create an Account

Once the app is downloaded:

- Open the app and create your account.

- You will need to provide basic personal information (name, email, address, date of birth) and verify your identity using official documentation (passport, driver’s license, etc.) as Freetrade is a regulated financial platform.

4. Fund Your Account

To be eligible for the free share, you’ll need to fund your account after signing up. This can be done using bank transfer, Apple Pay, or Google Pay. There is no minimum deposit amount to qualify for the free share, but make sure you fund the account soon after signing up.

5. Receive Your Free Share

After funding your account, the free share will be assigned to you. The value of the free share will range between £10 and £100. The free share is typically allocated within 7-10 days of your first deposit, and you can view it directly in your Freetrade portfolio.

6. Enjoy and Start Investing

Once the free share is allocated, you can choose to hold it, sell it, or buy more shares in different stocks and ETFs using Freetrade’s commission-free trading.

Tip: Make sure to remain within the app during the sign-up process to avoid missing out on the free share offer.

For further details on Freetrade’s services, pricing, and promotions, always refer to their official website

How Safe Is Freetrade?

Freetrade is a regulated financial services company, which means it is subject to strict rules and regulations designed to protect the interests of its users. Some of the measures in place to ensure the safety of your investments include:

- Regulatory oversight: Freetrade is authorized and regulated by the Financial Conduct Authority (FCA), the UK’s financial regulator. This means that the company is subject to regular audits and inspections to ensure it is operating in a safe and secure manner.

- Segregated accounts: Freetrade keeps your money separate from its own funds in a segregated account, so if the company were to go bankrupt, your money would be protected.

- Secure infrastructure: Freetrade uses secure servers and encryption to protect your personal and financial information, so you can be confident that your data is safe and protected.

- Insurance: Freetrade has insurance in place to protect your investments in the unlikely event of a system failure or other unexpected event. This provides an additional layer of protection for your money.

Remember when we say Freetrade is safe to use – we mean your money is safe should something go wrong with the platform. That aside – remember investing in the stock market carries some level of risk, and the value of your investments can go up or down. As with any investment, it’s important to do your own research and carefully consider the risks before investing your money

Pros and Cons of Using Freetrade

Here are the up-to-date pros and cons of using Freetrade, especially compared to other popular investment platforms in the UK such as Trading 212, eToro, and Hargreaves Lansdown:

Pros of Using Freetrade

- Commission-Free Trading:

- Freetrade offers unlimited commission-free trades on UK and US stocks and ETFs, which is appealing to both new and experienced investors. This makes it competitive with other platforms like Trading 212 and eToro that also offer commission-free trading.

- User-Friendly App:

- Freetrade’s mobile app is praised for its clean, intuitive design and ease of use. The app is simple, making it a great choice for beginners who might find more advanced platforms overwhelming.

- Fractional Shares:

- Investors can purchase fractional shares of expensive stocks, allowing them to invest small amounts in high-priced stocks like Amazon or Tesla. This feature is beneficial for those with smaller budgets.

- Tax-Efficient Accounts (ISA & SIPP):

- Freetrade offers a Stocks and Shares ISA and a SIPP (Self-Invested Personal Pension), providing tax-efficient ways to invest for long-term goals like retirement. This gives it an edge over some competitors that may not offer such accounts (e.g., eToro does not offer an ISA)

- Free Share Referral Program:

- New users can receive a free share worth between £10-£100 when they sign up through a referral link, adding extra value for new customers.

- Interest on Uninvested Cash:

- Freetrade Plus subscribers can earn up to 3% interest on cash held in their accounts (up to £4,000). This is a unique feature compared to other platforms, many of which don’t offer interest on cash balances.

- Freetrade Plus subscribers can earn up to 3% interest on cash held in their accounts (up to £4,000). This is a unique feature compared to other platforms, many of which don’t offer interest on cash balances.

Cons of Using Freetrade

- Limited Research and Analysis Tools:

- While Freetrade offers some basic market data, it lacks advanced research tools that other platforms (e.g., Hargreaves Lansdown) provide. Investors looking for detailed stock analysis and educational resources may find Freetrade insufficient.

- FX Fees for Foreign Investments:

- Freetrade charges a foreign exchange fee of 0.45% for non-GBP trades, which is higher than competitors like Trading 212, which charges 0.15%. This can add up for frequent traders who focus on US or international stocks.

- No Desktop Trading for Basic and Standard Plans:

- Freetrade is primarily an app-based platform. Only Freetrade Plus subscribers have access to a desktop trading interface. Competitors like Trading 212 and eToro offer both mobile and desktop platforms for all users.

- Fewer Investment Options:

- While Freetrade offers a wide range of stocks and ETFs, it doesn’t provide access to other asset classes like cryptocurrencies, commodities, or CFDs, which platforms like eToro and Trading 212 offer. This makes Freetrade less suitable for investors looking for diversification across different asset types.

- No Instant Deposits:

- Freetrade only supports bank transfers, Google Pay, and Apple Pay for deposits, and these can take time to process. In contrast, platforms like eToro and Trading 212 offer instant deposits via credit cards, PayPal, and other faster methods.

- Advanced Features Are Paywalled:

- Some advanced features, like limit orders, stop-loss orders, and access to more stocks, are only available to Freetrade Plus subscribers, which costs £11.99/month. Other platforms, like Trading 212, offer these features for free.

- Some advanced features, like limit orders, stop-loss orders, and access to more stocks, are only available to Freetrade Plus subscribers, which costs £11.99/month. Other platforms, like Trading 212, offer these features for free.

Conclusion

In conclusion, Freetrade is a compelling investment platform for those seeking a cost-effective, beginner-friendly way to invest in stocks and ETFs. Its commission-free trading, fractional shares, and user-friendly app make it accessible for new investors and casual traders alike. The addition of tax-efficient accounts like the Stocks and Shares ISA and SIPP make it particularly appealing for long-term, UK-based investors looking to save for retirement or other financial goals.

However, Freetrade does have limitations compared to its competitors. The higher foreign exchange fees and the paywalling of advanced trading tools in its Plus plan may deter more experienced investors who require broader tools and asset classes. Additionally, the lack of cryptocurrencies or commodities limits its appeal for those seeking more diverse investment opportunities.

Ultimately, Freetrade is a great option for those who value simplicity and low fees, especially those focused on long-term investing with a focus on ISAs and SIPPs. It may not be the best fit for investors looking for more advanced features or immediate access to a broader range of asset classes

Don’t miss out! Sign up with the Freetrade referral link today and get a free share worth between £10 and £100. Whether you’re new to investing or looking for a commission-free platform to diversify your portfolio, Freetrade offers the tools and resources to help you succeed.

Frequently Asked Questions

How do I get a Freetrade free share when joining?

To get a free share you need to use the freetrade referral link: https://magic.freetrade.io/join/faisal/4953c3fc before registering.

What is the value of the Freetrade free share?

If you use the referral link https://magic.freetrade.io/join/faisal/4953c3fc you will get a free share stock worth between £3 – £100. This will be randomly selected by Freetrade.

How long does it take to receive your freetrade free stock?

Normally once you have registered by following the freetrade referral link https://magic.freetrade.io/join/faisal/4953c3fc you will get a notification that you have a mystery free stock. This will then gets released to your share account within 7-10 days.

What is the criteria to to take part in the Freetrade.io free share promotion?

In order to get a Freetrade Free share you need to register by following this link https://magic.freetrade.io/join/faisal/4953c3fc and then registering and depositing at least £50. Once you have deposited the money you should get your free share confirmed within 24 hours.

Recent Comments