Anna Referral Code: UT71853

Click the Anna Money referral link above or enter the Anna Referral Code: UT71853 during signup to activate an additional month’s free subscription to Anna.Money app

ANNA Business Bank Account Review – Best for Small Business?

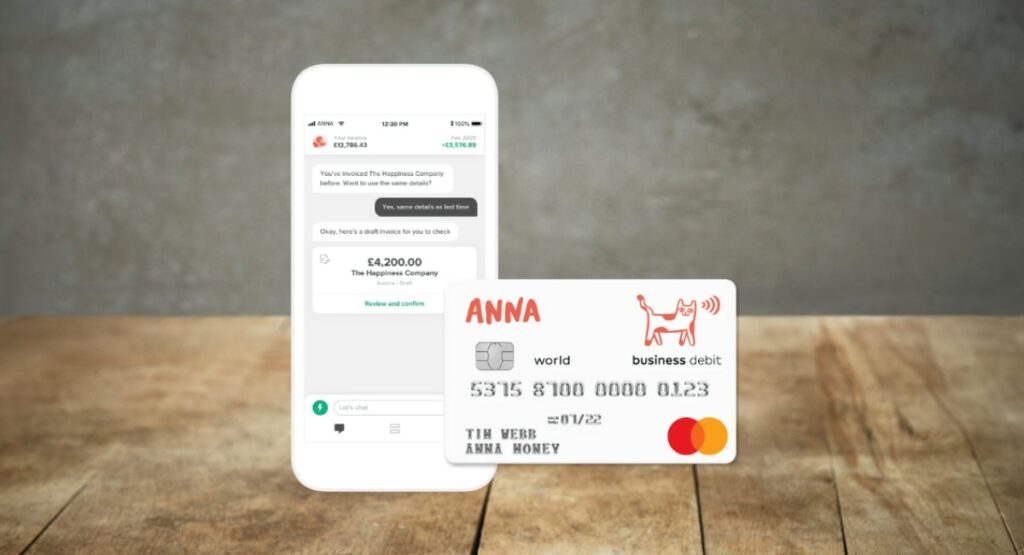

When it comes to online banking, the ANNA business bank account stands out as a forward-thinking digital option for small businesses and freelancers. With its user-friendly app, competitive fees, and a suite of business-centric features, ANNA helps business owners streamline financial management and empowers entrepreneurs to focus on what matters most – growing their businesses.

But is this app the best option for your business banking? Let’s delve into our detailed review of the ANNA business bank account to uncover its strengths, drawbacks, and whether it suits your business requirements.

What is the ANNA Business Bank Account?

ANNA stands for “Absolutely No Nonsense Admin”, which should give you a clear idea of the app’s streamlined approach to finances for freelancers and small business owners. With a speedy sign-up process and a straightforward, no-nonsense approach to transactions and admin, ANNA business bank accounts have been designed to provide a streamlined process for busy users looking for both accuracy and speed.

With an estimated 10-minute account opening process, the ANNA business banking app is simple to use, and you don’t have to wait for a credit check before you can get started using your account.

What Are The Key Features of the ANNA Business Account?

Before we dive into our Anna Business Bank account review in detail, let’s take a brief look at the stand-out features available. UK freelancers and small business owners can benefit from:

- A speedy account setup process that can take up as little as 10 minutes of your time!

- Access to an online business account with no monthly fee.

- 1% cashback on selected business spending.

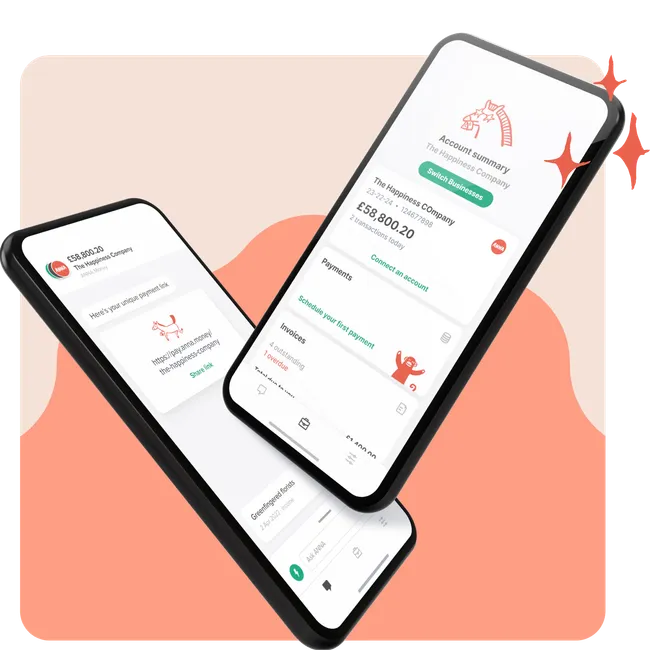

- Instant payment link set up, so you can receive business payments right away.

- Neat and reconciled business accounts to help you with HRMC submissions.

- Create professional business invoices quickly and easily.

- Connect other personal and business bank accounts to your ANNA account.

- An easy-to-use, streamlined business banking app.

- 24-hour customer support via the ANNA business account app.

If you are a small business owner looking for a quick and no-cost way to receive and make payments, then this no-fuss finance app could be the right fit for you. Now, let’s delve into the specifics of the ANNA business account.

How does this Business Banking App Work?

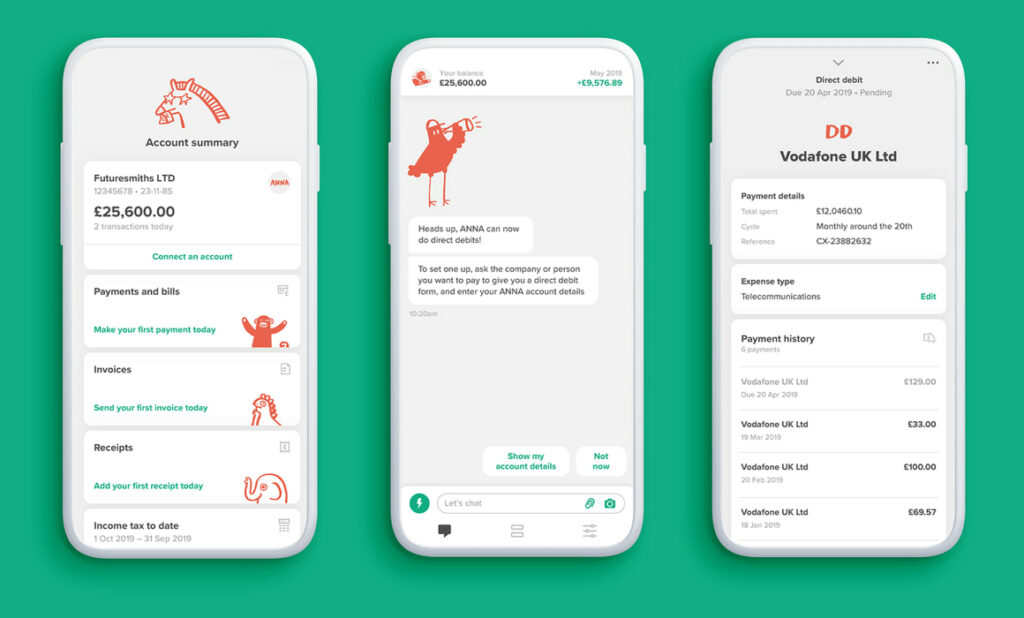

ANNA is a business banking app designed specifically for sole traders, freelancers, and small business owners in the UK. With its user-friendly interface, comprehensive features, and competitive pricing, the app aims to simplify money management and streamline everyday business operations.

With a comprehensive suite of features, including invoice creation and management, payment reminders, direct debit setup, and expense tracking, ANNA empowers businesses to operate efficiently.

Additionally, its competitive pricing plans, (including a free account option), make it a great choice for small businesses looking to keep outgoings as low as possible.

Is Anna Business Banking a UK Based Account?

ANNA Business Banking, despite its name, is not a traditional bank but rather an e-money provider licensed by the Financial Conduct Authority (FCA). This distinction is crucial as it impacts the level of protection offered to account holders.

While the e-money provider status enables ANNA to offer a Mastercard debit card for spending in the UK and abroad, it also means that your money is NOT covered by the FSCS (Financial Services Compensation Scheme). This means that in the event of ANNA’s insolvency, any deposits would not be protected. That said – Anna money deposits your money in a 3rd party account and is not invested and loaned out so ‘should’ be considered relatively safe.

What Types of Businesses will Benefit from this Type of Account?

ANNA’s features align well with the needs of small businesses and freelancers seeking a user-friendly, feature-rich, and affordable banking solution. Its intuitive app, comprehensive features, and competitive pricing make it an attractive option for businesses that prioritise convenience and cost-effectiveness.

However, its limited FSCS protection and restricted foreign currency options may not suit larger businesses seeking comprehensive financial protection or frequent foreign currency transactions. Larger companies with complex financial needs may prefer an account with a more traditional bank with broader features and coverage.

What Features Are Available with an ANNA Business Account?

There are three different account options available with ANNA business banking, one free and two with a subscription cost. Here is a breakdown of the different features available with ANNA business banking and what is available with each account plan.

ANNA Pay As You Go Account – No monthly fee.

- No monthly fee. Simply pay for what you use, with no hidden charges.

- 50 free local transfers per month, then pay 20p per additional transfer.

- 3 free ATM withdrawals per month, then pay £1 per additional withdrawal.

- £5 for SWIFT payments.

- 1% currency conversion fee.

- Accept payments securely and efficiently through your unique payment link (with a 1% commission.)

- Up to 5 debit cards, with the first one included for free and additional cards costing £3 per month.

- Deposit cash into your ANNA account with a 1% fee.

- Organise your finances effectively using pots, with a £1 monthly fee per pot.

- Earn 1% cashback on select spending categories for your business purchases.

ANNA Business Banking Account – £14.90 (plus VAT) per month (Get one month free with Anna.Money Referral Code: UT71853 during signup)

- 1 month free and then £14.90 + VAT per month.

- Built-in tax and bookkeeping tools to help you manage your tax obligations.

- Make 50 free transfers per month, then pay 20p per transfer after that.

- 3 free ATM withdrawals per month, then pay £1 per withdrawal after that.

- 1 free SWIFT payment and subsequent payments costing £5 each.

- Convert currencies at a competitive 1% fee.

- Accept payments securely through your unique payment link with free usage up to £200 per month, then 1% commission after that.

- Up to 5 inclusive debit cards, with additional cards costing £3 per month after that.

- Free deposits up to £300 per month, then 1% commission after that.

- Organise your finances effectively with 2 free pots and £1 per pot per month after that.

- Earn 1% cashback on select categories of purchases.

Big Business Account – £49.90 per month (plus VAT.)

- Unlimited free bank transfers.

- Free, unlimited ATM withdrawals.

- 4 SWIFT payments for free each month, with £5 charge per payment after this.

- International transactions with a competitive 0.5% currency conversion fee.

- Unlimited, commission-free payment link.

- Issue unlimited free debit cards to streamline business operations and expense tracking.

- Commission-free deposits, eliminating the need for third-party services.

- Organise your finances effectively using unlimited pots to categorise and manage funds.

- Earn 1% cashback on select categories of purchases, boosting your business’s bottom line.

- Unlimited pots for saving and financial organisation.

Which Option is Right for You?

ANNA Pay As You Go Account: This is the best option for businesses that have simple financial needs and want to avoid monthly fees. It is also a good option for businesses that only make a few international payments each month.

ANNA Business Banking Account: This is a good option for businesses that want a more comprehensive banking solution with built-in tax and bookkeeping tools. It is also a good option for businesses that make a moderate number of international payments each month.

Big Business ANNA Account: This is the best option for businesses that have complex financial needs and make a high volume of international payments. It is also a good option for businesses that need to issue a large number of debit cards.

What is Anna + taxes?

Anna now has a new feature available for users (£3 for the first 3 months – then £24 + Vat per month) – This service provides a one-stop shop for all your various business tax requirements. The tool can help with the following:

- Easily calculate VAT, Corporation Tax and PAYE automatically

- Assistance with filing Corporation Tax and Annual Accounts for new businesses

- Automatic expense categorisation and transfers to savings pots for taxes

- Tools to reduce taxes and increase expense claims

- Customised tax calendar to help you stay on top of deadlines

- Automated VAT Return calculations and direct filing with HMRC

- Unlimited XLS VAT filing – Exportable Profit/Loss, balance sheet, and income statement for easy record keeping

- Payroll services for one employee

- Bookkeeping Score to help keep your books tidy and organized – 24/7 access to expert support via chat

- Accept card payments by using invoicing feature.

Is the Anna Business Banking App Safe?

While ANNA Business Banking doesn’t hold the full FSCS protection offered by traditional UK banks, it employs various security measures to safeguard your business finances. These include two-factor app authentication, data encryption, regular audits, secure payment processing, fraud prevention, regular updates, secure storage, access management, and 24-hour responsive customer support.

What Are The Pros and Cons of the ANNA Business Account?

As with any business banking account option, there are pros and cons to ANNA business banking which can make it a better fit for some business owners than others. Here is a breakdown of the pros and cons of opening an ANNA business account.

Pros of ANNA Business Banking

- Flexible pricing options: ANNA Business Banking offers three different pricing plans to suit different company requirements: Pay As You Go, Business Banking, and Big Business. This means that you can choose a plan that fits your business budget and usage.

- No monthly fee: The Pay As You Go plan has no monthly fee, so businesses only pay for what they use. This can be an excellent banking option for businesses that have simple financial needs and want to avoid any extra monthly costs.

- Built-in tax and bookkeeping tools: The Business Banking and Big Business plans both include built-in tax and bookkeeping tools to help businesses manage their finances more effectively. This can save you time and money and can help you avoid accounting or tax reporting errors.

- Competitive international transfer fees: The Big Business plan includes 4 free SWIFT payments each month and international transactions with a competitive 0.5% currency conversion fee.

- Free debit cards: Each plan includes some free debit cards, so businesses can issue cards to their employees and contractors without having to pay any fees.

- Cash deposits without low or no fees: The Big Business plan includes commission-free deposits, so businesses can deposit cash directly into their accounts without having to pay any fees.

- Unlimited pots: The Big Business plan includes unlimited pots so businesses can categorise and manage their funds more effectively.

- 1% cashback on select spending categories: All ANNA Business Banking plans include 1% cashback on selected spending categories.

Cons of an ANNA Business Bank Account

- Limited FSCS protection: Unlike traditional banks, ANNA is not currently protected by the FSCS (Financial Services Compensation Scheme). This means that if ANNA were to go bankrupt, your deposits would not be protected up to £85,000. This could be a significant concern for businesses with large cash reserves.

- No joint account option: The app does not currently offer joint account options, which could make it difficult for partnerships to manage their finances together. This could be a disadvantage for businesses that involve multiple owners or partners.

- No credit facilities: ANNA does not currently offer any credit facilities, such as loans or overdrafts. This could limit the financing options available to businesses seeking to grow or expand.

- Cannot deposit cheques: The banking service currently does not support cheque deposits, which could be a challenge for businesses that receive a considerable number of payments through cheques. Businesses would need to find alternative payment methods, such as electronic transfers or direct debits.

- Restricted foreign currency payments: ANNA currently only allows businesses to receive foreign currency payments in Dollars or Euros. Companies that deal in other currencies would need to convert their payments to Dollars or Euros before depositing them into their ANNA accounts. This could add an additional layer of inconvenience and fees for overseas customers.

How to Open an ANNA Business Bank Account

Opening an ANNA Business account is a straightforward and quick process that can be completed in as little as 3-4 minutes. You can seamlessly open your account through the ANNA app, which provides a user-friendly interface and a guided setup process to assist you throughout the journey. Upon successful registration, your ANNA Mastercard debit card will be dispatched within 5 working days, allowing you to use it in physical locations within a week.

Who is Eligible to open an account?

To determine eligibility for an ANNA Business account, individuals running small businesses, freelancers, or sole traders should meet the following criteria:

- You must be at least 18 years old.

- Be able to provide a verified copy of your full driving license or passport.

- Submit proof of your address, such as bank statements and council tax or utility bills issued within the last 3 months.

- Have your business details readily available.

Setting up the account and getting started should take you under ten minutes, according to current ANNA banking estimates and is as simple as this…

Sign up in a matter of minutes

- Click the link above –

- Enter your mobile number

- Enter your email to sign up

- Download the ANNA app and make sure you enter the Anna.Money referral code:

- Answer a few simple questions about your business

- Complete your application in less than 10 minutes!

Conclusion: ANNA Business Account Review – Best Online Banking for Small Business and Freelancers?

ANNA Business Banking is an excellent option for small business owners and freelancers who are looking for a flexible, affordable, and feature-rich business banking solution. With its three different pricing plans, built-in tax and bookkeeping tools, free international transfers, unlimited free debit cards, cash deposits without fees, unlimited pots, and 1% cash back on select categories, ANNA Business Banking can help businesses save money, grow, and succeed. Remember to sign up with our Anna.money referral offer by clicking the link at the start of the article or entering referral code: UT71853 during registration.

Anna Money Alternative?

If, after reading this review of Anna Money you don’t think it’s for you … then please check out our extremely popular review and offer from Tide Bank found here: Tide Referral

Recent Comments