Capital On Tap Promo Code: 2REFF362E24

Sign up for a Capital On Tap credit card and enter Capital On Tap promo code: 2REFF362E24 when registering or click the following link. Once you have made your first transaction using your credit card (within 30 days) you will get £75 FREE cash credited to your account.

The Capital on Tap Business Credit Card is a credit card designed specifically for small businesses. The card offers uncapped 1% cashback on all card spending, flexible reward options, and a credit limit of up to £250,000. With rates as low as 13.6% APR, unlimited free company cards, and up to 56 days interest-free on card spending, the Capital on Tap Business Credit Card is the ideal solution for businesses of all sizes. The company has received an impressive 4.6 out of 5 rating on Trustpilot, which is a testament to its quality of services and customer satisfaction. In addition, the card provides real-time visibility, smart spending controls, and the option to connect with accounting software, making it a one-stop solution for business spending.

Who Is The Capital On Tap Business Card For?

The Capital on Tap Business Credit Card is designed for small businesses that want to streamline their spending and earn rewards for doing so. The card is suitable for businesses of all sizes, from start-ups to established companies. It offers the flexibility to add unlimited free company cards for employees and set tailored spending limits, making it ideal for businesses with multiple employees.

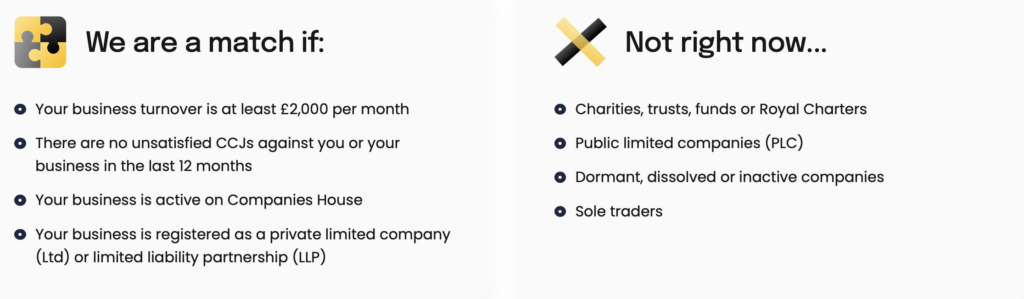

The specific criteria listed on the Capital On Tap website state that in order to be approved for the Capital On Tap business credit card you must:

1. Be an active director of the registered company with a shareholding of at least 25% – (if you would like to set up a limited company check out our article on setting up a limited company here and our amazing Tide offer here).

2. Your business must have an annual turnover of £24000 and have been trading for a minimum of 12 months.

3. You must have had no unsatisfied CCJs against your business in the last 12 months.

How Do You Sign Up?

Signing up for the Capital on Tap Business Credit Card is quick and easy. Simply apply online and get a decision in less than 2 minutes (80% of customers receive a decision in 2 mins or less). The complete one-page signup form can be found here – Just make sure you also complete the field marked Capital On Tap Promo code with 2REFF362E24 to get £75 FREE credit added to your balance when you complete your first transaction (within 30 days)

You can start spending immediately with your virtual card or use your credit limit to transfer cash directly to your bank account. There are no hidden fees, no annual fees, and no impact on your credit score (Capital On Tap only conducts a soft search on your personal and business details which does not effect your credit score) and your physical credit card should arrive within 2-6 days.

How Much Does It Cost?

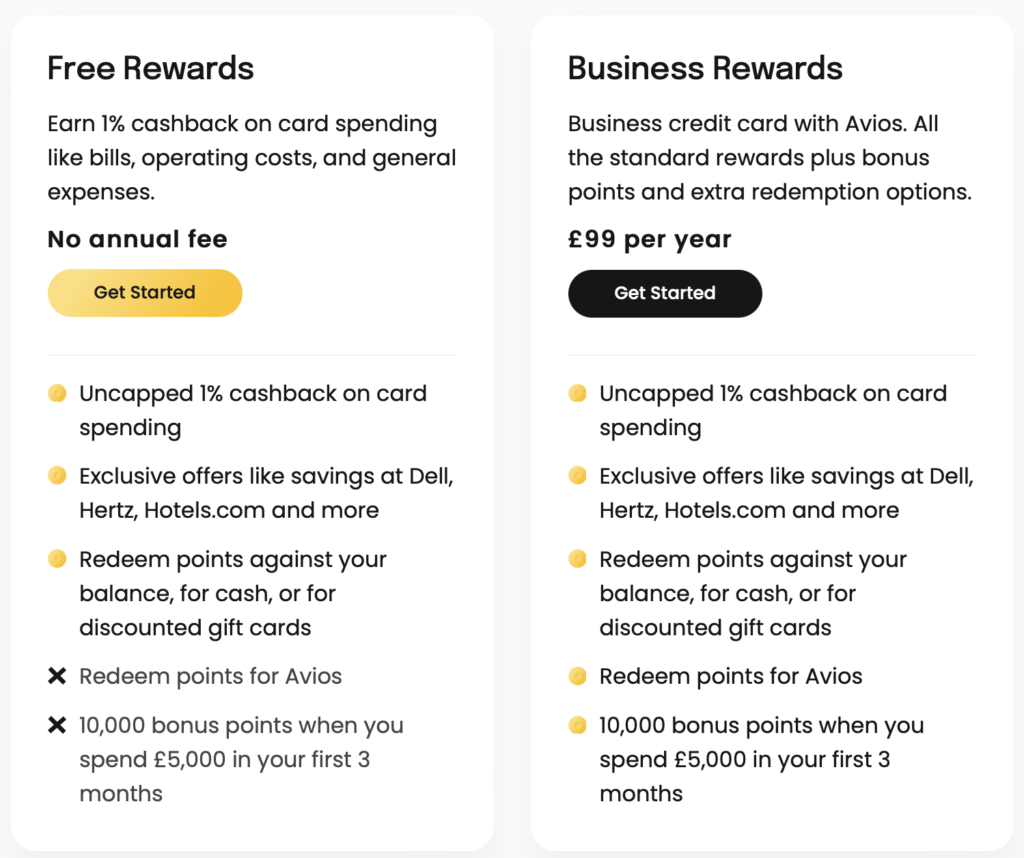

The Capital on Tap Business Credit Card is offered in two packages: Free Rewards and Business Rewards. The Free Rewards package offers uncapped 1% cashback on card spending, with exclusive offers and the option to redeem rewards for cash, gift cards, and Avios. The Business Rewards package offers all the benefits of the Free Rewards package, plus bonus points and extra redemption options like Avios. The Business Rewards package costs £99 per year. Unless you are going to spend £5000 to get the bonus points or you use Avios the free card is more than sufficient for most users.

What Additional Benefits Do You Get?

The Capital on Tap Business Credit Card offers several benefits to help small businesses manage their expenses and grow their business. Some of the key benefits include:

Uncapped 1% cashback: With the Capital on Tap Business Credit Card, you can earn 1% cashback on all card spending, with no annual fee. The cashback is uncapped, which means there is no limit to the number of rewards you can earn. You’ll also receive exclusive discounts and offers from a range of popular merchants, including Nike, Amazon, M&S, Booking.com, Microsoft, Zoom, and more. The Business Rewards plan offers all the benefits of the Free Rewards plan, plus bonus points and additional redemption options, such as Avios.

Interest-free period: The card offers an interest-free period of up to 42 days on card spending, which means you can take advantage of the credit line without incurring interest charges.

Credit limits up to £250,000: The card provides a credit limit of up to £250,000, allowing you to grow your business with a line of credit.

Drawdown funds to your business account: Not only do you get a substantial credit limit but you can draw down these funds directly to your business bank account in seconds – (Note interest is payable daily till these funds are repaid)

Unlimited free company cards: With unlimited free company cards, you can add cards for your employees and control their spending with tailored limits.

Virtual Credit Card: Access to a virtual credit card which is safer for online purchases as it can void it can create a new one if you are unsure about a purchase you have made.

Phone Integration: Capital On Tap can be added to both Apple Pay and Google Pay and can also be used wherever the contactless icon is displayed.

Real-time visibility: The card provides real-time visibility into your business spending, allowing you to keep track of your expenses and make informed decisions. Your Capital on tap account details are available on the website or the easy to use app available for both iOS and Android.

Auto-sync with accounting software: The card integrates with popular accounting software such as Xero, FreeAgent, Freshbooks, and more, allowing you to keep your books up-to-date. The process is simple and takes a couple of minutes.

Rewards: With the card, you can earn rewards points on all card spending and redeem them for cash, gift cards, Avios, and more.

Capital On Tap Referral: Get £75 when signing up using Capital On Tap Referral Code: 2REFF362E24 and you will also have the opportunity to refer others once you have signed up.

Is Capital On Tap Safe?

The Capital on Tap Business Credit Card is safe and secure. The card is supported by advanced security measures, and all transactions are encrypted for added protection. In addition, the option to connect with accounting software provides real-time visibility, making it easier for business owners to keep track of their spending.

How Do You Contact Customer Services?

For any questions or concerns, Capital on Tap offers 24/7 support. One of Capital On Tap’s USPs is that customers can talk to a real person in 10 seconds or less by calling 24/7 support on 020 8962 7401 which is pretty unique in this day and age of chat bots and messaging services.

Summary

The Capital on Tap Business Credit Card is a great option for small businesses looking to streamline their spending and earn rewards in the process. With flexible reward options, real-time visibility, and 24/7 support, this card provides a one-stop solution for business spending. Apply online today and make purchases immediately with your virtual card whilst waiting for your physical card to arrive.

With a near-instant signup process and credit limits of up to £250k available – Capital On Tap makes a beeline for businesses who might need short-term funding arrangements with its high credit limit and drawdown options from the get-go. In terms of pricing options, we found that although Capital On Tap offers a paid-for credit card option known as Business Rewards (which includes Avios points redemption and bonus sign-up points) – at Referandsave we found the free card was more than adequate for our needs and this will probably be the case for most users. Plus for a more Avios-orientated card, we recommend you read our article on Avios points redemption and our exclusive Amex Referal offer which includes an Avios-specific card in its portfolio.

In closing – with its human customer support centre, its high Trustpilot scores and its easy-to-use app – we believe Capital On Tap is one of the best business credit cards on the market. Plus it offers £75 just for signing up and completing one transaction within 30 days as long as you sign up using Capital on Tap Promo: 2REFF362E24. We think that makes it a winner.

FAQ: Capital on Tap Business Credit Card

1. What is Capital on Tap?

Capital on Tap is a UK-based fintech company that provides flexible funding solutions for small and medium-sized enterprises (SMEs) through a business credit card with a high credit limit, competitive interest rates, and no annual fees.

2. How do I apply for a Capital on Tap business credit card?

To apply, visit the Capital on Tap website, click on “Apply Now,” and complete the online application form with your business and personal information. You may also need to connect your business bank account for financial verification.

3. What are the eligibility criteria for Capital on Tap?

Your business must be registered in the UK (Limited company), have an annual turnover of at least £24,000, and have been trading for a minimum of 6 months. The creditworthiness of both the business and the owner(s) will be assessed.

4. How quickly can I get approved?

The initial decision is usually made within minutes of submitting the application, with full approval often granted within 24 hours.

5. What is the credit limit for the Capital on Tap business credit card?

The credit limit can go up to £100,000, depending on the business’s financial profile and credit assessment.

6. Are there any fees associated with the Capital on Tap business credit card?

There are no annual fees for the credit card. However, other fees such as interest on carried balances or late payment fees may apply.

7. Can I earn rewards with the Capital on Tap business credit card?

Yes, you can earn rewards points on your spending, which can be redeemed for cash back or travel.

12. How can I manage my Capital on Tap account?

You can manage your account through the Capital on Tap online portal, which allows you to track spending, make payments, and manage rewards points efficiently and through the Capital on tap mobile app available for both Android and Apple devices.

14. Can I use the Capital on Tap card for international transactions?

Yes, the Capital on Tap business credit card can be used for international transactions, making it suitable for businesses that operate globally.

15. Is their a promotional signup offer available for new Capital On Tap customer?

Of Course! If you enter the Capital on Tap promo code : 2REFF362E24 in the promo code box during registration you will receive £75 FREE cash credited to your account if you complete one transaction on your card within 30 days of registering..

For more information or to apply for a Capital on Tap business credit card, visit www.capitalontap.com.

Recent Comments