Chip Referral CHIP-BGK748

To welcome you in, Chip are giving you a 0.17% boost to your interest rate. Your exclusive 0.17% AER boost is applied on top of your existing Chip Cash ISA interest rate (4.58% variable) for 90 days. All you need to do is enter your email address, join Chip now and deposit £5000 or more into an eligible account. Hold your deposit for 30 days to qualify.

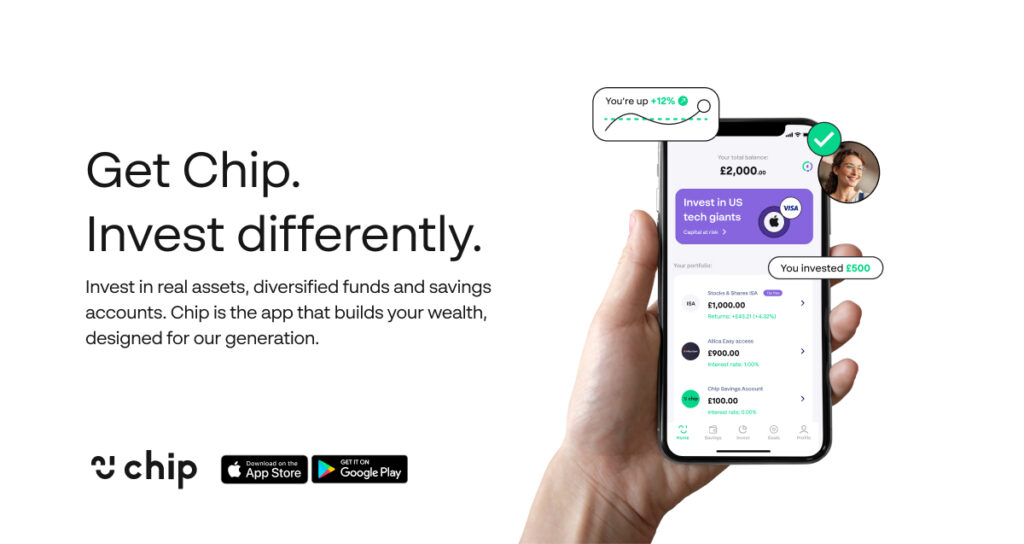

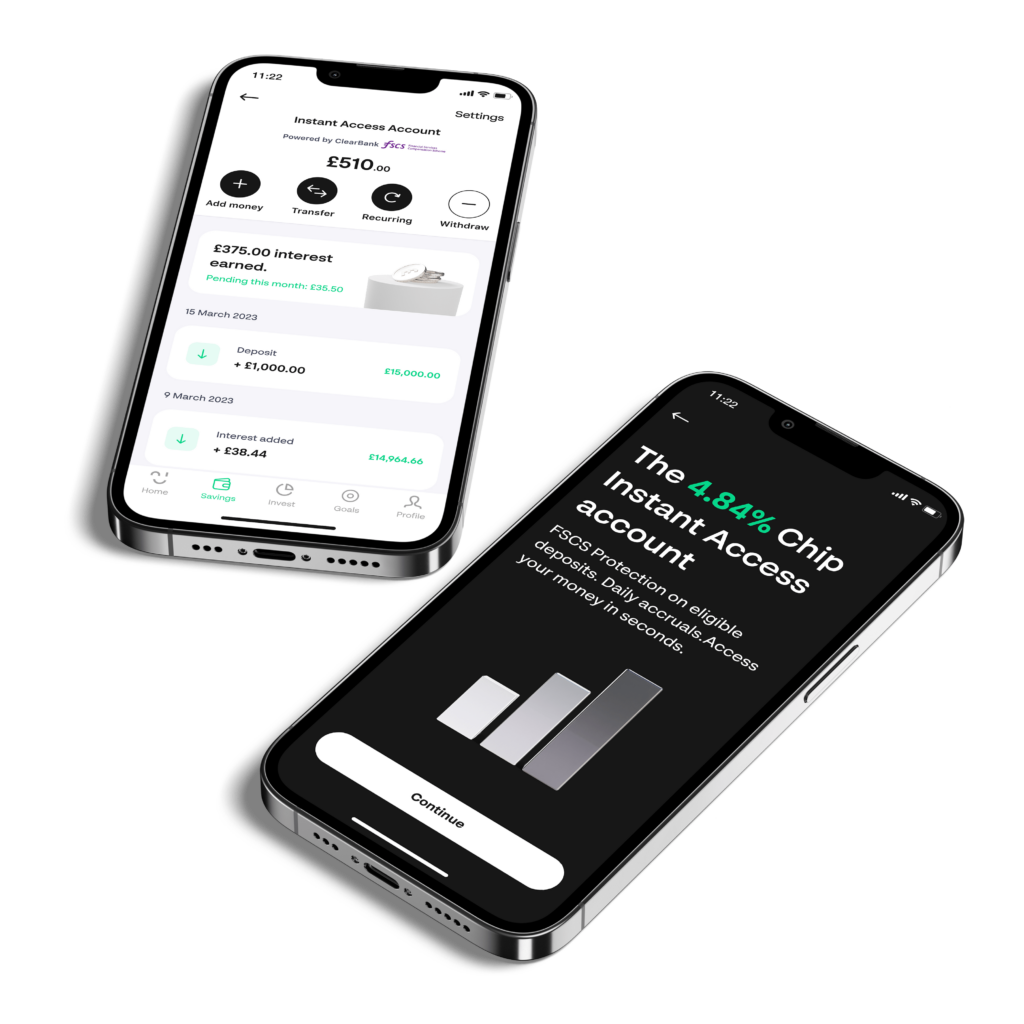

Chip is a UK-based savings app designed to help users save money effortlessly by using AI to analyse spending habits and automatically set aside small, affordable amounts into a separate savings account. The app allows users to create savings goals, track progress, and invest in various financial products from simple saving accounts to stocks and funds, offering competitive interest rates. With features like round-ups and payday deposits, Chip aims to make saving simple and stress-free for users, catering to those who may struggle with traditional budgeting methods. Its flexible, fee-free withdrawal system and regulated protection provide added security and peace of mind.

What is Chip and how does it work?

Chip is an award-winning savings app that utilises artificial intelligence (AI) technology to both simplify and enhanceyour savings potential. By using open banking to connect to your designated bank account, it analyses your spending habits, works out how much you can afford to save, and transfers what it considers the optimum amount of money automatically to your Chip account. It does this while ensuring you have enough money for your daily expenses, so you won’t feel out of pocket. Additionally, all users are notified prior to the amount being moved, giving you time to stop the transfer if necessary.

Of course, using Chip’s award-winning AI is entirely optional. If you prefer, you can manually save money on an ad-hoc basis. Chip is designed to be flexible and accessible, allowing savers to build wealth in a way that best suits them.

The app is free to download for both Android and iOS users and has a very simple registration process. It is super user-friendly and easy to navigate, which allows you to clearly see how much money you’ve recently transferred to the app, how you are progressing against the savings targets you have set, and how much interest you have accrued. Charges may apply for additional features.

What features are available with Chip?

Chip is different. Its AI autosave feature is worthy of its award-winning status, especially when combined with market-leading savings options. In addition to this, it provides a blazing-fast deposit and withdrawal process, with almost instant access to your money when you need it.

Chip is far more than autosaves and rapid deposits. At the time of writing, the offerings (for the free Chip Account) include:

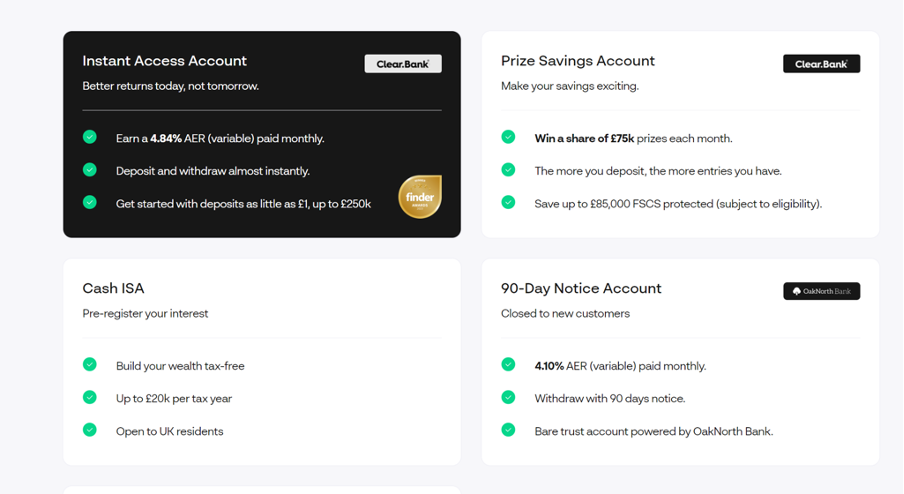

- Chip Instant Access Account (3.75% Return)

- Chip Easy Access Account( 3.82% AER + 0.77% 12-month boost) but only allows 3 withdrawals per year or will revert to 3.74% AER. (variable tracker)

- Chip cISA account & earn 4.58% AER (variable tracker) but get 0.17% Bonus if signing up using referral code: CHIP-BGK748

- Prize Savings Account (Opportunity to win a £10,000 monthly Grand Prize, as well as 4,900 other monthly cash prizes, T&Cs and minimum average balances apply)

- Investing opportunities with GIA (General Investing Account) & Stocks & Shares ISA Account

- Earn a 0.17% interest rate boost when you deposit £5,000 and refer a friend (T&Cs apply) using the code: CHIP-BGK748 .This offer applies to the CHIP ISA Account.

Breakdown on the 3 main Savings account:

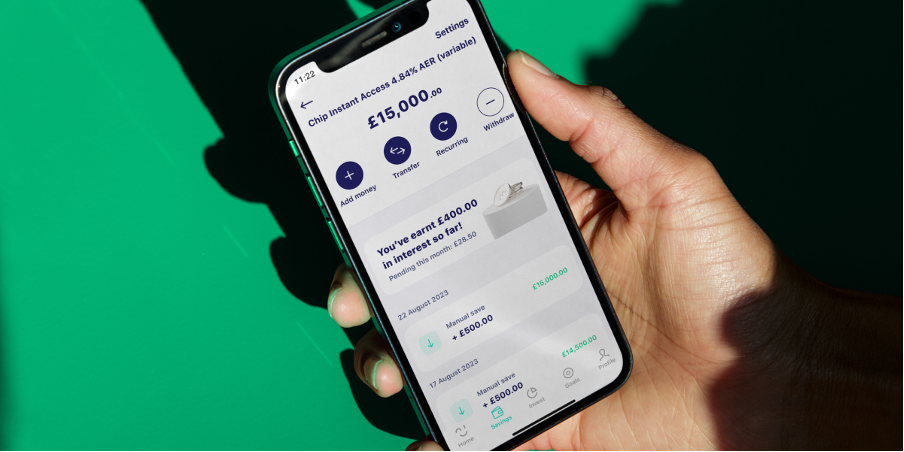

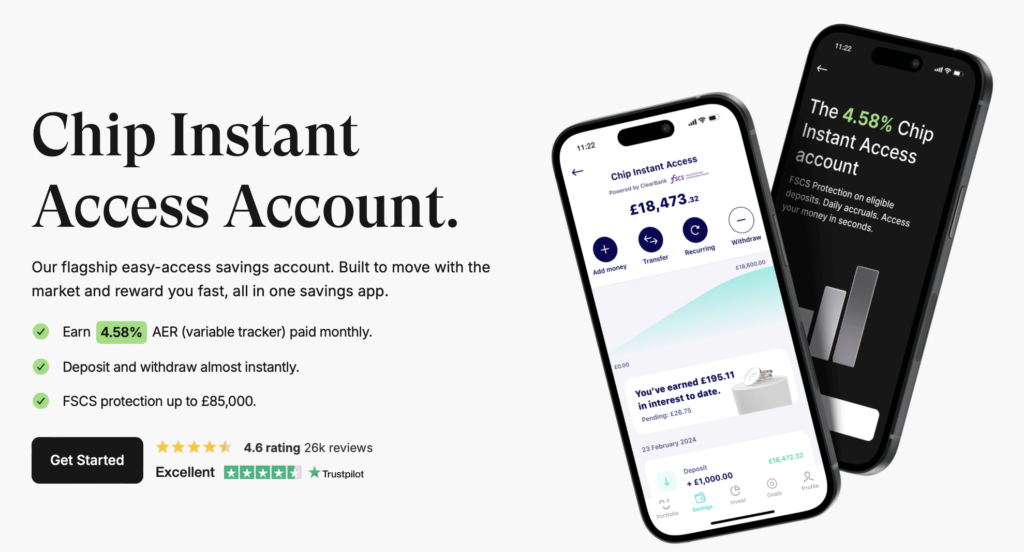

Chip Instant Access Account – Click Here To Sign Up

The Chip Instant Access Account is a flexible savings account offered by the Chip allowing users to earn interest on their savings while having immediate access to their funds. There are no restrictions or penalties for withdrawals, making it ideal for those who want to earn interest but need the flexibility to access their money at any time. The current interest rate on this account is: 3.75% AER (variable tracker) paid monthly.

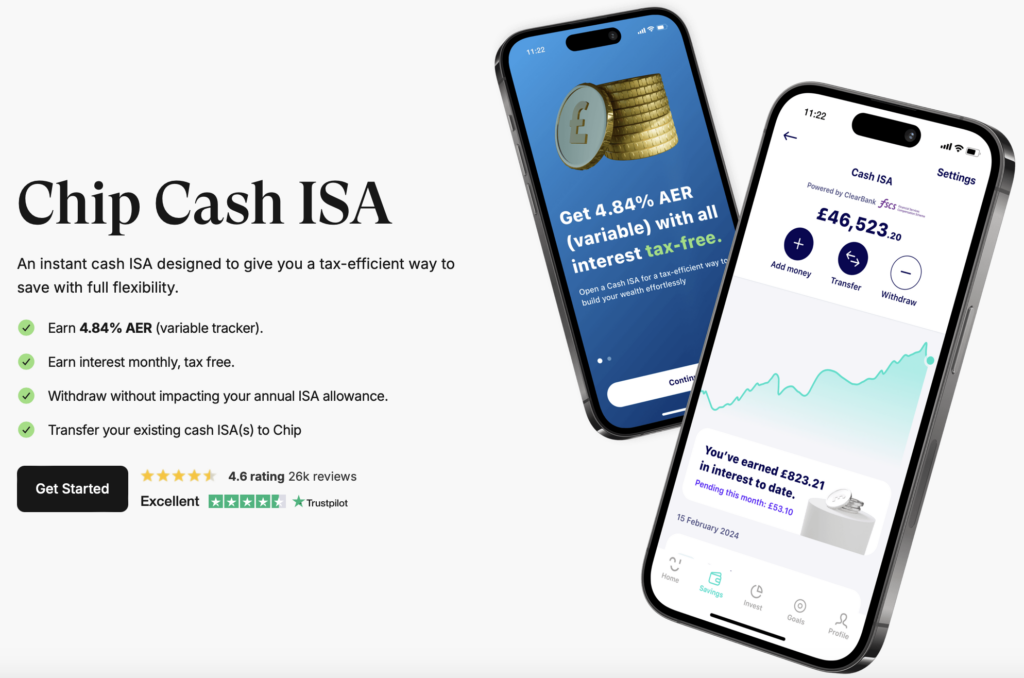

Chip cISA Account – Click Here To Sign Up

Chip have just launched a new cash ISA account with an interest rate or 4.58% AER (variable tracker). This new account offers complete flexibility, enabling you to deposit a maximum of £20,000 per tax year and make withdrawals at your convenience, all without affecting your ISA allowance. With no taxation applied to the interest you accrue, it is a smarter way to grow your finances. Using Chip referral code: CHIP-BGK748 gets you a 0.17% interest rate bonus for 90 days.

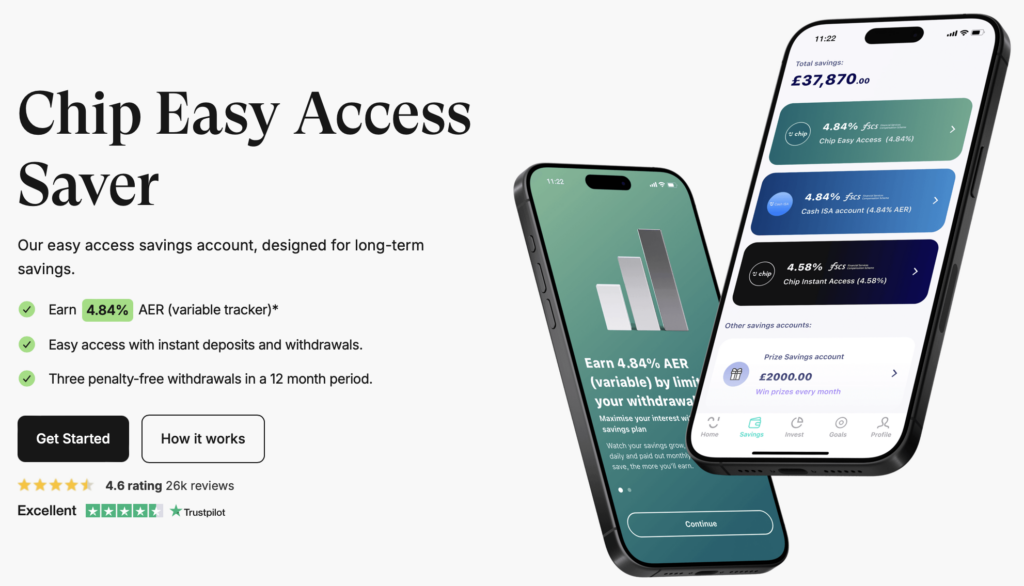

Chip Easy Access Account (NEW) – Click Here To Sign Up

The new Chip Easy Access Account is a product designed for more longer-term savings offering users a competitive interest rate while providing flexibility to withdraw funds if needed. The interest rate on offer is 3.82% AER + (0.77% AER boost for 12 months )variable tracker paid monthly and is designed for savers who want to grow their money while maintaining full access to it. This account allows customers to make 3 penalty fee withdrawals per year but after 3 withdrawals within a 12 month period the rate will revert to 3.74% AER.

Investing With Chip

Chip allows you to autosave to a savings account, to a prize-winning account or to a number of investment accounts. (Any decision to go into using the investment features with Chip should not be taken lightly & it is advised that you seek guidance from a qualified professional first if you are unsure about investing) and note that using an investment account means your capital is at risk and you may get back less than you put in.

That being said, using the investment feature with Chip is easy and straightforward. Chip provides a wide range of funds from from a number of investment managers which allow you to grow a somewhat impressive and varied investment portfolio. Investing in funds is generally considered safer than choosing to trade individual shares yourself, as you are usually letting fund managers who are looking after billions of dollars of funds make the decisions on where to invest.

All you need to start investing with Chip is your National Insurance number. The money you put into your investment account is invested into a range of assets, and Chip will provide an annual return figure and a complete history of the fund in question. You can even set up auto-saving for your investment fund, much like your savings account. Investment management and some platform fees will apply; however, if you’re willing to go into investing for the long run, Chip is a trustworthy and easy-to-use option.

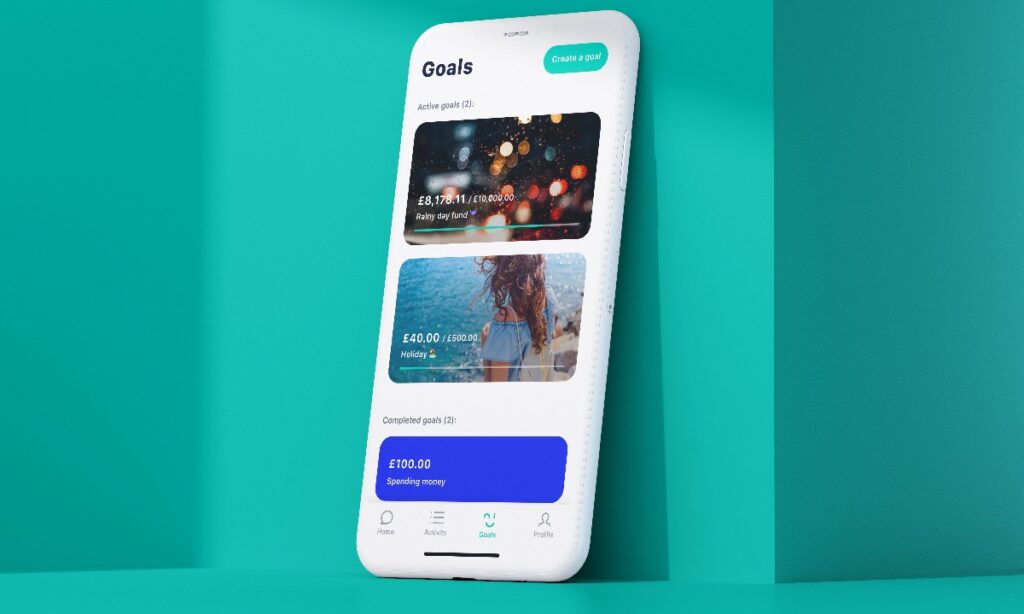

What are savings goals?

Savings goals are an opportunity to set a target date and monetary amount to help motivate you to reach your financial goals. Goals you set do not create separate accounts, meaning all your money remains in your selected Chip accounts. The goals are simply a separate handy feature that helps you better visualise and track your savings progress. It’s a simple process to choose the desired goal amount, target date, automatic money save allocation and even a relevant photo for improved visualisation.

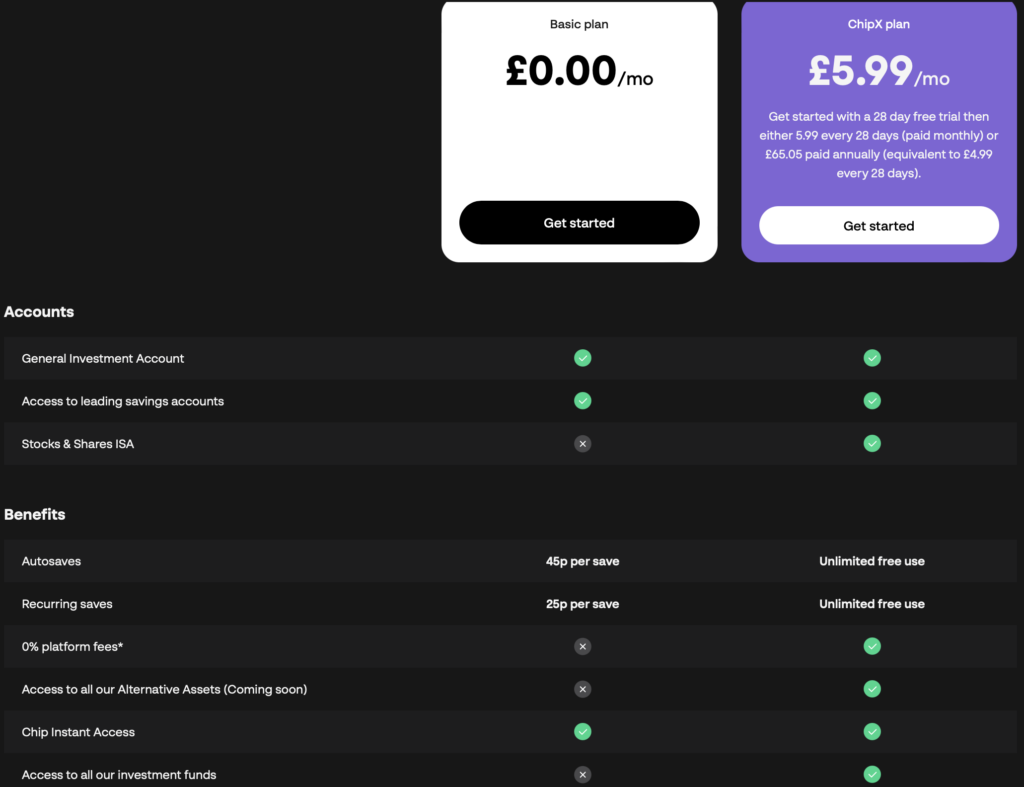

How much does it cost to use Chip?

As previously mentioned, the app is free to download. You’ll be automatically placed on the basic plan, but this means you will need to pay £0.45 per autosave. The basic plan offers all the essential features like autosaving, interest on savings, and money-saving goals planning.

However, you’ll need to upgrade to the ChipX plan (£5.99 per month or £65.05 per year) if you want to be able to utilise additional features, such as:

- Acces to ALL investment funds

- Stocks and shares ISA

- 0% platform fees

The Chip Basic plan is perfect for your every-day savings and also for getting into investing with smaller deposits. It’s got fewer investment options and higher fees associated with use, however, unless you’re looking to invest large sums, the Basic plan may be your best option. ChipX is better suited to someone looking to create a broad and heavily invested investment portfolio.

On either plan, you have the option for the following types of savings accounts:

- Chip Instant Access: You’ll earn 4.58% AEU paid monthly (plus a boost of of 0.25% upon successful referral or if you prefer this you can use our Chip referral code: CHIP-BGK748 to avail this offer instead of the cash bonus )

- Chip Prize Savings Account: Win a monthly Grand Prize of £10,000, or one of 4,900 smaller cash prizes. The more you save in the account, the more entries you get in the monthly prize draw.

- cISA Account: An ISA account launched by chip with a tax free interest rate of 4.84% variable tracker. The annual ISA allowance is currently £20,000 (across the four different types of ISAs available)

- Chip Easy Access Account: A newly launched account which offers a higher savings rate of 4.84% AER (which includes a 0.77% 12 Month Boost) but only allows 3 penalty free withdrawals per year.

How do you sign up for Chip? – (and don’t forget to apply our Chip referral code)

To sign up with Chip, you’ll first need to download the app via Google Play or Apple’s App store. Click our link at the top of this article to download the app. And don’t forget to enter our Chip referral code (depending on your deposit level)in the promos and referral section under the profile menu option in the app.

Once you’ve downloaded the app you’ll need to enter some basic personal information such as:

- Phone number

- Date of birth

- Address

- Tax information

- Only if you want to open up an investment account with Chip – National Insurance Number (you won’t need to give this information if you don’t intend on opening an investment account)

You’ll then need to link a bank account with the app. It’s worth noting here that not all bank accounts are accepted by the app. The following accounts can be linked (although this list is increasing):

- Bank of Scotland, Barclays, Danske, First Direct, Halifax, HSBC, Lloyds, Monzo, Nationwide, NatWest, RBS, Revolut, Santander, Starling, TSB, Ulster Bank

Note: You can only link one bank account. However, the one you choose to start with is not set in stone, and you can change your linked bank account at any time if required.

Set your saves

Once you are at this point, you can set up any savings goals and targets, and also decide where you would like your autosaves to end up. Right now the Instant Access savings account with easy access offers 4.84% which is where we are saving but you also have the prize-winning account if you are feeling lucky or you could decide that you would like to grow your funds and invest in an investment fund – (the types of investments funds open to you will depend on whether you are in a basic or paid for Chip plan)

You can also let Chip know whether you want to save more or less, you can set up recurring saves on a certain day of the week or month (outside of autosaves), and you can let Chip know when not to make autosaves (for example, you can make it so that if your bank balance is below £1,000, there will be no autosaves). It is entirely up to you how much you want to save, how often, and to what savings option.

How to deposit and withdraw money

To deposit money into the app you have two options:

- Use the autosave feature

- Manual deposit

Make your first deposit via bank transfer, from your Chip savings accounts, debit card or Apple/Google pay and that’s it. Your account is open!

Once this is done, simply visit your account and click ‘add money’ – it’s that easy! Just note that there’s a minimum deposit amount of £1. Card payments are not always instant, and may take up to two business days to complete.

To withdraw your money from Chip, head to the accounts tab in the app, select the amount you want and click ‘withdraw’. Much like with deposits, withdrawals can take up to two business days to complete although we have found these take minutes too!

Is Your Money Safe With Chip?

Chip is a UK-registered company (Chip Financial Ltd) that gives access to savings products offered by partner UK banks. All funds held in these partner bank accounts up to (£85,000, per customer, per bank) are protected by the Financial Services Compensation Scheme (FSCS) scheme that protects savers and compensates them if their chosen savings provider ceases trading.

Furthermore, under the Data Protection Act, Chip acts in full compliance to its legal obligations with regards to how it handles your personal data. You can use Chip to increase your savings safe in the knowledge that both your money and your personal data are safe.

What about Chip customer services?

So, what kind of customer service is available in the event you need to contact someone at Chip?

The Chip website provides a brief frequently asked questions section. However, for times when this is not suitable, there are several options for contacting Chip:

- In-app chat: here is a support team available, Monday–Friday, 8am–8pm. You can contact them via the in-app chatbot that you can launch by going to the profile tab in the app and clicking ‘Contact Us’. We tried this and were chatting to a real person within 30 minutes.

- Email: Send any queries to ‘hello@getchip.uk’

- Facebook: Visit the official Chip Facebook page and send a direct message

Chip does not have a phone number option available online. This is similar to most other businesses providing an online-only service, so is not out of the ordinary. We found contacting Chip to be simple enough through the in-app chat process.

Summary of the Chip app

While the app is indeed user-friendly and offers a number of handy features, like any app out there, it comes with both pros and cons that you should consider carefully before downloading.

Pros –

- User-friendly;

- Autosave feature that can help make sure you maintain regular deposits;

- Option to set saving goals to maintain focus on your financial goals and track your progress in a highly visualised approach;

- Deposit as little as £1;

- Pause transfers into your Chip account if you hit a financially tight period;

- Spending analysis to get the bigger picture on your money management.

Cons –

- Sometimes the fees can be quite high on either the free plan (with 45p autosaves) or the requirement to pay £5.99 for the ChipX plan if you want more options;

- While provided with varied enough investment options for what the ap offers, it is limited considering other investment options available with other providers.

- Not all banks are currently accepted.

If you’re looking for a financial app to help you with your day-to-day savings goals, Chip is an amazing option that can help you with that. From its range of market-leading savings accounts to choose from to its ease of use for the least tech-savvy. Furthermore, the optional investment opportunities within the app are brilliant for anyone wanting a simplified route to building their investment portfolio with a trustworthy and reliable company. It may not be completely free to use, but the minimal cost involved is most definitely worth it for the features you’ll have at the touch of a button and currently there are very few substitutes out there.

Frequently Asked Questions

What is the Chip referral code?

After signup, you can enter a Chip referral code into the promotional/referral code box to activate the Referandsave exclusive offer. The code to use depends on the value of your initial deposit.

What do you get if you use a Chip referral code?

There are a number of exclusive Chip referral codes available to Referandsave readers. You can use Chip referral code: CHIP-BGK748 if you are depositing £5000 in a Chip ISA account to get a 90 days interest rate bonus of 0.17%

Where do you enter the Chip promo code?

After signing up, you can enter the Chip promo code in the promo box, which can be found under the profile menu option – the far right icon in the app. Remember to use the corresponding Chip referral code depending on the amount you deposit.

What are the Chip referral terms and conditions?

Please see the chip website and these T&Cs change on a very regular basis to see what the latest offer is.

Happy Saving! H X

Recent Comments