Currensea Referral Code: FN5E39

Updated FEBRUARY 2025 : Sign up to Currensea and enter Currensea referral code: FN5E39 to get £10 FREE when you complete over £100 in FX transactions within 120 days of signup. You can also combine this with completing the signup through Topcashback here to get an additional £10 FREE

Introduction to Currensea

Currensea.com is a fintech platform that is revolutionising the way people make international transactions. With its innovative approach, Currensea.com offers a low-cost alternative to traditional bank transfers, allowing customers to make foreign currency payments without incurring the high fees and exchange rate markups typically associated with these transactions.

The platform has gained significant attention in recent years for its user-friendly interface, transparent pricing, and fast transaction times. In this article, we will take a closer look at the features of Currensea.com and explore why it has become a popular choice for individuals and businesses alike in the UK.

Detailed Review Of Currensea

Currensea offers low-cost international payments to its customers. The platform is designed to help customers save money on international payments by providing them with competitive exchange rates and transparent pricing. Unlike traditional banks, Currensea does not charge customers any hidden fees or markups on exchange rates, which means that customers can enjoy significant savings on their international transfers.

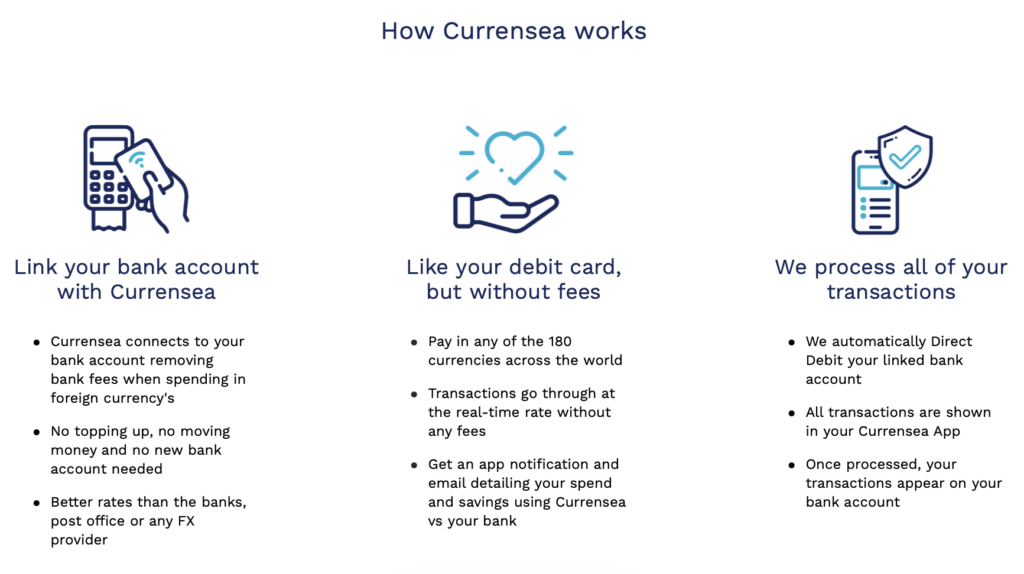

To use Currensea, customers simply need to sign up for an account on the platform and connect their bank account. Once their account is set up, they can use the platform to make international payments to over 180 countries worldwide. Currensea uses open banking to securely verify customers’ bank account information and initiate payments from their bank account to the recipient’s bank account. This means that funds are transferred directly from the customer’s bank account to the recipient’s bank account, which is faster and more secure than traditional bank transfers. As a result users do not have to sign up for a new bank account or transfer funds to its service like Monese or Revolut to use Currensea.

What Does it Cost To Use Currensea?

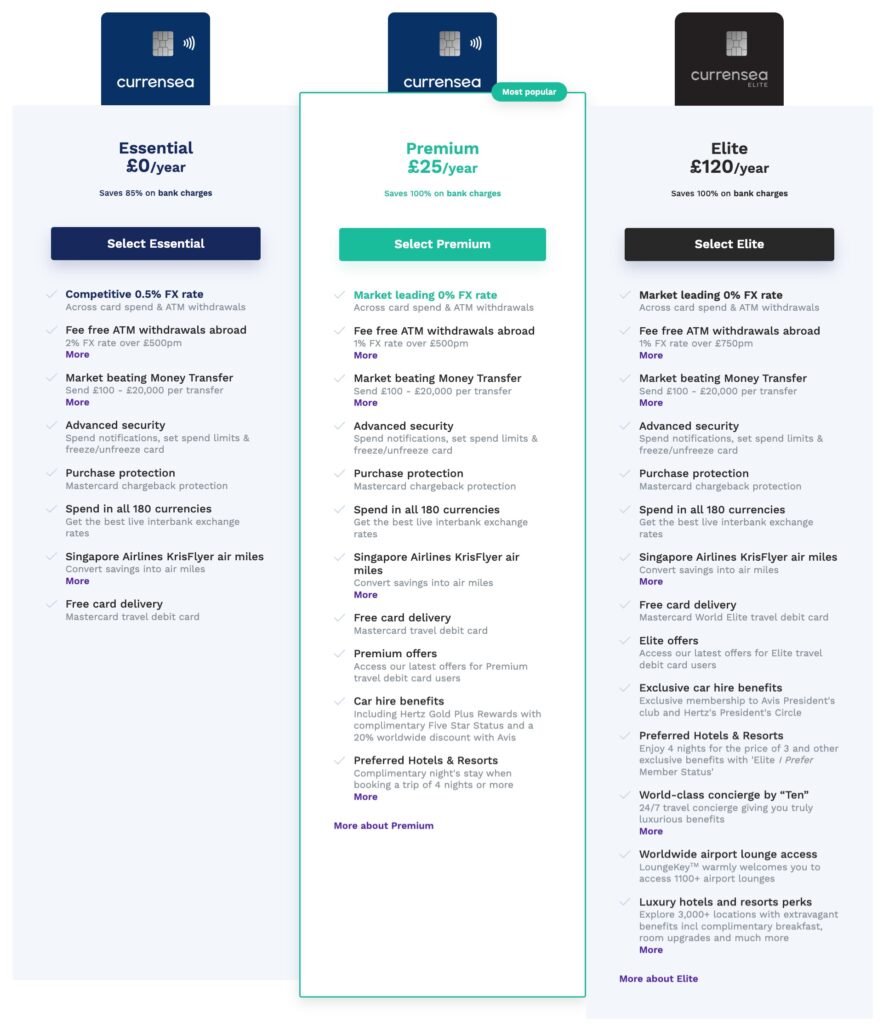

Currensea’s fees are transparent and straightforward. They charge a 0.5% fee on all foreign currency transactions on their essential plan, which is significantly lower than the fees charged by traditional banks (Currensea uses the mid-market exchange rate, which is the rate at which banks and financial institutions buy and sell currencies with each other. This rate is generally more favourable than the rates offered by traditional banks, and Currensea does not charge any additional markup or commission on top of it). Outside this, there are no additional costs to using the Currensea service unless you spend above the ATM limit of the plan you are on – or you pay for the upgraded plans as detailed below:

What Are The Key Benefits Of Currensea?

Currensea is a UK-based fintech platform that offers low-cost and hassle-free international payments to its customers. Here are some of the key benefits and features of the platform:

- Convenient – Currensea partners with your current bank account to make saving money simple. No need to prepay, no need to top-up, no need for a new bank account.

- Low-Cost International Payments: Currensea offers low-cost international payments to over 180 currencies worldwide. The platform uses the mid-market exchange rate, which is generally more favourable than the rates offered by traditional banks and money transfer services. Tou get access to the best rates at only 0.5% above the FX base rate on the Essential plan, saving you at least 85% on every transaction – Or 0% on the Premium and Elite plans, saving you 100% on every transaction

- Transparent Pricing: Currensea offers transparent pricing to its customers, which means that there are no hidden fees or markups on exchange rates. Customers can see the exact exchange rate and fees associated with their international transfer before they confirm the payment, which ensures that there are no surprises.

- Fast Payments: Currensea uses open banking to initiate payments from customers’ bank accounts to the recipient’s bank account. This means that payments are typically processed within 24 hours, which is faster than traditional bank transfers. Additionally, customers can track the status of their payments in real-time using the Currensea platform.

- Secure Platform: Currensea is a secure platform that uses industry-standard encryption to protect customers’ sensitive information. Additionally, the platform is regulated by the Financial Conduct Authority (FCA) and is authorized as a payment institution under the Payment Services Regulations 2017 and all transactions are covered by Mastercard chargeback protection.

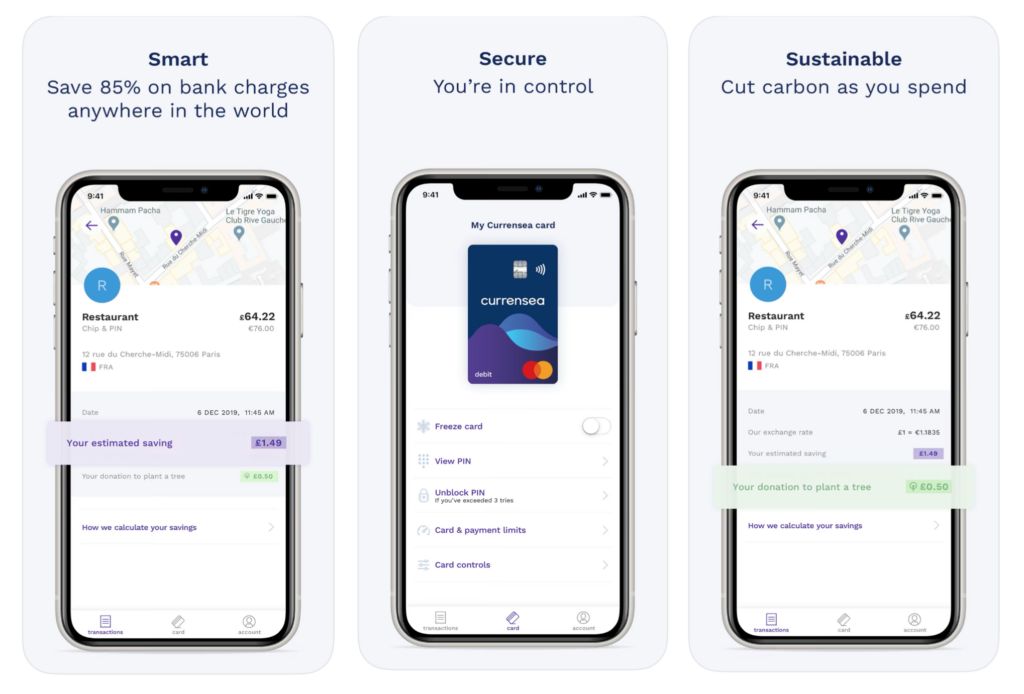

- User-Friendly Platform: Currensea offers a user-friendly platform that is easy to use and navigate. Customers can sign up for an account, connect their bank account, and make international payments in just a few clicks. The platform also provides customers with real-time exchange rates and a clear breakdown of the fees associated with their transfer and in-app notifications of all spend immediately.

- Cashback Rewards: Currensea allows you to earn cashback by clicking through the app against a number of retailers like the service provided by Topcashback or Quidco and also provides cahsback against some retailers instore when you use your Currensea card.

- Sustainable – Currensea removes 2.5 times the plastic it produces from the ocean, and you can automatically recover ocean-bound plastic or plant trees every time you spend.

How Do you Sign up For Currensea?

The signup process for Currensea is simple and straightforward and you can be ready to go in a few clicks.

Step 1: Visit the Currensea.com website – Open your preferred web browser and go to the Currensea.com website at https://www.currensea.com.

Step 2: Click on the “Sign up” button – Once you’re on the Currensea.com homepage, click on the “Sign up” button located in the top right corner of the screen.

Step 3: Provide your personal details – You’ll be redirected to a page where you’ll need to provide your personal details such as your full name, email address, and phone number. There will be a field labelled Currensea referral code – make sure you enter the code: FN5E39 to get £10 FREE credit added to your account if you make FX transactions totalling over £100 in your first 120 days.

Step 4: Verify your email address – After you’ve provided your personal details, Currensea.com will send a verification email to the email address you provided. Click on the link in the email to verify your email address.

Step 5: Set up your account – Once you’ve verified your email address, you’ll be redirected to a page where you’ll need to set up your Currensea.com account. This will involve providing additional personal information such as your new card pin and address and mobile number (which will also then be verified).

Step 6: Connect your bank account – To make payments using Currensea.com, you’ll need to connect your bank account. Note – the number of banks you can use with Currensea is quite limited – ( *details below). Follow the instructions on the screen to link your bank account to your Currensea.com account. This may be in two steps. Once to connect Currensea to your account with open banking and secondly to provide direct debit authorisation.

Step 7: Start making payments – Once you’ve connected your bank account, you can start making international payments using Currensea.com. Simply select the country and currency you wish to transfer to, enter the amount you want to transfer, and confirm the payment. Your transfer will typically be processed within 24 hours. You Currensea card will now be shipped and should be with you in 3 working days.

That’s it! Following these simple steps will enable you to set up a Currensea.com account and start making low-cost international payments.

How Do You Link Your Bank Account?

The process for linking bank accounts to Currensea is straightforward and can be completed in just a few minutes. Currensea uses a secure, encrypted connection to link with your bank account using Open Banking which ensures that all transactions are safe and secure. It should be noted that Currensea does not have access to your transaction data and the link only provides Currensea with the ability to check that you have the funds available to complete the transaction you are currently carrying out using the Currensea service

What Bank Accounts Can You Link To Currensea?

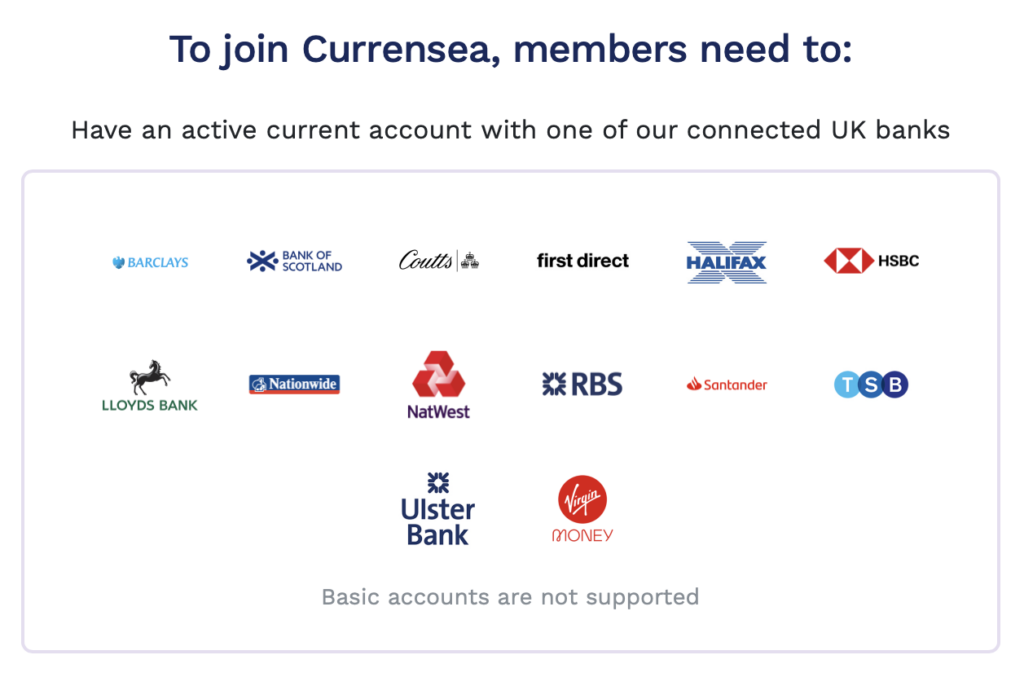

Unfortunately, the number of banks you can currently connect with the Currensea service is quite limited although the majority of the big high street brands in the UK are covered. The current list at the time of article writing is as per below image:

How user-friendly is Currensea’s platform?

Currensea’s platform is designed to be user-friendly, with a simple and intuitive interface. Users can make foreign currency transactions directly through the Currensea app, which is available for both iOS and Android devices. The app allows users to view their transaction history, track the status of their transactions, and manage their account settings.

In terms of managing foreign currency transactions, Currensea’s app makes it easy to enter the amount and currency of the transaction, and to see the total cost in the user’s home currency. The app also provides real-time exchange rates and allows users to set rate alerts to stay informed of changes in exchange rates.

How Safe Is Currensea?

Currensea takes security very seriously and has implemented several measures to protect customer data and transactions. They use 256-bit SSL encryption to secure all data transmissions, and all customer data is stored securely in a PCI-compliant environment. Additionally, Currensea is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, which means they must adhere to strict security and data protection regulations.

What is Currensea for Business?

Currensea also provides an account for Business users which you can connect directly to your business bank account and enjoy the same benefits outlined above which are available for personal users. This means low-cost international payment solutions for businesses! It enables businesses to make international payments quickly, securely, and at a low cost, without the need for complex and expensive international wire transfers.

Currensea for Business allows businesses to make international payments in over 180 currencies worldwide, using the mid-market exchange rate, which is generally more favourable than the rates offered by traditional banks and money transfer services. Businesses can manage their payments, track their transactions, and view their payment history all in one place.

Currensea for Business also provides businesses with access to real-time exchange rates and a clear breakdown of the fees associated with their transfer. This ensures that businesses have complete transparency and control over their international payments, which is crucial for managing their finances and cash flow.

What Are The Pros And Cons Of Using Currensea In A Nutshell?

Advantages:

- Simple to use: You can signup for Currensea and use the service immediately. You don’t need to setup a new bank account and you don’t need to prepay funds into your Currensea account. All payments are made when they are required directly from your current bank account using open banking.

- Quick sign up: The entire sign up can be completed in a few minutes (as you are not opening a new bank account). There are no stringent KYC ID checks and the whole process is a matter of a few clicks. Make sure if you are signing up that you enter Currensea referral code: FN5E39 to get £10 FREE

- Cost-effective: Currensea provides low-cost international payment solutions for individuals and businesses, with no hidden fees and transparent exchange rates.

- Secure: Currensea uses open banking technology to securely access and manage financial data, and is regulated by the Financial Conduct Authority (FCA) in the UK.

- Convenient: Currensea allows users to make international payments quickly and easily, with a simple sign-up process and intuitive payment dashboard.

- Multi-currency account: Currensea provides users with a multi-currency account that supports up to 180 currencies, making it easy to manage finances in different currencies.

- Mobile app: Currensea offers a mobile app that allows users to manage their finances on-the-go.

Disadvantages:

- Limited availability: Currensea is currently only available to UK residents with a UK bank account.

- Limited number of bank accounts: While Currensea supports a number of the popular high street banks in the UK – a large number of banks available in the UK are still missing and therefore you cannot use this service if you bank with them.

- Limited features: While Currensea offers many useful features, it may not have all the features or services that some users require. It offers 3 basic services. Money transfer direct from the app. Purchases using the Currensea card and cashback rewards.

- Relatively new: Currensea is a relatively new platform, and may not have the same level of reputation or trust as more established financial institutions.

Final verdict

After thoroughly reviewing Currensea, I can confidently say that it is a great product that provides an innovative solution to a common problem faced by many travellers. The ability to use a debit card abroad without incurring excessive fees and unfavourable exchange rates – And Currensea delivers on its promise!

One of the standout features of Currensea is the simplicity of the product. It is easy to sign up and use (Don’t forget to use our Currensea referral code: FN5E39 to get £10 FREE), and the website and app are user-friendly and intuitive. The integration with existing bank accounts and cards is seamless, and the ability to view all transactions in one place is a great convenience. Additionally, the customer support team is helpful and responsive, ensuring that any issues are quickly resolved.

The pricing structure of Currensea is also a major advantage over traditional bank accounts and cards. The 0.5% fee on foreign transactions (on the essential plan but 0% on all others) is significantly lower than the fees charged by the majority of other providers. The fact that there are no hidden fees or charges means that users can accurately budget their spending while travelling without worrying about unexpected expenses.

The biggest downside to Currensea is the limited range of bank accounts you can connect with Currensea. While the major banks are covered, some other major banks and most of the new fintech banks such as Starling and Monzo are completely missing which I hope is something that Currensea are looking to rectify over the coming months.

Finally, it is worth pointing out that Currensea is very niche in the services it provides. Many of the other products in the same space provide a number of services and benefits (outside of those you can see included in the yearly plan) and this is something I assume Currensea are looking at such as travel insurance or discounted hotels which would make Currensea a more rounded product.

In conclusion, Currensea offers a cost-effective, convenient, and secure solution for individuals and businesses in the UK to manage their international payments. By using open banking technology, Currensea provides users with access to transparent exchange rates and low fees, while also ensuring the security and privacy of their financial data. While there may be some limitations, such as its limited availability and feature set, Currensea’s commitment to providing a high-quality user experience and reliable service make it a promising option for those looking to manage their finances across borders. As the platform continues to expand and develop, it has the potential to become a leading player in the international payments market in the UK and beyond.

Frequently Asked questions:

- What is the Currensea Referral Code?

Enter the Currensea referral code: FN5E39 when signing up to earn £10 FREE cash credited to your account. - Where do you enter the Currensea referral code?

During signup you are asked if you have a referral code. In this field you need to enter the Currensea referral code: FN5E39 to earn your free £10 credit - Are there any other terms and conditions to be aware of when trying to activate the referral offer?

In order to receive your £10 free credit you need to complete £100 of FX transactions within 120 days of signing up .

Recent Comments