Kroo Referral

Click the Kroo bank referral link above or here and signup for a new account to get £10 FREE cash added to your balance when you spend on your Kroo debit card within 30 days of activation.

Kroo Bank: A Comprehensive Review & Kroo Referral Offer

Are you curious about Kroo Bank in the UK and what it has to offer compared to other digital banks? This article provides an in-depth review of Kroo, exploring its features and a broad overview of its pros and cons. If you’re on the lookout for a digital bank that is free, easy to use and more transparent than other banks, Kroo might just be the bank for you.

What is Kroo Bank?

Formerly an e-money account known as B-social, Kroo is an award-winning digital bank founded in 2016 by Tim Brown and Nazim Valimahomed. Having gained full banking status in 2022, Kroo is one of the newest banks in the UK.

Kroo garnered attention when it was featured on The Martin Lewis Money Show on ITV, where it was praised for its higher interest rates of 4.35% AER on balances of up to £85,000. Kroo is also renowned for its emphasis on environmental and social values. The bank has partnered up with the charity One Tree Planted and promises to plant two trees for every new customer. Kroo isn’t unique in this respect; however, its ambitions to plant a million trees by 2024 showcases its commitment to environmentalism. Kroo is transparent about how it stores and invests your money, appealing to environmentally-minded users. But that isn’t the only reason why it positions itself as a formidable financial challenger.

Here’s a high level breakdown of its pros and cons:

Pros

- 4.35% Interest rate on easy access savings account (one of the best on the market)

- Very simple signup process (Don’t forget to use our Kroo referral here for £10 FREE)

- No account fees

- Environmentally conscious

- Excellent customer service

- Split-the-bill feature

- Spending insights

- User friendly

- Free foreign spending

Cons

- No 7-day switching

- Free ATM withdrawal capped at £200

- No international payment options

- Only accessible through an app (no web or desktop option)

- No cash deposits

What are the main features of Kroo?

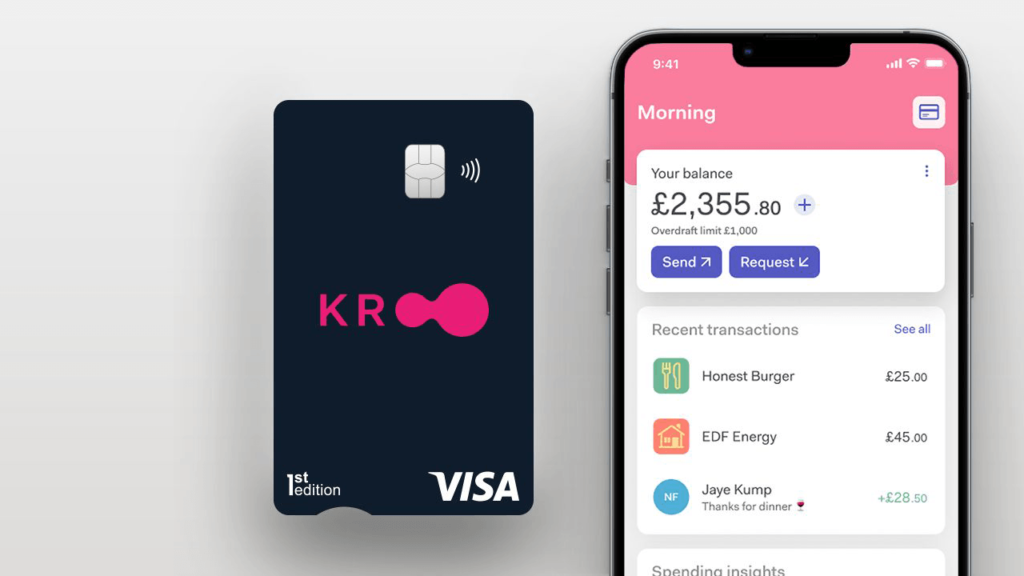

Kroo is an all-digital bank that is completely free to use. Everything is handled in the app, from obtaining a VISA debit card to budgeting, savings, spending insights and social tools such as its split-the-bill feature. The Kroo app is available to download from the iOS App Store or Google Play Store and supports both Android and Apple Pay.

Kroo’s standout feature is the 4.35% AER interest, which is one of the best digital banking has to offer, even if it doesn’t quite live up to some(new) regular savings accounts available. Instead of having savings and expenditures separate – interest is offered on the current account. While this approach simplifies the banking experience, it does present limitations. For example, some users might prefer to separate their savings but will find this option unavailable to them.

User-friendly experience and accessibility

Kroo’s main selling point is its user-friendly experience. The app is designed with simplicity in mind. Gone are the days when customers must present themselves to a long and tedious sign-up process at a high-street branch. Registration takes just a few minutes, making Kroo a great choice for those new to digital banking and those looking for simplification.

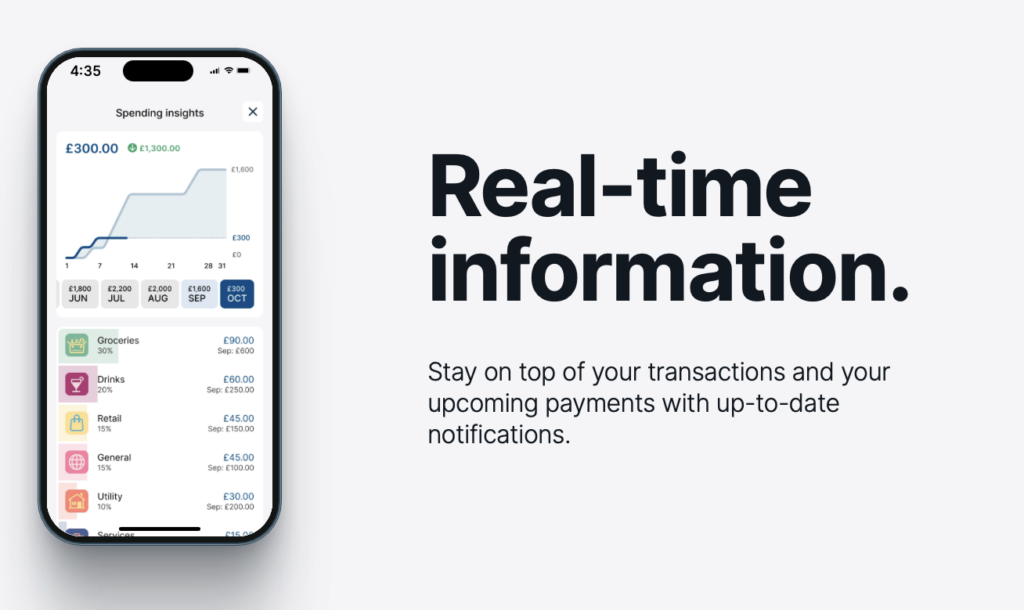

The app keeps users informed about transactions by automatically categorising them into groceries, bills, entertainment or customisable categories. It also notifies you when payments leave or enter your account, ensuring that you are always aware of account activity. However, it’s worth noting that there is no confirmation of payee when making a payment. This is something to be wary of as users will need to double-check account details before sending money.

As pleasant as the app is to use, the lack of desktop or web accessibility will be off-putting to users in need of some flexibility. It’s always nice to know that if you have any issues you can log in to your account on your PC but Kroo’s exclusive focus on mobile banking means this is unlikely to change soon.

Another limitation is the absence of options for cheque deposits or cash transactions. This is a general trend with digital banks, but competitors like Starling and Monzo offer such services. Users who are accustomed to traditional banking methods might find this inconvenient. This would be an issue for business owners also if it weren’t for the fact that you can only open personal accounts with Kroo.

As a mobile banking option, Kroo offers all the essential features like overdrafts (by invitation only) and direct debits. With Kroo you can create groups with friends, request or send money instantly, and split bill payments. Its money management tools such as the budgeting, saving and spending insights are easy to use. However, customers looking for deeper insights into their spending or other features like saving pots may want to set up an account elsewhere. For example, many digital banks provide budgeting predictions that help you afford mortgage and rent, but this just isn’t available with Kroo.

Can I use Kroo Abroad?

Kroo is an ideal option for users travelling abroad on holiday, with its free foreign spending feature and competitive exchange rates, calculated using the VISA rate. This feature is in high demand with digital banks these days and fortunately, Kroo doesn’t disappoint. While not all territories accept Kroo – Egypt and the Bahamas being two examples – it compensates with a low-cost service.

The downside is the cost of 3% when you exceed monthly withdrawals of £200. This is actually quite a lot. That extra £300 you withdraw will cost you £9 and will be inconvenient, particularly in cash-dependent regions. Aside from this, there are no hidden fees to worry about as Kroo prides itself on its transparency and low-cost service. The maximum daily transfer is £250,000 and the daily card spending limit is £10,000 which is pretty standard for most banks.

Despite its traveller-friendly features, Kroo currently lacks international payment options. If you travel overseas regularly, your best option would be to open an account with another bank and transfer your money from there to your Kroo account. It’s a bit of a hassle so hopefully, international payments will be introduced in future.

Are overdrafts available?

A personal overdraft which is available via invitation comes with several perks, including an interest rate of 24.9% APR Variable, and an arranged overdraft limit of £2500. This can be managed in the app once your overdraft has been approved but cannot be reduced to less than the current overdraft amount. An additional and quite useful perk is the free overdraft calculator on the Kroo website, which again underlines Kroo’s commitment to transparency. Overdrafts will be available to all customers soon.

What is Kroo’s customer service like?

Kroo’s customer service is reportedly very good. You can expect any queries or concerns to be answered swiftly and efficiently. This is an area digital banks tend to prioritise since there is no way to visit the bank in person.

After Martin Lewis mentioned Kroo on ITV there was a momentary surge in Kroo applications, causing complaints online of slow customer service. If you look at reviews on Trustpilot, for example, you’ll see some people had trouble with their account freezing. Kroo has now adapted to the situation and is confident that it can deal with such an event in future.

Customer support is accessible on the app, by email at help@kroo.com and by telephone on 0800 802 1323 between 9am and 5.30pm.

How do I open an account with Kroo?

Interested in joining Kroo? You can open an account in just a few, simple easy steps. Within 5 minutes you will be signed up and ready to go.

First, you must provide some basic details and send your photo ID. You must be a UK resident to sign up with Kroo, but you can be of any nationality.

Next, you will need to send a short video, following some simple instructions. Verification will then take up to several days, but most users find their account available within an hour. During this process, Kroo will also do a credit check with a UK Credit Reference Agency, leaving a soft footprint on your credit file. This is nothing to worry about as it won’t affect your ability to gain credit in future.

If at this point your account has not been verified then you may need to provide further details such as a bill showing your current address or a letter from HMRC. Kroo ensures a smooth enough verification process by emailing users the necessary information.

Upon successful verification, Kroo will post a VISA card to you within five days. To activate the card all you need to do is confirm a code to receive your PIN. Remember if you sign up using our Kroo referral link here – you will get £10 credited to your account when you make your first transaction on your Kroo debit card within 30 days.

How much does Kroo cost?

The good news is that Kroo is free to set up with zero monthly fees. As of right now, Kroo doesn’t offer a paid premium service, but perhaps this is an option we can expect in the future. Your first two replacement debit cards are free, then it is £5 per card. Some specialist payment types (e.g. CHAPS) cost money to send but otherwise, transactions are free.

Customer reviews

Kroo’s current rating on Trustpilot is 4.4 out of 5, with 74% of reviewers awarding it a 5-star rating. Only 11% gave it a 1-star rating. What customers appreciate most about Kroo is its quick and easy setup, and interest on their account. Debit cards typically arrive within 2-3 days, which is much faster than other banks. However, as mentioned above, a recurring complaint is customer service being unresponsive when accounts have been frozen, denying users access to their money for a week or more. These individuals are in the minority, but the availability of customer service is definitely something to be wary of when everything is handled through an app.

Should I join Kroo?

Joining Kroo requires very little effort. The 5 minutes it takes to sign up is worth your time to earn some interest and enjoy the app’s features like its spending analysis, free foreign spending and splitting the bill with your friends. There is also the additional ethical motivation to have an account with Kroo. That said, Kroo does not have much more to offer than other UK digital banks such as Chase, Monzo or Starling. Its monthly withdrawal limit is also restrictive, especially when compared to Starling’s withdrawal limit of £300 per day.

FAQ

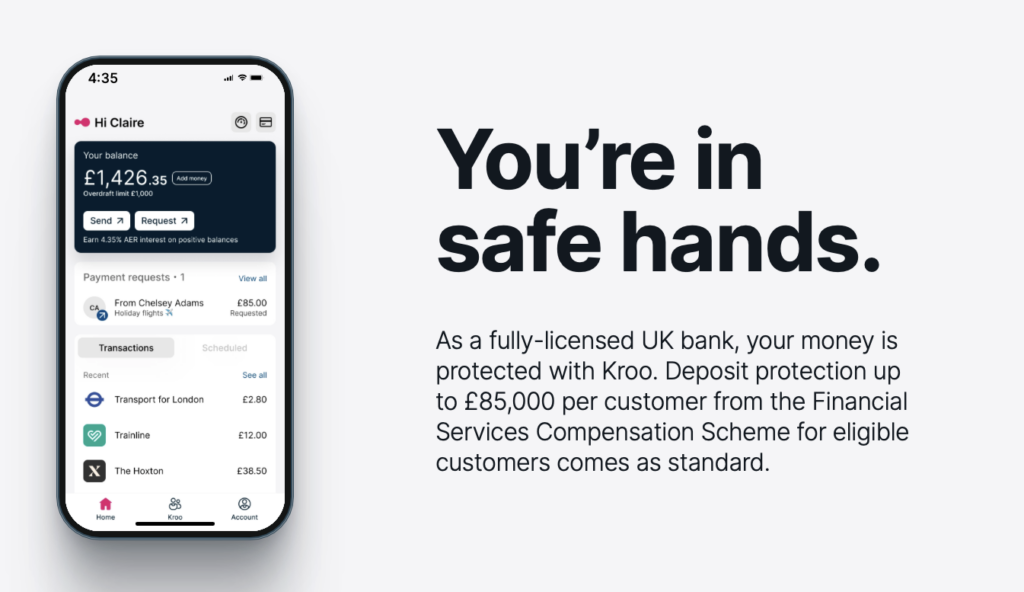

Is my money safe with Kroo?

Kroo is a fully licenced bank in the UK. The banking app itself uses secure 256-bit data encryption to keep your details safe. The app is only accessible when you enter a PIN code or through fingerprints or face ID, which is standard with most banking apps. Multi-factor authentication ensures your money and personal data are extra secure. Kroo notifies you every time a transaction is made, informing you in real-time of your account activity. You can also freeze or cancel your card very easily. As with all registered UK banks, deposits of up to £85,000 are protected by the Financial Services Compensation Scheme (FSCS).

Does Kroo offer a credit card?

No, Kroo doesn’t currently offer credit cards. Kroo may have instead chosen to concentrate on its core banking services, such as current accounts and loans. Many digital banks initially focus on providing a streamlined set of services before diversifying into additional financial products.

Does Kroo offer overdrafts?

Yes, Kroo offers a personal overdraft available via invitation, which comes with an interest rate of 24.9% APR Variable and an arranged overdraft limit of £2500. An overdraft calculator is available on the Kroo website for transparency. Overdrafts will be made available to all customers soon.

Does Kroo offer loans?

Yes, Kroo currently offers customers loans of up to £5,000 with a representative APR of 8%. Applications for loans are fully credit-checked. This process involves an assessment of the applicant’s credit history and financial behaviour to determine creditworthiness.

Is 7-day switching available with Kroo?

Kroo isn’t a member of the Current Account Switch Service (CASS) so no it doesn’t offer 7-day switching. Users will instead find that they’ll have to coordinate the transfer of direct debits, standing orders, and other account details manually. This means that the switching process for customers wanting to move their primary account to Kroo will take longer than the standard 7-day duration.

Kroo Bank – Our Verdict

Kroo Bank is a relatively new challenger bank that has quickly gained popularity among UK consumers. With its competitive interest rates, fee-free spending abroad, and easy-to-use app, Kroo has positioned itself as a compelling alternative to traditional banks.

What We Like About Kroo

- High Interest Rates: Currently offering a competitive 4.35% AER interest rate on in-credit balances, Kroo stands out from other UK banks that often offer low or even negative interest rates. This generous interest can help you grow your savings faster.

- Fee-Free Spending Abroad: Kroo doesn’t charge any fees for spending abroad, making it a great choice for international travelers. This is a significant advantage over traditional banks, which often charge high fees for foreign transactions.

- Seamless App Experience: Kroo’s mobile app is user-friendly and intuitive, making it easy to manage your finances on the go. The app provides real-time spending insights, bill splitting functionality, and secure payment options.

- Commitment to Sustainability: Kroo is committed to environmental sustainability and partners with organizations that plant trees for every Kroo account. This shows that the bank is not only focused on financial gains but also on social responsibility.

What We Don’t Like About Kroo

- Limited Branch Network: Unlike traditional banks, Kroo does not have a physical branch network, so you’ll need to rely on online or phone support for most queries. This may be a drawback for those who prefer face-to-face interactions.

- Limited Features: While Kroo offers a solid core of features, it lacks some of the more advanced options found in some other challenger banks. For instance, it doesn’t currently offer overdrafts or specific investment products.

- Limited Foreign Currency Support: Kroo only supports a few major foreign currencies, so if you travel frequently to countries with less common currencies, you may need to consider other options.

Overall Assessment

Kroo Bank is a solid choice for UK consumers seeking a modern, fee-friendly, and environmentally conscious banking experience. Its high interest rates, fee-free spending abroad, and user-friendly app are compelling features that set it apart from traditional banks. However, its limited branch network, lack of advanced features, and restricted foreign currency support may deter some users.

Recommendation

Kroo Bank is a good choice for:

- Individuals seeking high interest rates to grow their savings.

- Travelers who frequently make purchases abroad.

- Tech-savvy users who prefer managing their finances through a mobile app.

If you value face-to-face support, access to a wide range of features, or support for multiple foreign currencies, you may want to consider other options.

Our Verdict: Kroo Bank is a promising challenger bank that offers a unique set of features and a strong commitment to sustainability. It’s worth considering for those seeking a simplified banking experience with competitive interest rates and fee-free spending abroad. Remember if you do decide to signup – then use our Kroo referral code to get £10 free by clicking here

Recent Comments