PensionBee Referral

Sign up to PensionBee using our PensionBee referral by clicking the button above or here and you will get a £50 bonus added to your account once you have contributed £100 to your pension or transferred a pension to PensionBee

PensionBee hopes to revolutionise the way individuals in the UK manage their pension plans. As one of the leading online pension providers in the country, PensionBee’s platform allows users to consolidate their existing pension plans, track their investments, make contributions, and manage their accounts entirely online.

With its user-friendly interface, range of pension options, and ethical investment portfolios, PensionBee has become a go-to choice for individuals looking to take control of their retirement planning. In this article, we will take a closer look at PensionBee, its history, services, and benefits, as well as how it has helped users across the UK manage their pension plans more effectively.

Review Of PensionBee

PensionBee has made significant strides in the UK’s pension industry, offering individuals a streamlined and user-friendly way to manage their retirement savings. With a range of pension plans, including ethical investment portfolios, PensionBee has become a popular choice for those seeking to consolidate their pension plans and take control of their retirement planning. While there are many benefits to using PensionBee, it’s important to take a closer look at the company’s services, fees, customer support, and user experience to determine whether it’s the right pension provider for you. In this review, we will examine PensionBee’s strengths and weaknesses, providing an in-depth analysis of its platform and services to help you make an informed decision about your retirement planning.

Who are PensionBee?

As of September 2021, PensionBee managed over £2.5 billion in pension assets on behalf of its users. The company has grown significantly in recent years, and in April 2021, it completed its initial public offering (IPO) on the London Stock Exchange, raising £55 million in the process.

PensionBee is a publicly-traded company, so it is owned by its shareholders. PensionBee’s co-founders, Romi Savova and Jonathan Lister Parsons, also own shares in the company. As of September 2021, the largest shareholders in PensionBee are BlackRock, Legal & General, and Interactive Investor.

What Services Does Pensionbee Provide?

PensionBee provides a user-friendly platform that allows customers to manage their pension accounts online and consolidate their pensions into one place.PensionBee’s platform allows customers to track their pension savings, view their projected retirement income, and make changes to their pension plan as needed. Customers can also set up automatic contributions and track the performance of their pension investments. One of the main benefits of PensionBee is that customers can consolidate their pensions from multiple providers into one easy-to-manage account. This feature is especially helpful for people who have changed jobs multiple times and have accumulated pensions with different providers.

The process of transferring pensions to PensionBee is straightforward and can be completed online in a matter of minutes. Customers simply provide their pension information, and PensionBee takes care of the rest for free. The company uses advanced technology to identify and transfer pensions, so customers don’t have to worry about contacting their old pension providers or filling out complicated paperwork.

You do not need to transfer a pension over from an old provider to use Pensionbee. You can also start a new pension or leave old pensions where they are.

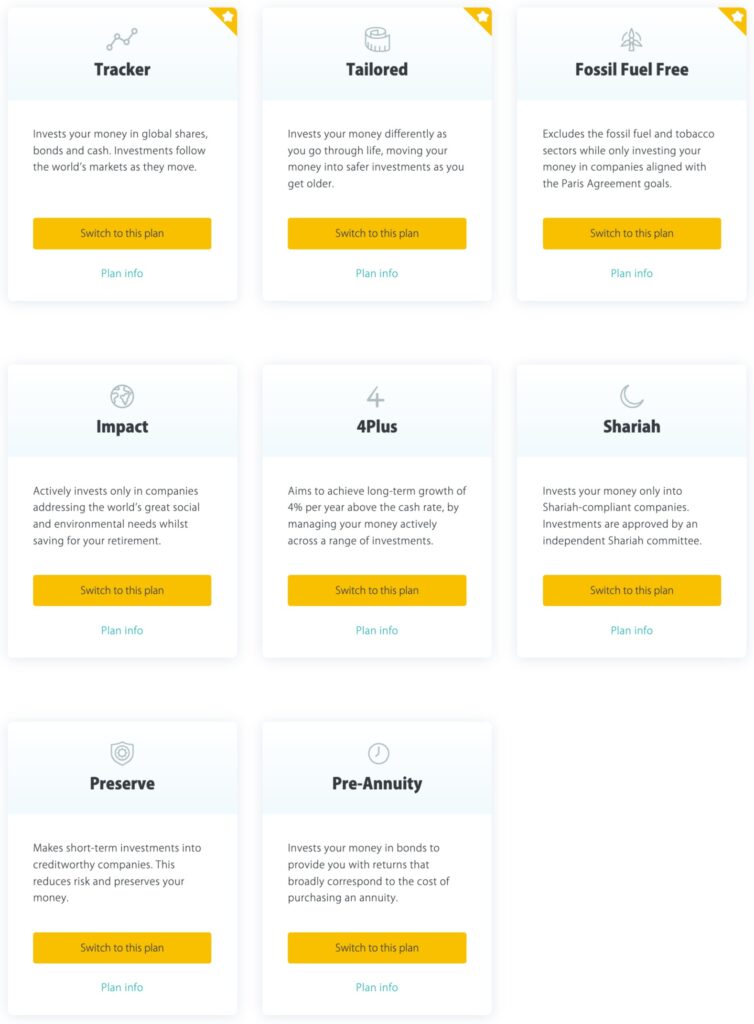

PensionBee offers a variety of plans which are suited to individuals with different needs and preferences. Customers can choose from several options as detailed below depending on their risk appetite:

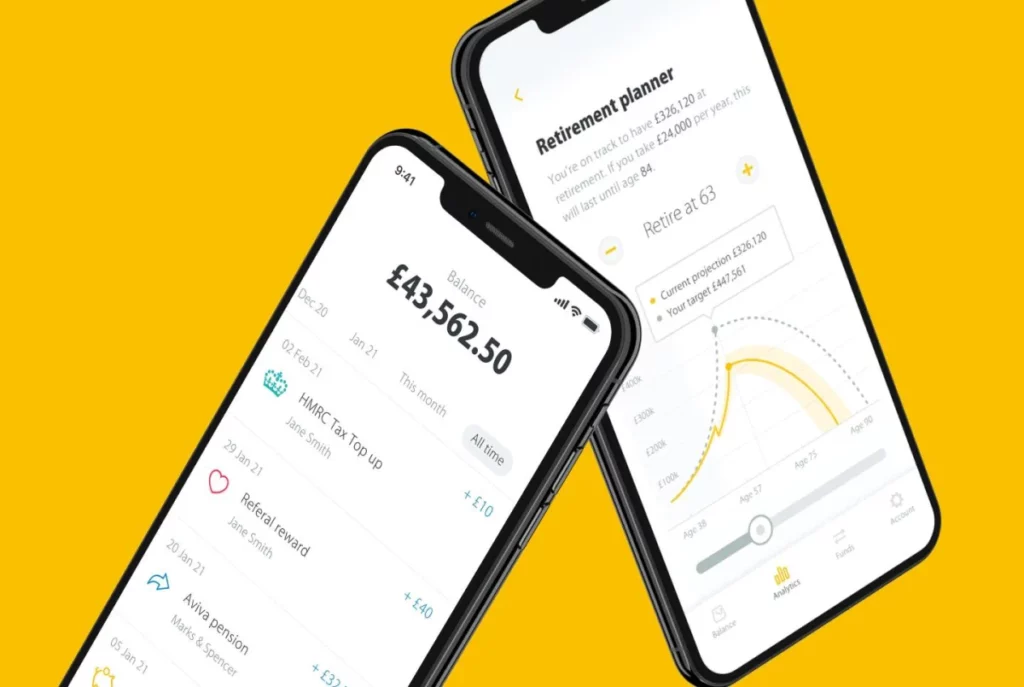

PensionBee’s platform offers a user-friendly and intuitive user experience for managing pension savings. The sign-up process is straightforward, and the user is guided through each step with clear instructions. Once the user has created an account, they can log in to the platform and access all the features available to them.

The homepage is where the user can view their pension savings, including the current value of their pension pot, recent transactions, and any changes to their investment strategy. The user can also view their pension performance and compare it to other pension providers. This feature provides valuable insights into how well their pension savings are performing compared to others in the market.

Navigating the platform is easy, with a clear menu bar at the top of the screen that allows the user to access different sections of the website. The user can view their dashboard, pension details, investment strategy, and settings. The user can also view their statements, pension charges, and projected retirement income.

Lastly, PensionBee also provides a comprehensive help and support section with a number of pension guides and calculators to help you better understand your current and future pension position. All you need to know about pensions is available in the comprehensive knowledge section of the website.

Account Set-Up and Onboarding: How Easy Is It?

To begin with, the PensionBee account set-up process is relatively straightforward. You’ll need to provide some basic information about yourself, such as your name, date of birth, and contact details. PensionBee will also ask you some questions about your pension history, such as the names of your previous pension providers and the value of your pensions. Make sure you use our Pensionbee referral link here to get £50 FREE

Once you’ve provided this information, PensionBee will use it to locate and consolidate any existing pensions you have. This process typically takes a few days, but it can take longer if PensionBee needs to contact your previous pension providers to request information. This processis completely FREE and Pensionbee should be able to move your pensions across quite quickly. If there are any costs involved to complete the transfer(fees charged by your old pension provider to leave or transfer for example) then Pensionbee will get in touch before going any further.

How Much Does PensionBee Cost?

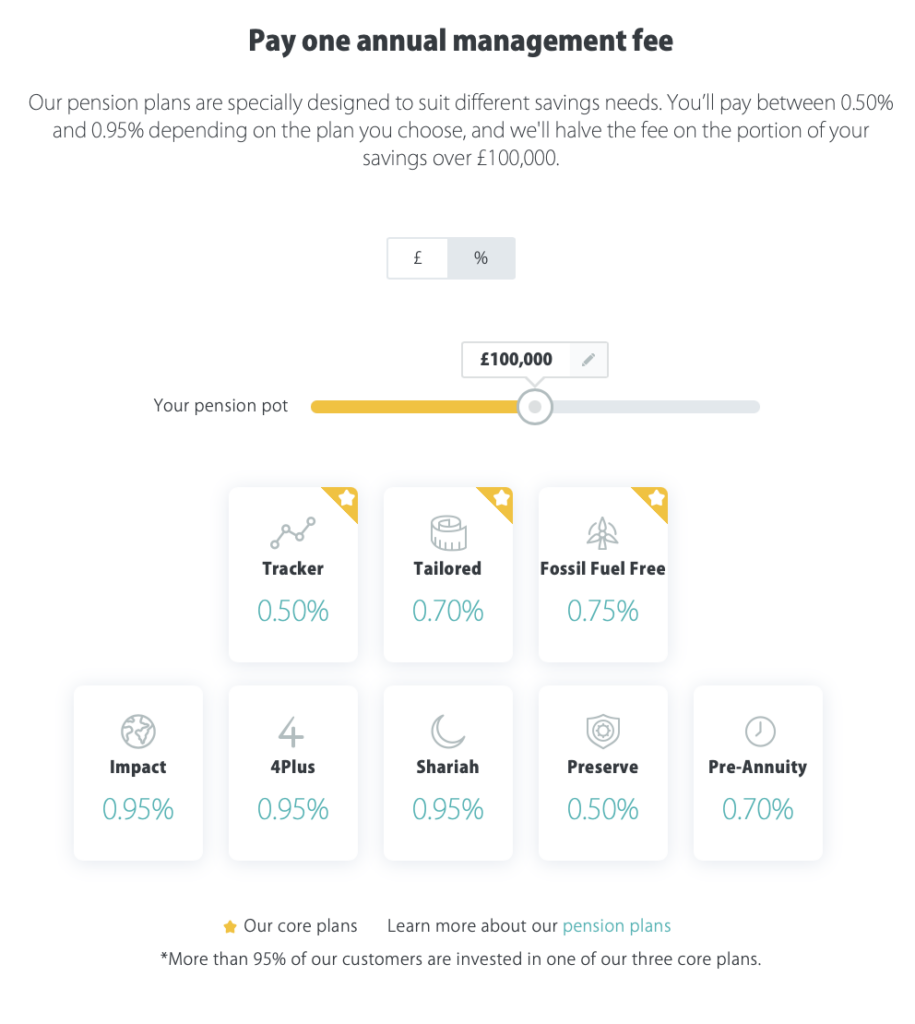

PensionBee’s fees vary depending on the pension plan that users choose. However, in general, PensionBee’s fees are competitive with those of other pension providers in the UK. There are no costs to open a Pensionbee account and there is no cost to consolidate all your old pensions into Pensionbee either. The only charges are related to the plan you invest in and the size of your pension pot. If you are considering opening a pension plan with PensionBee, it is important to carefully review the fees and charges associated with each plan to determine which one is the best fit for your needs and budget.

As an example, the costs for a number of plans are provided below. As you can see these range from 0.50% to 0.95% for the first £100,000 invested and fees for all funds held above this amount are charged at half the rate shown below.

How Has PensionBee Performed Historically?

The company provides detailed information on the performance of each of its investment options on its website, allowing users to compare different plans and choose the one that best suits their needs. In general, PensionBee’s investment options have delivered solid returns over the years, with some plans outperforming others depending on market conditions.

It is worth noting that past performance is not a guarantee of future returns, and that the value of investments can go up as well as down. However, PensionBee’s investment approach is designed to be well-diversified, which helps to mitigate some of the risks associated with investing. Moreover, the company’s investment team is highly experienced and has a track record of making sound investment decisions.

How Responsive Is PensionBee’s Customer Support Team?

PensionBee offers various channels for customer support, including phone, email, and live chat. Customers can also access a comprehensive FAQ section on the website that provides answers to common questions. The customer support team operates from 9 am to 6 pm on weekdays, and customers can expect a response within a few hours during these times.

Overall, PensionBee’s customer support team is responsive and efficient in handling customer queries. Customers have praised the team for their prompt and helpful responses. The live chat feature, in particular, has been praised for its quick response times and helpfulness.

Is Your Data Safe With PensionBee?

PensionBee uses several security measures to protect its users’ data. The company is regulated by the Financial Conduct Authority (FCA) and is a member of the Pension Protection Fund. It also employs advanced encryption technology to secure all its transactions, which means that all data sent to or from its platform is protected from unauthorised access.

Pros And Cons: The Good And The Bad Of PensionBee & PensionsBee Referral

Here we will explore both the good and the bad about PensionBee, so that you can make an informed decision about whether or not it is the right choice for your retirement planning.

Pros:

- Easy to Use

PensionBee’s online platform is incredibly user-friendly and easy to use. The signup process is straightforward, and once you are registered, you can manage your pension online at any time. The platform also has a mobile app, making it easy to check your balance and track your investments on the go.

- Low Fees

One of the most significant advantages of PensionBee is its low fees. The platform charges a simple annual fee based on the value of your pension and the plan you are invested in, with no hidden charges or fees. This fee structure is transparent, which means you can see exactly what you are paying for.

- Consolidation

PensionBee allows you to consolidate all your existing pensions into one simple plan, making it easier to manage your retirement savings. You can transfer your pensions from other providers into PensionBee, and the platform will take care of the process for you for free.

- Flexible Investments

PensionBee offers a range of investment options to suit different risk profiles and investment goals. The platform has eight investment plans, ranging from cautious to adventurous, so you can choose the one that best suits your needs. You can also change your investment plan at any time if your circumstances change.

- Great Customer Service

PensionBee’s customer service is excellent. The platform has a team of friendly and knowledgeable customer service representatives who are available to answer any questions you may have about your pension. You can contact them via phone, email, or live chat, and they aim to respond to all queries within 24 hours.

6. Free £50 Cash: Get £50 added to your pension plan by signing up using our PensionBee referral.

Cons:

- Limited Investment Options

While PensionBee offers a range of investment options, they are limited compared to other pension providers. If you are looking for a wider range of investment options, you may need to consider other providers.

- No Advice

PensionBee is a self-service platform, which means it does not offer financial advice. If you are unsure about which investment plan to choose or how to manage your pension, you will need to seek advice elsewhere.

- Not Suitable for Large Pension Pots

PensionBee may not be suitable for those with large pension pots, as the platform’s fees are based on the value of your pension. If you have a significant amount saved for retirement, you may find that the fees are higher than other providers.

- No Guarantee

PensionBee’s investments are not guaranteed, which means there is a risk that you could lose money. While the platform’s investment plans are diversified to reduce risk, it’s important to remember that there is no guarantee of returns and that your capital is at risk.

- No Workplace Pensions

PensionBee does not offer workplace pensions, which means you cannot use the platform to manage a workplace pension scheme. This may be a drawback for those who are looking for a comprehensive pension solution that covers all their retirement savings.

Conclusion: Is PensionBee the Right Choice for You?

After reviewing the various aspects of PensionBee, including its features, fees, customer support, investment options, and user experience, it is clear that PensionBee can be a suitable choice for individuals seeking an easy-to-use and transparent pension management platform.

PensionBee offers a wide range of investment options, flexible plans, and a simple interface that is easy to use, making it an attractive option for those who want to take control of their pension savings without having to go through complex processes. Its customer service is also praised for being responsive and helpful.

However, it’s important to keep in mind that PensionBee may not be the best fit for everyone. Its fees can be higher compared to some other providers, especially for larger pension pots. Additionally, PensionBee’s investment options may not be as extensive or customisable as those offered by some other providers.

Ultimately, whether PensionBee is the right choice for you depends on your individual needs and preferences. If you prioritise simplicity and ease of use over customisation and lower fees, PensionBee could be a good fit for you. However, if you have a larger pension pot and want more control over your investments, you may want to explore other options. In any case, it’s always a good idea to do your research and compare different providers to find the one that best meets your needs.

Don’t forget to sign up with our Pensionbee referral to get yourself £50 cash added to your Pension pot held at Pensionbee. Sign up here

Recent Comments