Raisin Referral Code

Get £50 FREE when you use the Raisin referral link above or HERE. You must open your first savings account with a minimum term of six months, and a minimum deposit of £5,000. If you opt for an easy access savings account, you must keep the balance at or above £5,000 for six months). At the end of the six month period, the bonus will automatically be paid to your transaction account.

Introduction

With so many savings and investing accounts available for UK personal finance, finding a savings account that delivers both convenience and competitive returns can feel like searching for buried treasure.

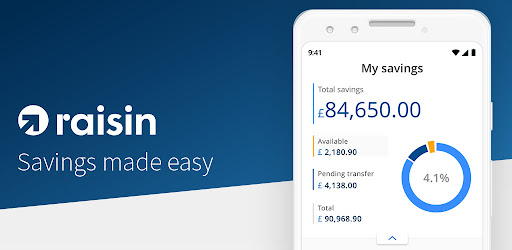

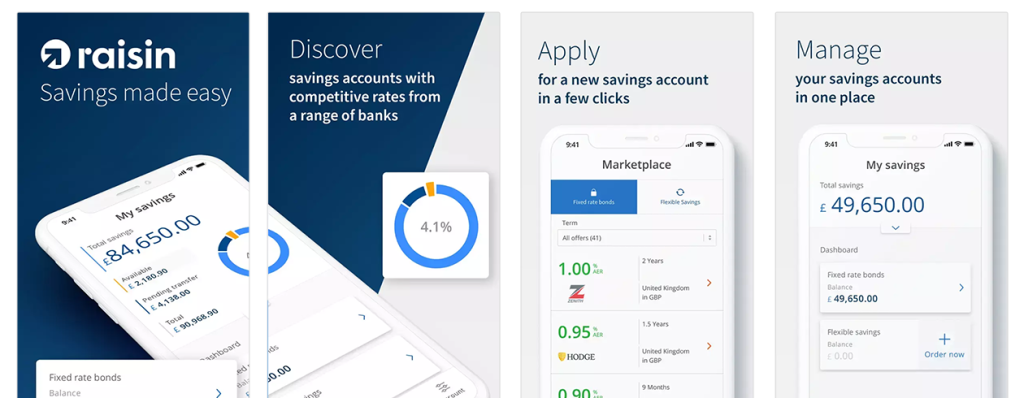

In your search for a high-return savings account, you may have come across Raisin. The Raisin online platform has been created to revolutionise how you manage your hard-earned cash, offering a treasure trove of high-yield accounts from a diverse range of providers, all under one user-friendly roof.

But is this a safe and user-friendly online savings option? Our Raisin review will uncover the truth about Raisin’s savings, interface, and potential for UK savers.

Raisin Savings Platform Review

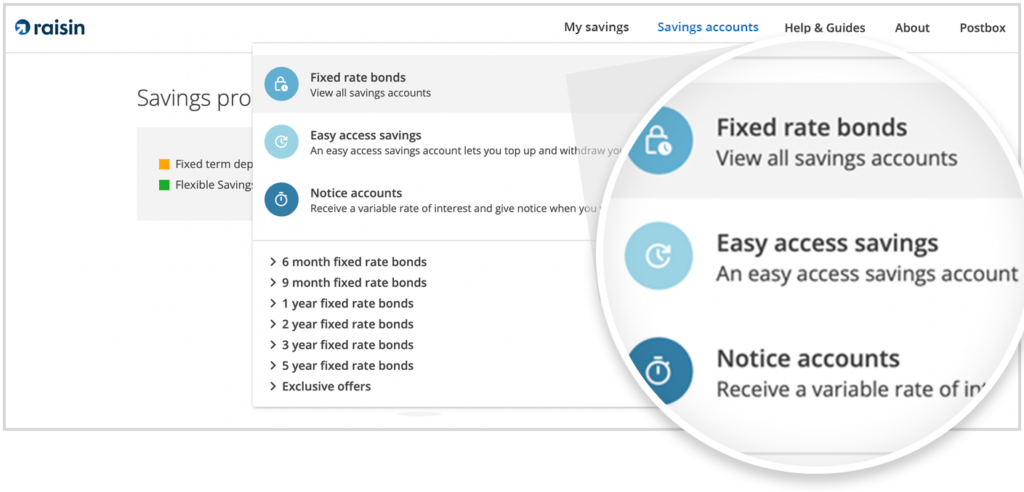

Raisin’s main attraction lies in aggregating savings accounts from several UK banks and building societies into a single online platform. This saves you the time and effort of having to scour individual apps, websites and banks – offering a centralised hub for comparison and account management. With easy access, notice, and fixed-rate options available, Raisin caters to various saving goals and risk tolerances.

Opening a Raisin account is also a simplified and quick process. You simply need to register online (bypassing the mountains of paperwork some other banks may require), and within minutes, you’ll have access to a marketplace brimming with savings options. Raisin streamlines the process, allowing you to choose and open accounts with a few clicks.

Pros and Cons of Raisin Savings Accounts

Before we delve into the features of Raisin Savings in detail, here is a breakdown of the service’s standout benefits and sticking points. These should help you get an idea if this is the right UK savings option for you.

Pros: Where Raisin Shines

- Centralised Savings Management: Raisin offers users a single platform to manage multiple savings accounts from various providers. This provides both convenience and reduced time spent on individual bank websites.

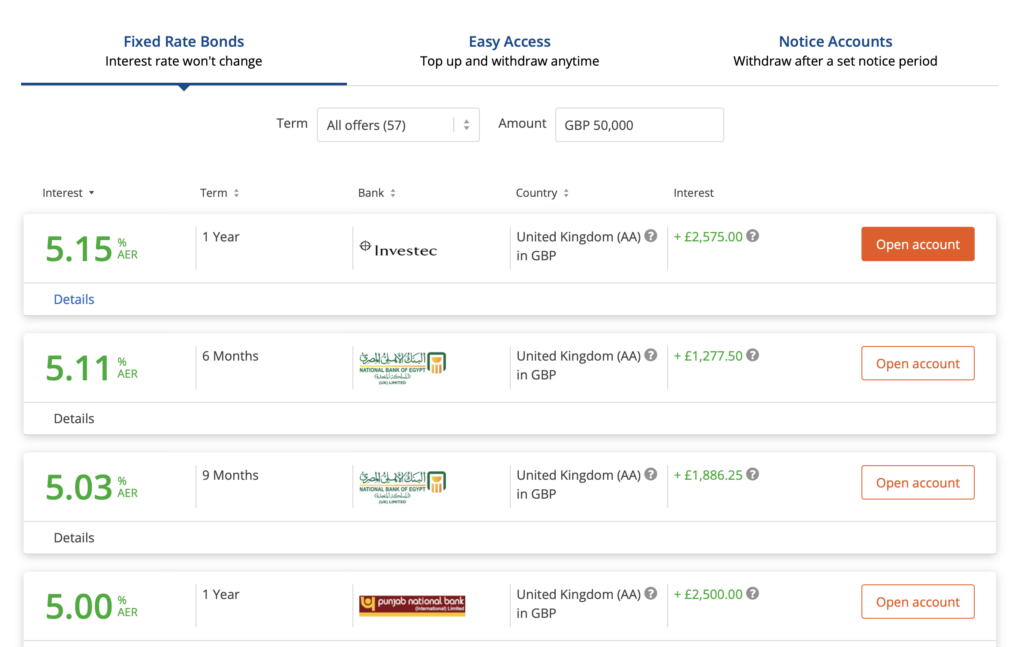

- Competitive Interest Rates: Raisin provides access to a marketplace of savings accounts with potentially higher interest rates than some traditional bank offerings. However, comparing rates across different providers and platforms is essential to make truly informed decisions.

- Transparent Rate Comparisons: Raisin allows you to compare interest rates and features for various accounts side-by-side. This can improve your decision-making by enhancing transparency and facilitating informed choices.

- Financial Security: Raisin is regulated by the FCA, and all deposits are FSCS-protected up to £85,000 per provider, offering a degree of financial security for savings.

- Additional Features: Raisin offers features like rate change alerts, maturity date management, and access to Sharia-compliant options, which may be valuable for some users.

- Raisin Referral: Sign up for a Raisin account using the Raisin referral LINK HERE or above and get £50 added to your account when you deposit £5000.

Cons: Where Rasin Savings Could Improve

- No ISA Options: If maximising tax-free savings is your primary goal, Raisin may not be the ideal solution as it currently doesn’t offer Individual Savings Accounts (ISAs). While it provides access to various other accounts, it’s important to consider alternative savings account options if ISAs are a vital component of your savings strategy.

- May Not Include All Peak Rates: While Raisin boasts competitive interest rates on its platform, it’s important to note that it may not always offer the absolute top rates available in the market. It’s crucial to compare rates across different providers and platforms, including traditional banks, to ensure you secure the best possible savings return.

- Focus on Core Functionality: Compared to traditional banks, Raisin’s platform prioritises core account management functionalities and may lack some features often associated with brick-and-mortar institutions. Debit cards, branch access, and certain account-specific perks might not be available through Raisin, which could be a drawback for users who prefer the full suite of traditional banking services.

- Single Account Reliance: When using Raisin, funding and withdrawals rely on a single linked bank account. This contrasts with some traditional banks and platforms that offer multiple funding options or integrations with different accounts. Depending on your existing banking setup and preferences, this reliance on a single linked account might require additional adjustments or limitations.

What Types of Savings Accounts Are Available with Raisin Bank?

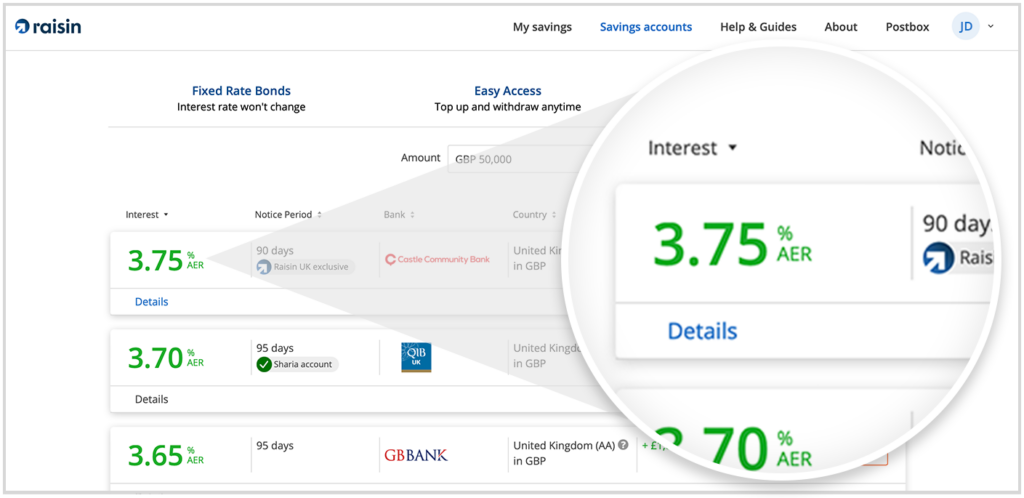

Raisin offers various savings accounts through its marketplace platform, catering to different saving goals and risk tolerances. Here’s a breakdown of the main types you can find:

Easy Access Accounts:

Perfect for: Quick access to your funds and short-term saving goals.

Features: No notice periods for withdrawals, often higher rates than traditional instant-access accounts; some may have minimum balance requirements.

Notice Accounts:

Suitable for: Balancing flexibility with potentially higher interest rates.

Features: The platform requires a few days’ notice for withdrawals but typically offers better rates than easy-access accounts.

Fixed-Rate Bonds and CDs:

Ideal for: Securely locking in higher rates for a specific period.

Features: Fixed interest rates are guaranteed for the term, early withdrawal penalties may apply, and they are suitable for longer-term goals.

Sharia-compliant Options:

Caters to: Individuals seeking savings accounts that adhere to Islamic finance principles.

Features: You can use the app to invest in assets deemed permissible under Sharia law, often with profit-sharing mechanisms instead of traditional interest.

Additional Features:

High-yield accounts: Raisin often features limited-time or exclusive offers with particularly high-interest rates.

Joint accounts: Some providers allow opening accounts with another person.

Different currencies: Depending on the provider, you may find accounts in euros or other currencies.

Remember, interest rates and terms can vary significantly between providers and account types. You should always compare and research individual accounts before deciding.

Raisin vs Traditional Banks: Which is Better for Your Savings?

So, how does Raisin stack up against the familiar comfort of your local brick-and-mortar bank? Well, the answer to this depends on your priorities. If convenience and potentially higher returns are your main deal-breakers, Raisin offers a quick and convenient way to select a high-rate account and enjoy the ease of managing everything in one place.

However, traditional banks still hold sway for those who value branch access, debit cards, or specific product offerings like ISAs.

Is Raisin a Safe Platform?

When it comes to your money and personal details, you can never be too safe. Here is a breakdown of the safety and security features available with Raisin.

Raisin’s security:

- FCA-regulated: Raisin is authorised and regulated by the UK’s Financial Conduct Authority (FCA), ensuring adherence to strict financial regulations and consumer protection guidelines.

- FSCS protection: All deposits held with Raisin partner banks are protected by the FSCS (Financial Services Compensation Scheme) up to £85,000 per institution. This means even if a provider goes bust, your savings are safe up to this limit.

- Secure platform: Raisin utilises industry-standard encryption and security protocols to protect your data and financial information. They also employ multi-factor authentication for additional security.

Partner bank security:

- Individual bank security: Each bank offering accounts on Raisin has its own security measures and regulations in place. It’s essential to research the specific bank you’re considering to make sure you understand their security protocols.

- FSCS protection again: Remember, the FSCS protection applies to each individual bank up to £85,000. This means spreading your funds across multiple banks within Raisin can maximise your FSCS protection.

Raisin Bank Review of Security: Things to Consider:

- Single linked bank account: Currently, Raisin relies on a single connected bank account for funding and withdrawals. This means your overall security depends on the security of your linked bank as well. This is also one of its strengths – you can only withdraw to your linked bank account and not a different account.

- No ISA protection: Raisin doesn’t currently offer ISAs, which have additional security features like government protection.

Overall, Raisin provides a safe and secure platform for managing your savings accounts. However, it’s crucial to remember that your overall security depends on both Raisin and the individual bank you choose.

How to Set Up a Raisin Savings Account?

So, how do you start using Raisin to find the best savings account for you? Here is a step-by-step guide to getting started:

Stage 1: Registering with Raisin and Connecting Your Bank Account

Creating a free Raisin account takes just a few minutes. You need to provide your basic information, like name, address, and contact details, and then you can browse the available accounts within a few minutes. Remember, if you sign up through our Raisin invite HERE – you will receive a £50 bonus added to your account when you deposit £50.

You’ll need to connect your existing bank account. Choose from a list of supported banks and authorise the secure transfer of funds between your accounts.

Stage 2: Exploring the Savvy Savings Marketplace

Once you have registered and set up your account, you can browse a range of savings accounts from many providers. You can use the easy-access options for immediate liquidity, explore fixed-rate bonds, or look at notice accounts for controlled flexibility. Each account displays its interest rate, term, and key features, making it easy to compare the various options.

You can use the filtering tools to narrow down your account choices based on your specific needs and risk tolerance. Whether you prioritise high returns, instant access, or ethical investing, Raisin will present you with the best choices for your financial aims.

Once you’ve identified your ideal account, you need to click on the “Open Account” button. The platform then guides you through the application process, pre-filling forms and minimising the need for additional time-consuming paperwork.

Stage 3: Finalising Your Chosen Account

To ensure the security of your account, you might need to undergo some quick verification steps. This typically involves uploading identification documents or confirming your details through your existing bank.

Within a few days, your chosen account will be activated, and you can start tracking your balances, depositing funds, and monitoring interest rates from your personalised Raisin dashboard.

Tips for Getting the Most Out of Your Raisin Account

Once you have opened your Raisin savings account, there are certain steps you can take to ensure you are getting the most from your savings:

- Rate Change Alerts: With Raisin’s notification system, you can stay ahead of the curve. Set up alerts for your chosen accounts, and you’ll be instantly informed when interest rates change, allowing you to optimise your savings strategy.

- FSCS Optimisation: Spread your funds across multiple providers within the platform to maximise the £85,000 FSCS protection limit per institution. This way, your hard-earned savings remain secure and protected. Currently, Raisin limits you to depositing £85k per provider on its platform to ensure this protection (but you should note that some institutions use the same bank to secure your funds and the protection is once per institution)

- CD Ladder: For a consistent flow of income, consider building a “CD Ladder” by investing in savings accounts with varying maturity dates. This ensures you have regular access to funds while benefiting from the stability of longer-term investments.

Raisin Bank Review: Is This The Right Savings Account Option for You?

Raisin Bank has become a popular option for savers looking for convenience, competitive rates, and a tech-savvy approach to managing your money. But before you dive headfirst into this digital oasis, it’s crucial to ask: is Raisin the right fit for you?

Good for those looking for flexibility and efficiency.

Raisin empowers you to compare and choose from a diverse range of savings accounts, from high-yield, easy-access options to fixed-rate havens for long-term goals. So, you won’t confined to the limited offerings of your traditional bank.

Raisin presents rates, terms, and features side-by-side, making informed decisions a breeze. You will quickly have all the information you need at your fingertips. The platform also streamlines the account opening process, slashing through mountains of paperwork and tedious phone calls. You only need to complete your registration details once, and you have access to all the savings options from various institutions directly in the Raisin platform. Within minutes, you can be browsing the marketplace and choosing your perfect savings haven.

Don’t forget if you do decide to open a Raisin account, then you can sign up with our Raisin referral and get £50 added to your account – CLICK HERE TO SIGN UP

Not a Good Option for Those Who Want Extra Banking Features or ISA Access

Raisin’s landscape currently lacks the option of Individual Savings Accounts (ISAs). So, you should consider alternative options if ISAs are your must-have financial tool.

Raisin might not be your ideal companion if you also value branch access, debit cards, and face-to-face interaction or other bank services or functionality.

Another sticking point may be that Raisin currently hinges on a single linked bank account for funding and withdrawals. This may not suit users who prefer the flexibility of multiple funding sources or integrations with different accounts, although, for some, this may be considered a valuable safety feature in that funds can only be withdrawn to the same account you used to fund your Raisin account.

Conclusion: Raisin Savings Account Review: Unlocking the Best Rates for UK Savers?

Remember to sign up with our Raisin referral to get £50 free added to your balance when you deposit £5000

Raisin offers an attractive solution for savers seeking convenience and potentially higher returns. You can compare and manage multiple accounts from various providers in one place, potentially snag better rates than some traditional banks, and enjoy user-friendly features like rate alerts and maturity date management. However, it’s not a universal fit.

If maximising tax-free savings through ISAs is your priority, Raisin isn’t your best bet. It also lacks traditional banking features like debit cards and branch access and relies on a single linked bank account.

Ultimately, whether this is the best savings account option depends on your individual needs. Are you tech-savvy, prioritising ease and competitive rates, and not bothered by the limitations? Raisin could be the perfect fit! Remember, compare options based on your savings goals, risk tolerance, and desired access and features. Then, choose the platform that unlocks the optimal returns during your financial journey!

Recent Comments