Revolut Referral – Get Upto £200 Free

Get upto £200 Free cash when signing up to Revolut using our Revolut referral above or click here. You need to sign up using the link, add money to your account, order a physical card and make 3 purchases with a minimum spend of £5 each to recieve your free cash.

Revolut Bank in the UK: A Comprehensive Guide

Introduction

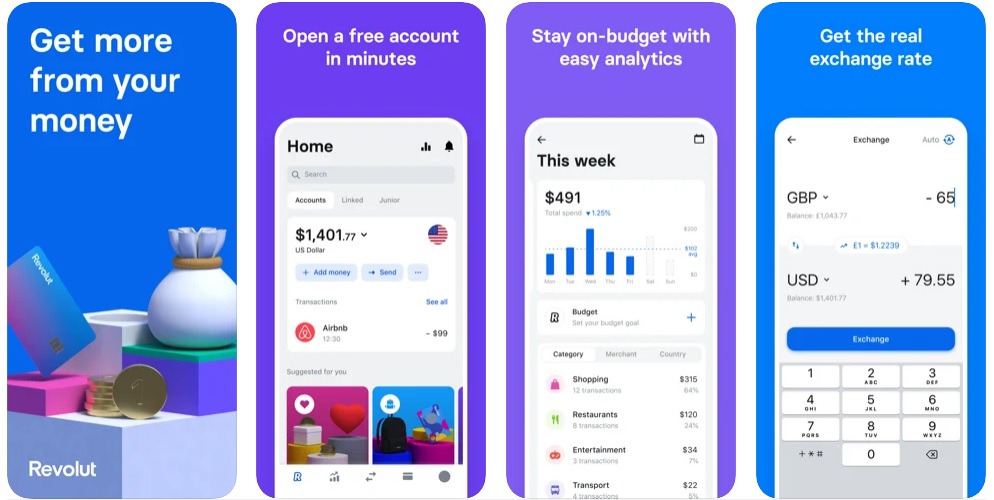

Revolut has become a major player in the financial technology sector, offering a seamless banking experience for customers worldwide. In the UK, Revolut provides a variety of banking services that challenge traditional banks with its innovative, digital-first approach. In this article, we will explore Revolut Bank in the UK, its features, benefits, fees, and how it compares to traditional banks.

What is Revolut?

Revolut is a digital banking and financial technology company that was founded in 2015. Initially, it started as a prepaid card service that allowed users to exchange currencies at interbank rates. Over the years, Revolut has expanded its services to include banking, investing, insurance, and cryptocurrency trading. The company has grown rapidly, with millions of users worldwide.

Is Revolut a Bank in the UK?

As of now, Revolut operates as an e-money institution in the UK, regulated by the Financial Conduct Authority (FCA). While it has received a banking license in some European countries, it has not yet obtained a UK banking license. This means that Revolut UK customers’ funds are safeguarded in a separate account rather than being protected under the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 in traditional banks.

Key Features of Revolut Bank in the UK

Revolut offers a variety of features that set it apart from traditional banks:

1. Multi-Currency Accounts

Revolut allows users to hold and exchange over 30 different currencies at interbank rates, making it an excellent choice for frequent travelers and international businesses.

2. Fee-Free Currency Exchange

Users can exchange currencies at real-time interbank rates with no hidden fees. However, there are limits on fee-free exchanges, and a small markup applies during weekends.

3. Instant Payments and Transfers

Revolut enables fast and free transfers between Revolut accounts and low-cost international payments. It also supports SEPA, SWIFT, and Faster Payments in the UK.

4. Subscription-Based Accounts and Pricing Plans

Revolut offers different account tiers, each with varying benefits:

- Standard (£0/month):

- Free multi-currency accounts

- Fee-free currency exchange up to £1,000/month

- Free ATM withdrawals up to £200/month

- Basic budgeting tools

- Plus (£2.99/month):

- All Standard benefits

- Purchase protection up to £1,000/year

- Priority customer support

- Customizable card options

- Premium (£6.99/month):

- All Plus benefits

- Free ATM withdrawals up to £400/month

- Overseas medical insurance

- Access to airport lounges (with additional fees)

- Virtual cards for secure online transactions

- Metal (£12.99/month):

- All Premium benefits

- Free ATM withdrawals up to £800/month

- 1% cashback on card purchases outside Europe, 0.1% within Europe

- Exclusive metal card

- Free lounge access if your flight is delayed

- Ultra (£45/month):

- All Metal benefits

- Higher cashback rewards

- Access to premium lifestyle perks

- Comprehensive travel insurance

- Concierge services

Each plan offers a range of financial tools and benefits designed for different levels of usage, making it easy to select one that fits your needs.

5. Cryptocurrency Trading

Revolut allows users to buy, sell, and hold cryptocurrencies, including Bitcoin, Ethereum, and more. However, users should be aware of the fees and potential risks involved in crypto trading.

6. Stock and Commodity Investments

Revolut provides access to stock trading with fractional shares, as well as gold and silver investments, making it an appealing option for beginner investors.

7. Revolut Junior

This feature allows parents to set up accounts for their children, teaching them financial responsibility with spending controls and savings tools.

8. Budgeting and Analytics

Revolut offers smart budgeting tools, categorizing transactions and providing spending insights to help users manage their money effectively.

9. Virtual Cards for Secure Online Shopping

Revolut provides disposable virtual cards that generate a new card number for every online transaction, reducing the risk of fraud.

10. Travel Perks

Revolut offers fee-free spending abroad, free ATM withdrawals up to a certain limit, and travel insurance on premium plans.

Revolut Referral Offer – Get Up to £200 Free Cash

Revolut frequently runs promotional referral offers where both the referrer and the new user can earn cash rewards. Currently, Revolut is offering up to £200 free cash when you sign up using a referral link and meet certain conditions.

How to Claim the Revolut Referral Bonus:

- Sign up using this revolut referral link: HERE

- Complete the sign-up process by verifying your identity.

- Order a physical or virtual Revolut card and complete at least three qualifying transactions.

- Meet the minimum spending requirement, which varies depending on the specific offer.

- Receive your bonus directly in your Revolut account once all steps are completed.

Terms and Conditions:

- The referral bonus is only available to new Revolut users who sign up through a valid referral link.

- A minimum spending amount (usually around £5-£10) must be met within a specific time frame.

- The bonus amount can vary based on the promotional period.

- Only transactions made with the Revolut card count towards the qualifying spend.

- Users must be residents of the UK and meet Revolut’s eligibility requirements.

If you haven’t yet joined Revolut, now is a great time to take advantage of this limited-time offer and enjoy all the benefits Revolut has to offer!

How Does Revolut Compare to Traditional UK Banks?

| Feature | Revolut | Traditional Banks |

|---|---|---|

| Multi-currency accounts | Yes, over 30 currencies | Usually only GBP, EUR, USD |

| Currency exchange fees | No fees (limits apply) | Often high fees |

| International transfers | Low-cost, fast transfers | Often expensive, slower |

| FSCS Protection | No | Yes, up to £85,000 |

| Cryptocurrency trading | Yes | Rarely offered |

| Budgeting tools | Advanced analytics | Basic tools |

| Investment options | Stocks, commodities, crypto | Limited to savings & ISAs |

| Branch access | No physical branches | Yes |

Conclusion

Revolut has revolutionized banking with its digital-first approach, offering a range of innovative features that traditional banks struggle to match. While it is not yet a fully licensed bank in the UK, its extensive offerings in currency exchange, international transfers, investment, and security make it a strong choice for many users. However, those who need FSCS protection should be cautious and consider keeping large sums in a traditional bank.

Should You Switch to Revolut?

Revolut is an excellent secondary account for travel, budgeting, and investments, but may not yet be the best primarybanking option due to the lack of FSCS protection. If you’re comfortable with digital banking and are looking for a flexible financial solution, Revolut is worth considering. Don’t forget to sign up using this referral link to claim up to £200 free cash: CLICK HERE

Recent Comments