Robinhood Referral

Sign up for a Robinhood account using our Robinhood referral link here or above and get a FREE share worth upto $175 when your account is approved

Introduction

In the fast-paced world of investing, accessibility and simplicity are often key factors driving individuals to participate in the stock market. Today with so many online platforms available in the UK, the landscape has become increasingly democratised, allowing people from all walks of life to invest in stocks, ETFs, cryptocurrencies, and more. Among these platforms, one name stands out and that is Robinhood. Originally launching in 2020 – Robinhood has finally launched in the UK in 2024 after taking the US by storm.

The Birth of a Robinhood.

Founded in 2013 by Vlad Tenev and Baiju Bhatt, Robinhood set out to revolutionise the way people invest. Named after the legendary outlaw who took from the rich to give to the poor, the platform’s mission is clear: to provide commission-free investing to the masses. This model challenged the traditional brokerage industry, which often charged hefty fees for trading stocks and other financial instruments. One of the most popular trading apps in the US – finally it has arrived to this side of the pond. 🙂

Democratising Finance

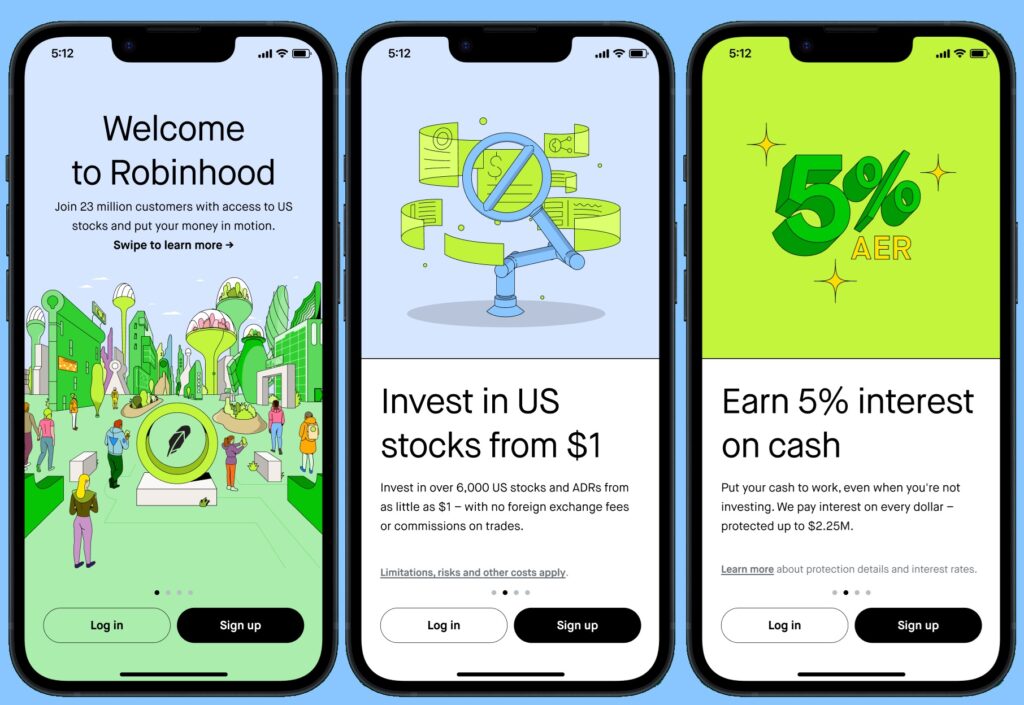

One of the key aspects of Robinhood’s appeal is its user-friendly interface, which is designed to cater to both novice and experienced investors alike. The platform offers commission-free trading on stocks, ETFs, (options & cryptocurrencies currently not available in the UK), making it accessible to individuals with any budget. This democratisation of finance has empowered millions of users to take control of their financial futures. Note: Currently you can only invest in US traded stocks

Remember to use our Robinhood free share offer by using the following Robinhood referral HERE

Innovative Features

The Robinhood trading platform offers a range of features designed to make investing accessible, user-friendly, and engaging for both novice and experienced investors. Here are some of the main features of the Robinhood platform:

- Commission-Free Trading: One of Robinhood’s most notable features is its commission-free trading. Users can buy and sell stocks, ETFs without paying any commissions or fees.

- Fractional Shares: Robinhood allows users to purchase fractional shares of stocks and ETFs, meaning you can invest in high-priced stocks with as little as $1. This feature enables investors to build diversified portfolios even with limited funds.

- 24/5 Trading: You can now trade 24 hour per day in a selection of stocks. Trade TSLA, AMZN, AAPL, and more of your favourite US stocks 24 hours a day, 5 days a week.

- Interest On Your Cash: Currently Robinhood offers 5% interest on any cash deposited in your Robinhood account

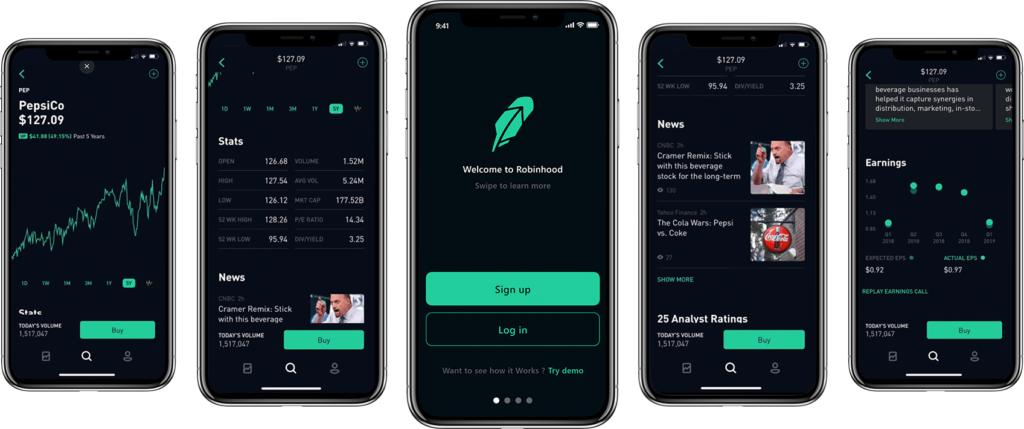

- User-Friendly Interface: The Robinhood app and website feature a clean and intuitive interface that is easy to navigate. Users can quickly view their portfolio, search for stocks, place trades, and access research and educational resources.

- Real-Time Market Data: Robinhood provides real-time market data, allowing users to stay informed about the latest stock prices, market trends, and news. This information is crucial for making informed investment decisions.

- Customisable Watchlists: Users can create custom watchlists to track their favorite stocks, & ETFs. Watchlists make it easy to monitor price movements and stay updated on the performance of specific investments.

- Investment Research: While Robinhood is known for its simplicity, it also provides basic investment research and analysis tools to help users make informed decisions. These tools include analyst ratings, earnings reports, and historical performance data.

- Instant Deposits: Robinhood offers instant deposits, allowing users to transfer funds from their linked bank account and start trading immediately. This feature can be useful for taking advantage of time-sensitive investment opportunities.

- Educational Resources: Robinhood provides educational resources and articles to help users learn about investing, personal finance, and the stock market. These resources cover topics such as investment basics, market trends, and trading strategies.

Overall, the combination of commission-free trading, fractional shares, user-friendly interface, and educational resources makes Robinhood a popular choice for investors looking to get started in the stock market. However, it’s important for users to conduct their own research and understand the risks involved in investing before making any trading decisions. It is also important to acknowledge that Robinhood in the UK is a far different platform to the one available in the UK

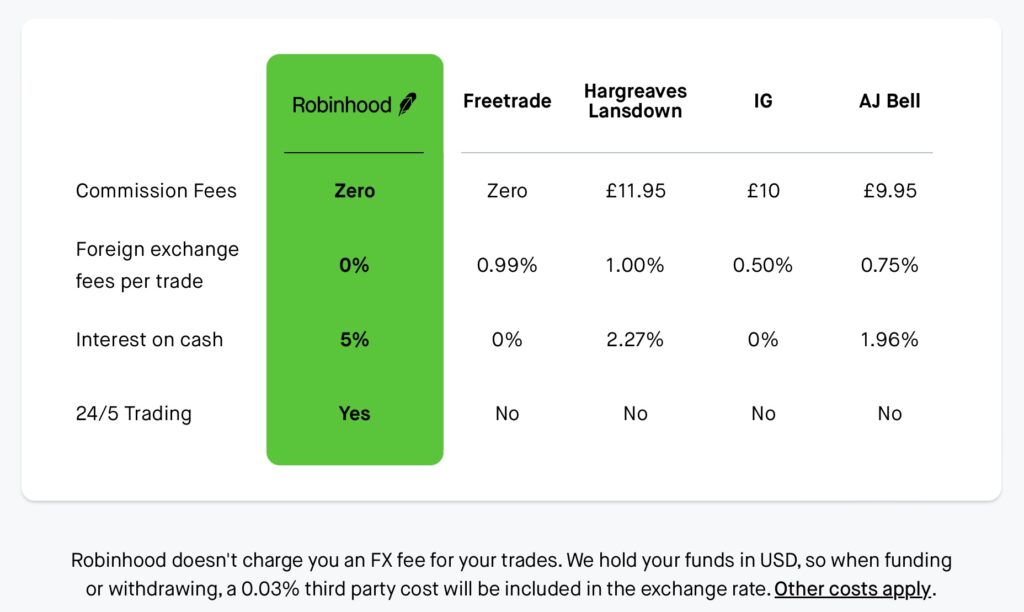

Comparison between Robinhood UK and some of the other platforms in the UK

How to Sign up For Robinhood in the UK : Remember to use our Robinhood referral link to get a FREE share worth $175

Signing up for Robinhood is a straightforward process that is completed entirely through the mobile app. Here’s a step-by-step guide on how to sign up for Robinhood:

- Visit the Website or Download the App: You can sign up for Robinhood by visiting their official website (robinhood.com) or by downloading the Robinhood app from the Apple App Store or Google Play Store. We recommend you follow our Robinhood referral link to activate the Robinhood free share offer here

- Create an Account: Once you’ve accessed the Robinhood platform, you’ll need to create an account. Click on the “Sign Up” or “Get Started” button to begin the process.

- Provide Personal Information: You’ll be asked to provide some basic personal information to verify your identity. This typically includes your full name, email address, date of birth, and Social Security number (or other identification number, depending on your country of residence).

- Verify Your Identity: To comply with regulatory requirements, Robinhood will need to verify your identity. You may be asked to provide additional information or documentation, such as a photo of your driver’s license or passport and complete a selfie to complete the identification process.

- Link Your Bank Account: To fund your Robinhood account and make trades, you’ll need to link a bank account. Robinhood supports linking checking and savings accounts from most major banks in the UK. You’ll need to provide your bank’s sort code and your account number to link it to your Robinhood account. This can be completed using open banking and true layer techonology.

- Complete Account Setup: Once your identity is verified and your bank account is linked, you’ll need to complete the account setup process. This may involve answering a few questions about your investment experience and financial goals.

- Set Up Two-Factor Authentication (Optional): For added security, you can enable two-factor authentication (2FA) on your Robinhood account. This will require you to enter a unique code sent to your phone or email whenever you log in.

- Review and Agree to Terms: Before you can start trading, you’ll need to review and agree to Robinhood’s terms of service and other legal agreements.

- Deposit Funds: Once your account is set up, you can deposit funds into your Robinhood account to start trading. You can do this by transferring money from your linked bank account.

- Start Trading: With funds in your account, you’re ready to start trading stocks, ETFs, options, cryptocurrencies, and more on the Robinhood platform.

It’s important to note that before you start trading, you should familiarise yourself with the risks involved in investing and educate yourself on how the stock market works. Robinhood provides educational resources and tools to help you make informed investment decisions.

Conclusion

In conclusion, Robinhood’s entry into the UK market has introduced a disruptive force in the world of online investing. Offering commission-free trading, fractional shares, and a user-friendly interface, Robinhood has quickly garnered attention and attracted a growing user base. By democratising finance and providing access to a wide range of investment opportunities, Robinhood has empowered UK investors, both novice and experienced, to take control of their financial futures.

However, it’s important to note that Robinhood’s expansion into the UK hasn’t been without its challenges. Regulatory hurdles and competition from established brokerage firms have presented obstacles along the way. Additionally, concerns have been raised regarding the gamification of investing and the platform’s role in facilitating speculative trading behavior. Further, being unable to trade stocks listed on the UK stock market and the limited functionality of the UK version of Robinhood should be taken into account.

Despite these challenges, Robinhood’s innovative features and commitment to accessibility continue to resonate with investors in the UK and beyond. As the platform evolves and adapts to the unique needs of the UK market, it has the potential to reshape the landscape of online investing and further democratize access to financial markets for individuals across the country.

Ultimately, Robinhood’s presence in the UK represents a significant step towards making investing more accessible, transparent, and inclusive. As the platform continues to grow and mature, it will be interesting to see how it navigates the regulatory landscape and addresses the needs of its users in the UK and beyond. Remember if you sign up for Robinhood using our Robinhood referral code you will get a free share worth upto $175

Recent Comments