Tax Scouts Referral Code:

Click the TaxScouts referral link above or here and get 10% discount on your self assessment completion. You will pay £134 instead of £149 for your accounts to be completed by a qualified accountant.

Tax Scouts Review – Affordable & Efficient Self-Assessment Tax Return Service

Check out our TaxScouts Review which looks at all the benefits and drawbacks of this online tax return service, from what it costs, to how the service works. You’ll discover everything you need to know in our TaxScouts review.

Whether you are a new sole trader or an experienced business owner – submitting your self-assessment tax return each year can be an extremely stressful process. Luckily, there are now a new breed of online tax return services (one of which is TaxScouts) which are both cheap and extremely easy to use. These platforms make sure you submit an accurate tax return to HMRC each and every year without incurring penalties and ensuring compliance with all the current rules and regulations.

A popular service in the UK is TaxScouts – who are a well-established and popular UK tax submission service with a solid online reputation catering to all types of customers who are required to complete a self-assessment return. But is this the right provider for you? Read our TaxScouts review below to discover the pros and cons of this self assessment tax return service.

Tax Scouts Review – What is TaxScouts?

Tax Scouts is an online service that you can use to streamline your self-assessment tax return process for an stress-free submission. This self-assessment tax return service aims to simplify taxes for freelancers, sole traders, business owners, and anyone else who is required to complete a personal self-assessment tax return. It should be pointed out that Tax Scouts specialise in self assessment tax returns rather than more wide-ranging accountancy requirements.

Tax Scouts do this by connecting those who require a tax return completed with accredited accountants online. The user-friendly platform has been created to ensure that taxpayers can use their service quickly, simply, and efficiently. No matter how much or little they know about the HRMC tax submission process.

For a fixed fee of £169 (or £153 if you use our TaxScouts referral code above) , the TaxScouts service will take all the hassle and time out of ensuring you are compliant with tax regulations. And leave you free to concentrate on more profitable aspects of your business or other income generating activities.

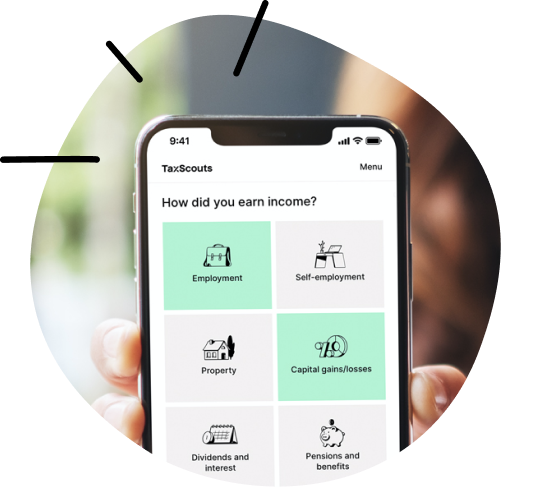

How Does TaxScouts Work?

Using the service is a quick and streamlined process. Before we delve into our Tax Scouts Review in detail, here is a breakdown of how the service works. And how it can help you submit your self-assessment taxes.

1. Data Gathering Stage:

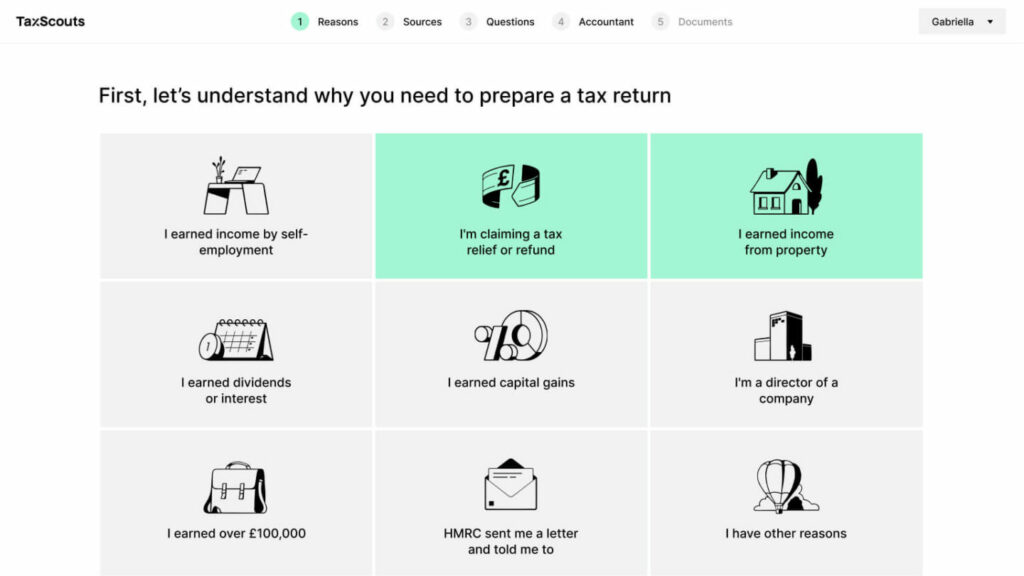

To get started with the service, you need to answer some questions about yourself and your business online. This stage makes sure that the platform has all the required information to help you with your tax return swiftly and correctly. This process should take at most a couple of minutes (provided you have all the relevant information to hand.)

2. Get Expert Guidance from an Accredited Accountant:

Once you have signed up for the TaxScouts service (make sure to use our Tax Scouts referral/discount code above to sign up and get 10% off) and you have submitted your personal and business information, the service will connect you with an accredited accountant who will guide you through the tax submission process.

This means you will have a personalised tax journey supported by a knowledgeable expert who will be able to meet the unique and specific needs of you and your business.

3. Swift and Secure Tax Filing:

Once your tax return has been prepared, the service will also help you with the filing process. After you have reviewed and approved your tax return, your dedicated accountant will then submit the return to the HRMC on your behalf within 48 hours. So, you can feel confident in a swift and secure submission which is compliant with the HRMC process.

TaxScouts offers its users more than just a tax-filing service. It’s also a comprehensive solution designed to make your experience simple, personalised, and efficient. If you aren’t confident with your ability to correctly submit your tax return or don’t have the time to devote to the process – then this could be £149 well spent!

Tax Scouts Review of Benefits.

Before we get into the details of TaxScouts’s features and costs, let’s take a look at the main benefits of the service to help you decide if this is the right option for you.

Simplicity and Efficiency:

Navigating the complexities of HRMC tax can be a time-consuming and stressful process if you don’t feel confident in what you are doing. The TaxScouts service allows you to save time and simplify your submission process. You simply need to provide the service with the information they ask for, and you’ll be connected with an expert who will oversee the process.

Fixed and Affordable Pricing – (Get 10% Off Using Our TaxScout Referral)

Another standout feature of the TaxScouts is the transparent and fixed pricing. As you’ve already seen in our Tax Scouts Review, for an affordable fee of £149, you can access the full suite of Tax Scouts services, including expert guidance, swift filing, and personalised attention from a matched accountant. This upfront and affordable pricing model ensures that you know what to expect without any hidden costs or surprises.

Expert Guidance and Personalised Attention:

One of the standout features of this service is the personalised assistance offered by accredited accountants for a very affordable price. Users are matched with a dedicated accountant who guides them through the process, providing expert advice tailored to their unique financial situation. This ensures that business owners receive the attention and support they need to make informed decisions about their taxes.

Swift Filing with Professional Oversight:

The qualified accountant you are matched with will oversee the entire tax filing process. Once you review and approve your tax return, your dedicated accountant will promptly submit it to HMRC. The result is a swift and secure filing, with the added assurance of professional oversight, reducing the time and effort you need to take away from other areas of your business to dedicate to your tax obligations.

Accessibility for All Taxpayers:

TaxScouts has been designed to cater to a diverse range of taxpayers, making the Self-Assessment process accessible and affordable to everyone. Whether you are a first-time freelancer, self-employed, small business owner, high earner, or involved in various occupations, the service can offer a tailored solution to meet your specific business tax needs.

Convenient Online Service:

TaxScouts operates entirely online, allowing you to complete your tax returns from the comfort of your home or office without having to arrange in-person meetings and appointments with an accountant. The digital platform is accessible 24/7, providing flexibility for users to engage with the service at their convenience.

TaxScouts is a comprehensive and user-centric solution, offering simplicity, expert guidance, efficiency, affordability, and accessibility to a wide range of taxpayers. Now let’s move onto the next part of our Tax Scouts Review – how much does it cost?

How Much Does TaxScouts Cost?

Tax Scouts offers three different service levels for users, depending on the types of support and features they need. From the basic tax return service to the complete tax bundle. You should be able to find a service to fit your needs. Here is a Tax Scouts Review of what’s available with each plan:

TaxScouts Return Service (£169) – remember you can save 10% using our TaxScouts discount code above or here

- You will be matched with an accredited accountant online.

- Your Self-Assessment tax return will be sorted and filed.

- Receive support to optimise your tax bill.

The Tax Advice Service (£119):

- Get matched online with an accredited accountant.

- Access to 1:1 tax advice consultation by phone or video.

- Receive a written summary of your tax advice consultation.

Tax Bundle Service (£229):

- Be matched with an accredited accountant.

- Your Self-Assessment will be sorted and filed.

- Get support to optimise your tax bill.

- Access to 1:1 tax advice consultation by phone or video.

- Receive a written summary of your tax advice consultation.

Each service comes with an all-in fixed fee, ensuring transparency and predictability in your budget.

Tax Scouts Review of Pros and Cons

As you can see in our Tax Scouts review above, there is plenty to recommend this self-assessment tax service. But before using the service, there are some pros and cons you should consider. No service is one-size-fits-all, and our list will help you decide if this service fits your specific needs.

TaxScouts Review of Pros:

Simplified Process:

Tax Scouts offers a user-friendly and straightforward process, reducing the complexity traditionally associated with tax filing. You simply need to answer a few questions online, so start making the entire experience more accessible.

Expert Guidance:

You will be paired with an accredited accountant who will provide personalised assistance and expert advice. This ensures that you will receive professional support tailored to your specific financial situation.

Swift Filing:

TaxScouts accelerates the tax filing process, with the potential to submit the Self-Assessment to HMRC in as little as 48 hours. This quick turnaround time is a benefit for users who prefer a prompt resolution of their tax obligations.

Transparent Pricing:

The fixed fee of £169 provides you with a clear understanding of the cost of services. This transparent pricing model ensures you can budget effectively without unexpected expenses. Get 10% off and have your self assessment completed for £134 using our TaxScouts promotional referral code HERE

Accessibility for Various Taxpayers:

TaxScouts caters to a diverse range of taxpayers, including first-time filers, self-employed individuals, freelancers, high earners, and those involved in specific occupations such as construction or courier services. This broad accessibility ensures that TaxScouts can meet the needs of a broad user base.

Online Convenience:

TaxScouts is an entirely online platform that allows users to complete their tax returns at their convenience, providing accessibility 24/7. This feature is especially beneficial if you have a busy schedule.

Tax Scouts Review of Cons:

Fixed pricing may not Suit All Budgets:

While the fixed fee of £169(or £153 using our Taxscouts referral) provides transparency, it may be considered relatively high for individuals with more straightforward tax situations. Some users might prefer a more flexible pricing structure based on the complexity of their tax returns.

Limited Face-to-Face Interaction:

The online nature of TaxScouts means that users interact with accountants virtually. While this is convenient and saves time, individuals who prefer face-to-face consultations may find this aspect less appealing.

Dependency on Online Platforms:

If you struggle with internet connectivity, you may face challenges accessing the TaxScouts platform. Technical issues or disruptions could impact the seamless completion of the tax filing process.

Not Suitable for Complex Financial Situations:

TaxScouts may not be the ideal solution if you have highly intricate financial situations that require extensive tax planning. In such cases, a more comprehensive, personalised, and in-person approach might be necessary.

Limited Control for DIY Users:

If you prefer a hands-on approach to their tax returns, you may find the level of assistance provided by TaxScouts accountants limiting. Some users may desire more control over the entire process.

TaxScouts offers numerous benefits, but when deciding if this is the right service for you, you should make sure these meet your individual needs and preferences. It’s essential to consider factors such as pricing, level of assistance required, and comfort with online platforms when deciding if this tax submission service is the right fit for you and your business.

Who Can Benefit From TaxScouts?

TaxScouts is a versatile platform that caters to a wide range of individuals, offering a stress-free and streamlined solution for tax-related matters. The platform is particularly beneficial for the following self-assessment tax filers:

First-Time Tax Filers:

Individuals who are filing their taxes for the first time can benefit from TaxScouts’ user-friendly interface and expert guidance, making the process less intimidating and more accessible.

Self-Employed Professionals:

Freelancers, contractors, and self-employed individuals can use TaxScouts to simplify the complexities of tax filing associated with their unique work situations.

Freelancers and Contractors:

Those working on a freelance or contract basis can use the service to navigate the intricacies of self-assessment, ensuring accurate and compliant tax returns.

Investors (Property, Forex, Crypto, etc):

Investors involved in various assets, such as property, foreign exchange (forex), or cryptocurrencies, can benefit from these tax submission services to manage their tax obligations efficiently.

High Earners (£100K+):

Individuals with higher income levels, including those earning £100,000 or more, can benefit from TaxScouts to manage their tax affairs efficiently and optimise deductions.

Landlords (Including Airbnb Hosts):

Property owners and Airbnb hosts can rely on TaxScouts to navigate the complexities of rental income tax and ensure compliance with relevant regulations.

Expatriates (Expats):

Expatriates living abroad can also use this online platform to manage their UK tax obligations seamlessly, even from different geographic locations.

Couriers, Riders, or Drivers:

If you provide delivery services, such as courier, rider, or driver services, you can find TaxScouts valuable for simplifying their tax filing and compliance processes.

Tax Scouts Review – Is TaxScouts the Right Tax Submission Service for My Business?

Deciding whether TaxScouts is the right fit for your business depends on the nature and complexity of your business finances. TaxScouts is particularly well-suited for small businesses, freelancers, and contractors who seek a simplified and streamlined approach to tax filing.

The platform’s emphasis on user-friendly online interactions, expert guidance from accredited accountants, and a fixed pricing structure can be beneficial for businesses looking to navigate the tax filing process efficiently without facing high accountant costs.

If your business falls into categories such as self-employed, a freelancer, or operates in industries like construction or courier services, TaxScouts may align well with your needs, offering a convenient and stress-free solution to managing tax obligations.

However, if your business has complicated financial structures, significant investments, or requires in-depth tax planning beyond the scope of a simplified online tax return service, you may want to assess whether TaxScouts can adequately address your specific requirements.

Remember that TaxScouts takes the hassle out of completing your self assessment for £169 which can be reduced to £153 using our TaxScouts referral here

Recent Comments