Tide Referral Code: REFER200

|

|

|

|

Tide Bank Business Account Overview (FEBRUARY 2025)

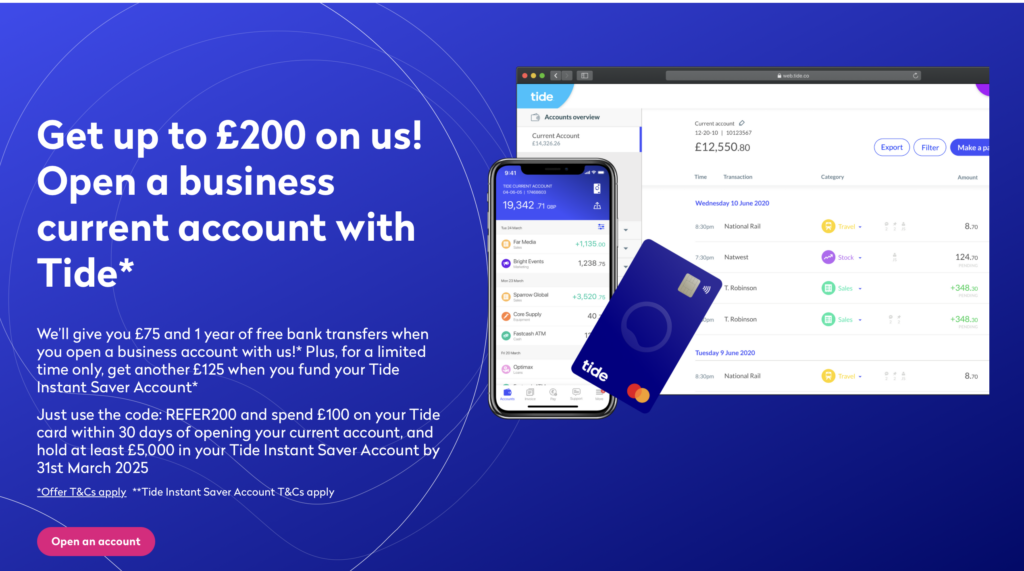

Get £200 signup bonus by entering Tide referral code: REFER200 (payable within 6-8 weeks of account opening). You will receive £75 as long as you have completed £100 of transactions within 30 days & another £125 Free when you deposit £5000 in a Tide Instant Savers Account within 30 days – Full T&Cs on the link above.

- Sign-up in as little as 10 minutes on a mobile device or via the web. You can also choose to register your company at the same time (for £14.99 saving £35) saving valuable time in getting your company and/or account set up to operate without having to visit any branches.

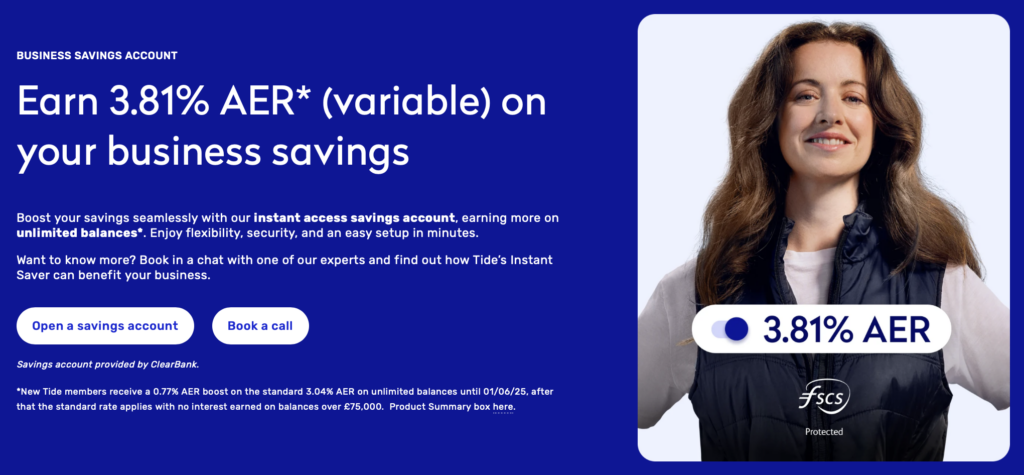

- Market leading Business Instant Savings Account with a 3.81% AER (Interest rate of 3.04% AER + an introductory bonus 0.77% boost until 01/06/25)

- No credit check required to open an account, therefore there is no risk in trying out Tide alongside an existing account

- Free sign-up, with no annual or monthly fees

- 1 Year of FREE UK bank Transfers

- Free Mastercard usage (at home and overseas)

- Access to all Tide Platform product features to manage their business admin such as the Company Registration tool, Virtual Office Address, Receipt Importer, VAT Manager (which links to HMRC), Expense Management, Expense Team Cards, Accountancy Software Integrations, Invoicing Tool, Invoice Protection, Invoicing by Direct Debit (with GoCardless), and Apple Pay

Tide Business Account - The Ultimate 2025 Review (Updated)

I recently took the plunge to go freelance full-time after many months mulling over the idea. Not only was this a big decision for me but I quickly realised that I had to learn about starting and running my own business – and that included opening a business bank account fast.

Although the idea of opening a new business bank account was intimidating at first, I needn’t have worried. That’s because gone are the days where you need to don a suit or dress and make an appointment with the bank manager and take all your paperwork to the branch. These days you can setup a new business account online and be ready to go in a matter of minutes.

After trawling google and reading up on the various business banking options available, I decided I didn’t want to go with one of the boring old high street banks which led me to a modern fintech bank known as Tide. I signed up using a Tide Promo Code: REFER200 to get £200 free and free cash aside I have genuinely been impressed with the service I have received especially as there’s no monthly fee.

Below is an in-depth review giving you with all the information you need to make an informed decision on whether Tide Bank is right for you. There are definitely a few things you need to consider before making your choice. Me personally – I have genuinely been impressed with the service provided by Tide and would wholeheartedly recommend them especially new start-ups.

Who are Tide Bank?

Tide is a private limited company founded by George Bevis in 2015. Tide has a customer base of over 400,000 small and medium-sized business, making up a market share of over 7% in the UK SME sector and making them the 7th largest provider of business banking services in the UK. They are definitely one of the fastest growing business banks in the UK and remember they have a partnership with Clear Bank which ensures you have full FSCS protection on your bank deposits.

How do you open a Tide business account ?

Tide is one of a group of new modern, innovative business accounts with a mission to make business banking simple. In the past opening a business bank account took days and even weeks and required you to visit in-branch to complete the paperwork. With Tide all you require is a form of ID and a smartphone and 10 minutes of your time (you can also complete on the Tide website if you so wish)

The signup process is fantastically simple. There is no queuing or appointment required. Simply download the app on your device to start the signup process or you can use the tide.co website. Then complete the following steps:

- Enter your personal details

Simply complete your personal details

(Don’t forget to enter Tide Referral Code: REFER200) during this phase to get £200 Free cash added to your account. If you forget to apply the code you can contact Tide in app and the code can be applied retrospectively if your account has been opened for 7 days or less.

2. Tell them about your company

Here you input your company name if you have one (or your name if you use that for your business) and basic details about your area of business.

This account is for both sole traders and those who have or want a limited company If you require a limited company setting up – Tide will do this for you during the same sign up process and it’s only £14.99 saving you the hassle of doing this separately and also paying the £50 fee

3. Scan your ID and take a selfie

Once that’s complete, you will need to upload your identification and take a selfie for the account. Not only is this an innovative and modern onboarding method but it also helps to secure your account.

4. Wait for approval

Tide state the approval usually takes about 10 minutes but mine was approved in a matter of seconds. In some instances it can take longer if Tide need to complete extra checks on your account opening.

Success!

You are officially up and running. You should be able to see your account number and sort code in the app already and Tide will get your card to you in a couple of days. In less than ten minutes, I went from having the basis of a business idea to officially having a LTD company and a professional secure business bank account1

Is Tide Bank open to everyone?

Tide is open to side hustlers, freelancers, UK based sole traders or limited company owners. If you’re the director of a business registered with UK Companies House, you will automatically be eligible for a registered business account.

UK-based side hustles, sole traders and freelancers with a valid UK residential address are also eligible for a sole trader account (subject to approval). You can even setup an account even if your business is not ready to go yet. If you’re an individual looking to set themselves up with a limited company, Tide can also help you with that!

There are a few businesses that Tide will not offer a current account to and these include some of the following: Insurance, cryptocurrencies, CBD, casinos, weapons and unlicensed pharmaceuticals which seems reasonable but they also do not offer accounts to non profit organisations and charities. The full eligibility criteria is available on the Tide website.

I had an idea for a business. Signed up for an account in minutes using my own name in the company name box as I hadn’t even decided on a company name yet – Was approved immediately!

I even got £200 free cash using Tide referral code REFER200 which I can put towards my new side hustle 🙂

Jayden Connor from Leeds

NEW Business Instant Savings Account - 3.81% AER (3.04% AER + 0.77% Introductory Bonus Until 01/06/25)

Tide have recently launched a new Instant Savings Account with an interest rate of 3.81% AER with the following features:

1. Market leading rate of 3.81% AER

2. Flexible easy access to savings (easily move money to and from your savings account)

3. Interest rate of 3.04% AER (variable) plus 0.77% Introductiory bonus until 01/06/25

3. No limits or fees on withdrawals (no regular deposits required, notice periods or penalties on withdrawals)

Signing up is easy too – You will be asked if you would like to signup for an Instant Saver Account during the registration process or you can click on the open Instant Saver Account option in the Tide app and you are ready to go! You can start earning monthly interest on as little as £1 deposited.

Can Tide Bank really help me to set up my own Limited company?

The answer is yes! Usually this costs £50 and involves a bit of admin with the gov.uk website or having to use a company formation agent. Using Tide means you can open a business account and a limited company in one go if you so wish. Click the following link for direct access to the £14.99 limited company and FREE £200 offer: https://www.tide.co/partners/refer-save-refer200/?cofo or you can enter the code Tide promo code REFER200 on the tide website or app to activate the offer.

Remember opening a limited company is not something which should be taken lightly as it will mean you have a legal business which brings with it some legal requirements. It is really important to note that you will be required to do your own research around how to comply with the law and HMRC.

There are of course a number of benefits to being setup as a limited company rather than as a sole trader including but not limited to more efficient tax treatment and limited liability should your business fail. More details available online and you should read up as there is plenty of information available online.

Is my money safe?

YES! – Your account and eligible deposits, up to £85,000*, are protected by the UK Government’s deposit guarantee scheme, the Financial Services Compensation Scheme (FSCS) similar to pretty much every other bank in the UK.

*Eligible deposits with ClearBank are protected up to a total of £85,000 by the Financial Services Compensation Scheme (FSCS), the UK’s deposit guarantee scheme. This limit applies to the total of any deposits you have with ClearBank. Any total deposits you hold above this limit are unlikely to be covered.

To verify against fraud, Tide also perform electronic checks (run by third-party services) to verify your identity. They also comply with UK anti-money laundering regulations and manage to get all of your information verified before opening your account. You can then be sure nobody can take out an account in your name or take your money.

I used Tide Referral Code: REFER200 when signing up and got £200 FREE cash added to my account a few weeks later. Thank you !

Jessica Eldridge from Surrey

Account and app features

Once you’ve downloaded Tide and have passed all the relevant checks, you can now check out your new Tide account app!

You can set your own password or choose facial recognition or Touch ID. I chose Face ID as it’s far more secure and I’m also not the best at remembering passwords. Once it’s recognised you, you’re in the app and you can start enjoying the following features:

Access your account – you’ll be able to see your balance, create/send/export your invoices or have a closer look at your incomings and outgoings

Integrate your accounts – Tide allows for integration with Xero, Sage and other accounting software you might use. I have xero and this allows linking directly between the two which means I can monitor my live profit and loss account, balance sheet and tax position including what VAT I owe etc in real time.

Create, send and pay invoices – This is one of the greatest functionalities of the Tide app. Create professional looking invoices and send them to your customers directly from the app. Then use the invoice matching functionality to mark these are paid when you receive a payment from your customers.

The app also allows you the following features:

- Payment notifications – In app notification alerts so you can keep tracks on both incomings and outgoings.

- Secure PIN number – Access to your card pin if you ever forget what it is and need a reminder.

- Apple pay integration – pay for your coffee or train and expense it, all within the app

- Freeze and unfreeze your card – this takes seconds, handy for it your card gets lost or stolen

- Multiple accounts – you can even set these to have their own account number all running from the same app with easy switching.

- Transaction categorisation: The ability to categorise all your transactions as per the HMRC codes to make it easier to complete financial reporting requirements an for your to see spend types easily.

- App and website mirroring – only use the app? If you ever need to use desktop, you’ll find exactly the same information awaiting you securely

- Business loans – securely apply for a company loan to take your business to the next level

- Set up direct debits or schedule payments – a very handy time-saving feature which can be completed directly in the app

- Monthly bank statements – just like with a regular bank, you can download these as a PDF for your accountant or just your own record

- Tide Credit Builder – which allows you to build your business credit score

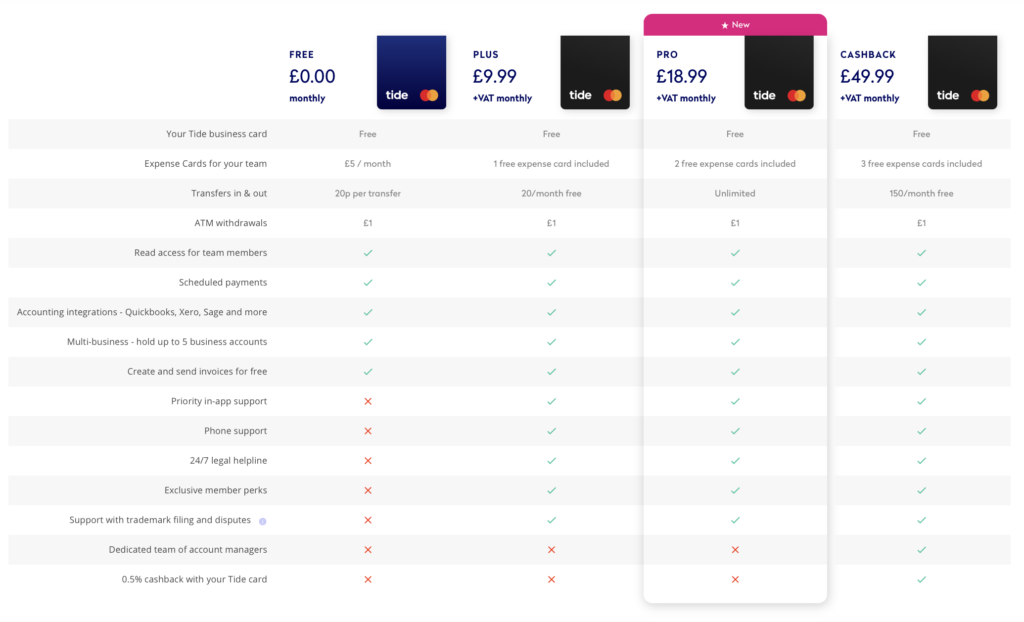

How much is it going to cost me?

For me, this was always the most important question. There are different subscription tiers based on the service you are looking for.

If you’re not keen on paying a monthly fee for your account (which the majority of business accounts charge) then Tide have an account just for you (and me). I think the free account would be suitable for most if not all new businesses starting out.

| Service | Fees |

| Tide’s FREE account | FREE – no catch |

| Tide’s PLUS account | £9.99 + VAT monthly |

| Tide’s PRO account | £18.99 + VAT monthly |

| Tide’s CASHBACK account | £49.99 + VAT monthly |

| Transfers in & out | FREE – 20p per transfer PLUS – 20 a month for free PRO – unlimited CASHBACK – 150 a month for free |

| ATM withdrawals | £1 |

| Expense cards | FREE – £5 per month PLUS – 1 free card included PRO – 2 free cards included CASHBACK – 3 free cards included |

| Cash deposits at the Post Office | £2.50 for deposits up to £500 or 0.5% of the total deposit amount for deposits over £500 |

| Cash deposits at Paypoint | 3% of the total transaction value |

What are the different account types?

There are four: FREE, PLUS, PRO and CASHBACK.

All of the membership types give you the following:

-

- A FREE Mastercard debit card

- £1 ATM withdrawals

- Scheduled payments

- Accounting integrations

- Multiple business accounts (up to 5 in total)

- Create and send invoices for FREE

The additional benefits for each account are shown here:

If you a just starting out the free account is perfect. However, if you are scaling up then upgrading to the £9.99 or above price plan is an inexpensive option for fee-free transfers, priority support and a legal helpline and other benefits

Can I use Tide business account abroad?

Tide do not charge any fees for using your Tide Mastercard abroad or online and if you pay in other currencies Tide will charge using the Mastercard exchange rate with no markup. Tide will still charge the standard £1 fee to withdraw cash from an ATM

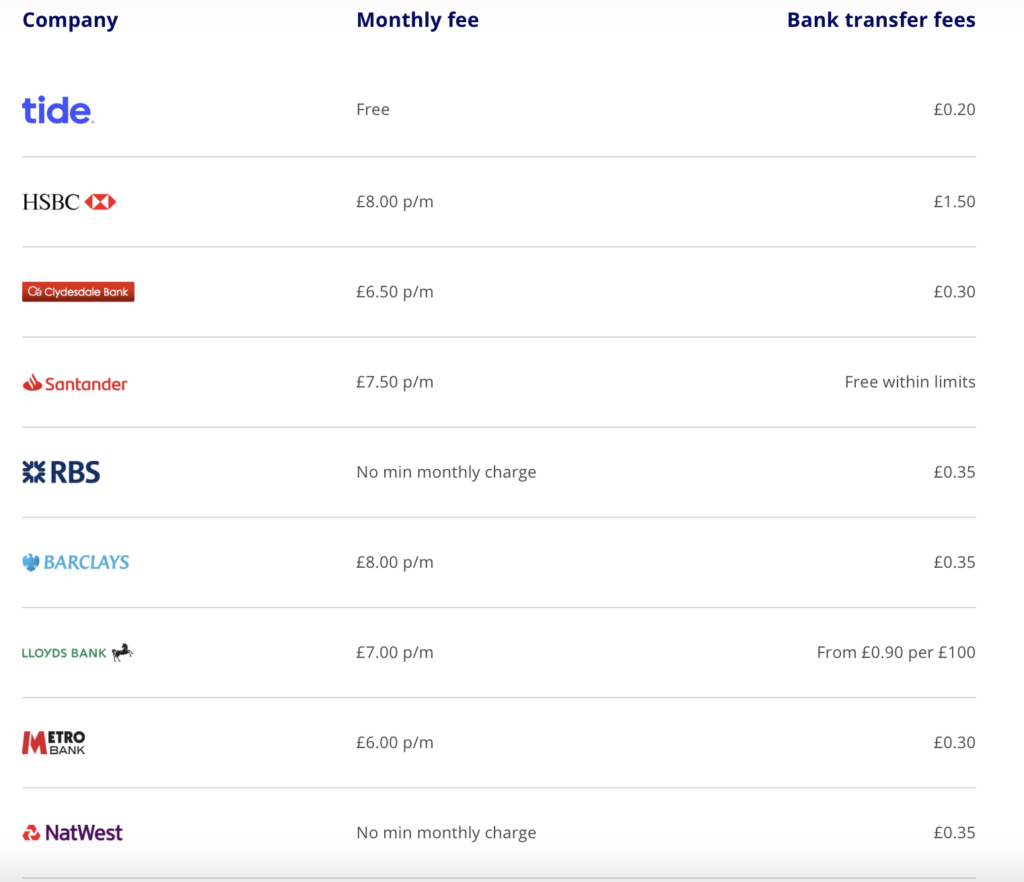

Is Tide bank better than its competitors?

There are a large number of other providers who provide banking services to small and medium businesses in the UK. The majority of the old high street banks all have a business bank account option but this is not something I really considered.

Most if not all have outdated apps and require you to complete an onerous signup process to get a new account ready to go. They also largely still charge a monthly fee for access to their business banking services as highlighted below:

So which company wins?

Like with anything, it is best to establish what it is you’re looking for from a business banking account. If your priority is startup-friendly, Tide is your best bet. They are the only company to offer the feature to register your own Limited Company at the same time and you can be ready to go in minutes.

Monzo and Starling are also good for starter companies as they are fee-free for those who need it and are very quick and easy to set up. Having tried all 3 I can say there is not much to choose between them. I have just decided that Tide is the best for my requirements and I love the app. Of course the Tide Referral Code definitely helps as entering REFER200 when signing up means you get £200 free cash added to your balance.

I love the fact Tide can turn you from a regular person with an idea to a company director with a business bank account and limited company all setup in ten minutes. Some of you may prefer to stick with their regular high-street bank or one of the other household names as they are well known and more trusted but the FSCS protection should help somewhat to calm any concerns you may have. If you don’t mind having no face to face contact with your bank and are comfortable using in app chat to contact customer services then Tide could be perfect for you.

How’s the customer support?

Tide currently has a 4.4 rating from 14,000 Trustpilot reviews. Three out of four consumers have had a five-star experience.

Responses to reviews are excellent. A recent five-star review mentioned Tide’s lack of ability to pay with cheques. This did get an official reply saying that this feature will be rolled out soon so this might be good news for those of you who need to use cheques.

All reviews are responded to with genuine interest in the consumer’s experience. The one-star reviews largely seem to relate to members being unable to access their account which, as advised in Tide’s responses, seem to do with ensuring security for the account.

Reviews largely seem above average compared with Fintech rivals.

Should I sign up for a Tide business account? Remember you can use Tide Referral Code: REFER200 for £200 cash.

I originally chose the Tide account simply because of their free pricing tier, plus the support they give to new companies including the FREE £200 for using the Tide referral code: REFER200. For me this also included £14.99 limited company formation during the registration process which meant I was ready to go as soon as my account was approved. I have not regretted my choice since.

That said there are definitely some negatives to using the Tide account which although not an issue for me – may indeed mean you need to look elsewhere for business banking services.

There are a huge number of positives to signing up for a Tide account but you might want to see if any of the below are likely to be issues for you before opening an account. For me these were all non issues as they are functionalities I don’t need or require for my business.

What are the downsides of having a Tide bank account

Tide does not have a physical presence on the high street so if you prefer to complete your banking face to face then Tide is not the account for you. This obviously means that if you need to pay cash in to your account you will need go to the post office or a Paypoint location but there are fees involved. Therefore all contact with Tide is through the in app chat functionality (although you can pay a monthly fee to go on to a higher pricing plan which does include telephone support).

Tide also do not provide any ability to pay by or receive cheques so if your business regularly uses these you might want to think twice about opening a Tide account. They also do not provide any support for international payments (unless you have a specific Tide currency account) so you cannot make payments to international accounts and you are only provided with a normal account number and sort code (no IBAN)

There are also a number of business categories which Tide do not support – please check out the eligibility criteria on the Tide website for more details although 95% of these are to be expected.

Frequently Asked Questions For Tide Promo Code: REFER200

What is the Tide Business Banking app referral code?

Use Tide referral code: REFER200 to get £200 FREE cash added to your balance, FREE bank transfers for 1 year and FREE LTD company formation if required

How do you open an account with TIDE business banking?

You can register directly at the tide.co website or you can download the ios or android app and register directly in app. Don’t forget to use the Referandsave EXCLUSIVE Tide referral code: REFER200 to get £200 for opening an account

What is the criteria to get your £200 free cash at Tide banking?

You must use referral code: REFER200 when registering or within 1 week of registering by contacting through the in app chat feature. You must then complete £100 of card transactions within 1 month to receive £75 bonus cash. You must deposit and hold £5000 in a Tide Instant Saver account within 30 days to receive a further £125 bonus cash.

What is the eligibility criteria for this offer?

To be eligible to receive the REFER200 promotional offer (the “Offer”), applicants must successfully open a business current account with Tide. The Offer is only valid for new accounts and applicants who haven’t previously opened an account with Tide.

When will I receive the £200 cash?

The £200 will be credited to your account within 8 weeks of completing the activation criteria but you can always contact Tide in-app to find out when you are likely to receive the bonus.

Recent Comments