Wealthyhood Referral

Clicking the link will not show any obvious signs a referral has been activated but this is normal. Your signup has been tracked.

Wealthyhood is a new user-friendly investment platform available in the UK that offers a wide range of resources and tools for making informed investment decisions. With customizable portfolios, real-time market data, and no fees, it’s an affordable option, especially for beginner investors. I have been using this app for the last few weeks and I have to say I’m loving the hands-off approach to investing this allows me. Below I will give you a high-level overview of the Wealthyhood service and as an added bonus if you sign up with the Wealthyhood referral link provided in this article and deposit at least £10 you will receive a FREE ETF share worth up to £200 bonus.

The Wealthyhood signup process using the Wealthood Referral Link

Want to claim your free £200 bonus now? You’ve come to the right place! Click the link which activates the referral offer in this article and then:

- Enter your email address

- Provide email verification code (mine took a few minutes to arrive so be patient)

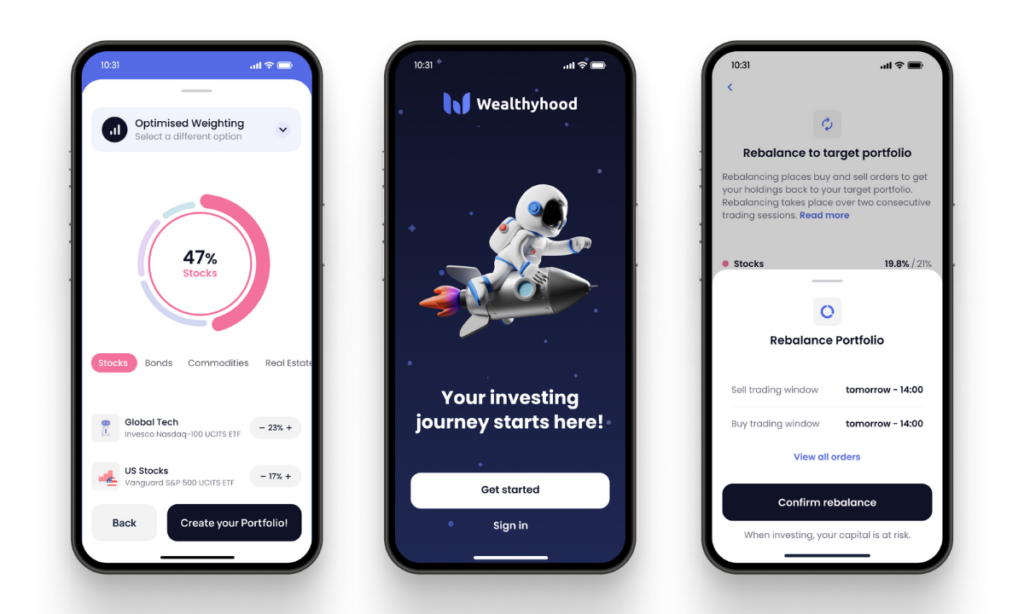

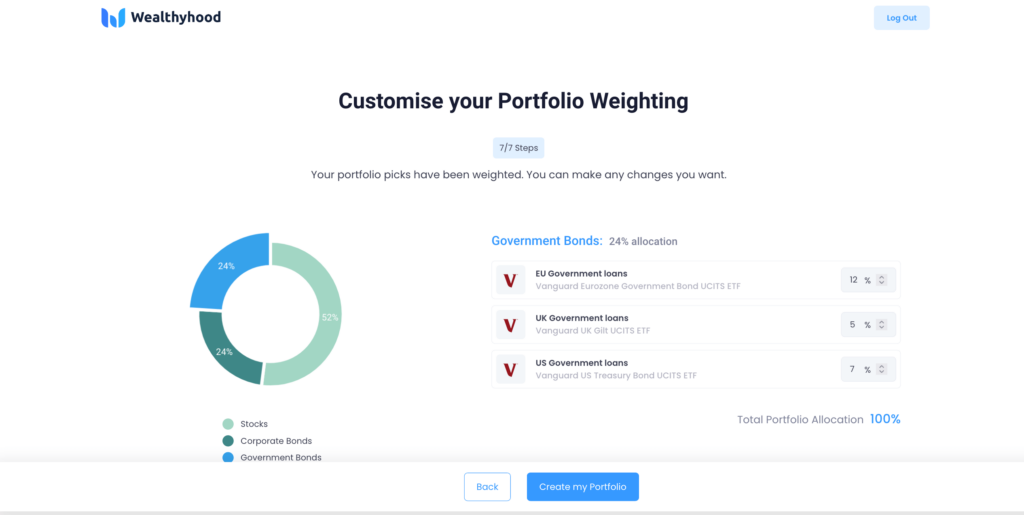

- Build your personalised portfolio: Click through the steps and decide what sorts of investments you are interested in – From picking whether its shares, bonds, commodities or real estate – and whether it is just in the UK, Europe or the US – to the types of funds you are would like to invest in from technology to healthcare. Don’t worry too much if you are unsure – pick those that interest you (you can obviously change these once you are more familiar with the app and have a better feel for your investments).

Next, Wealthyhood will optimise and allocate a weighting to your chosen categories based on the investment details you submitted earlier (although you can adjust manually the percentages if you decide to). - Enter your personal details – Just the usual request for name, address, DOB and National Insurance number and it was complete.

- Make a deposit – Deposit the minimum of £10 within 7 days to activate the referral but deposit whatever you are comfortable with to begin your investment journey. I deposited £100 using open banking and this amount was spread out across the weighted categories I had chosen earlier.

- What about the free share? Wait a few days for your free share to be credited to your account but ensure you hold your investment for at least 60 days to keep it!

- Setup scheduling You can choose to make regular top ups to your investment profile or make ad hoc payment moving forward

And thats it – you are on your way to investing with Wealthyhood.

Investing made easy with Wealthyhood

What makes Wealthyhood different to all the other trading platforms in the UK? Well if you are a new investor looking to dip your toe into the world of investing but feel overwhelmed by all the options out there then Wealthyhood is aimed directly at you.

Having used the app these last few weeks I have been impressed with the simplicity of both the signup process and the app as a whole – but most importantly it is what Wealthyhood has achieved with its hand-off approach to investing that has impressed me the most. Let’s be clear – Wealthyhood is aimed directly at those users who want a diversified portfolio but who have little time to make individual stock picks or investment decisions. This is not a platform designed for the seasoned investor looking to make daily stock choices and micro-managing his or her portfolio of investments. This is a platform designed to encourage regular investment in a basket of shares linked to your chosen ETFs and investment profile when you signed up.

If you are looking for a straightforward app that does all the hard work for you and allows you to invest in a broad range of investments which are chosen from a suite of ready prepackaged investments (managed by multi-billion dollar fund managers) then this is what Wealthyhood is all about.

What does it cost to use Wealthyhood?

Commission Free Trading

Wealthyhood promises commission-free trading. So basically when you buy investments (every time you add money to your account) – there’s no charge. All the selling and rebalancing of your portfolio to meet your weighted profile has no charges either. That said Wealthyhood do charge a monthly plan fee which is described below.

Wealthyhood Plans

The Wealthyhood team understands that starting on your investing journey can be overwhelming and that’s why they have created three different plans to choose from. At the time of writing this review only the beginner plan is available but we look forward to seeing the full details of what is on offer in the other plans

The Wealthyhood beginner plan is the perfect starting point for anyone new to the world of investing. At just £1/month, this plan offers unlimited commission-free investing in ETFs, portfolio automation, and over a million personalised portfolio templates. It also includes real-time guidance and insights on ETFs, so you can make informed decisions and watch your wealth grow.

For those looking for more advanced options, the Wealthyhood ISA plan is the way to go. Priced at £3/month, this plan includes everything included in the beginner plan plus access to a Stocks & Shares ISA account, which means you can invest inside the ISA wrapper for tax benefits. It’s a great way to make your money work harder for you.

Last but not least, the Wealthyhood Pro plan is for the more serious investor. Priced at £7/month, this plan includes everything in the Beginner and ISA plans, along with instant execution of your trades (currently when you buy/sell/rebalance your portfolio this is not immediate and can take a few hours to execute). And finally, this plan includes premium tools which are looking forward to hearing more about.

How safe is Wealthyhood?

Wealthyhood is fully regulated by the FCA and an appointed representative of WealthKernel Limited, providing added trust and security to your investments. Your money is also protected by the FSCS up to £85,000 and the platform uses the latest security features to keep your investments safe. The App does use open banking to link to your bank account but this uses true layer security and still requires you to log into your bank account to make deposits to Wealthyhood.

Is Wealthyhood really good for beginners?

Yes, it is! Wealthyhood is designed with beginners in mind. If you’re new to investing and not sure where to start, Wealthyhood is a great option for you. The platform guides you through the process of building an investment strategy that aligns with your goals and risk tolerance. The interface is user-friendly and easy to navigate, making it accessible for even the most novice of investors.

One of the great things about Wealthyhood is that it allows you to start with as little as £10, and you can invest as little as £1 into each investment. This is perfect for those who are just starting to save and invest their money. Plus, there are no commission fees, so you can keep more of your money invested instead of paying it out in fees. And don’t forget if you sign up with our Wealthyhood referral you can get a FREE share when you have deposited £10 within 7 days (worth upto £200)

Wealthyhood also offers a range of educational resources and guides to help you learn more about investing and the basics of the stock market. They have partnered with Finimize, a great app for easy-to-understand financial news and analysis. This is a great way to learn more about the market and make informed decisions about your investments.

Why invest with Wealthyhood?

If you are a beginner or just don’t have the time to research all your investment decisions then Wealthood is perfect for you. I’ve been impressed with the easy and user-friendly process of customizing my portfolio. The platform guides you through 7 steps, starting with selecting your asset class – stocks, bonds, commodities, and real estate. Then you choose the geography of your investments and finally your desired sector or industry (The platform offers a variety of sectors to choose from such as technology, consumer, communication and more)

I also liked the option of selecting additional ETFs from any asset class or industry. If you’re not sure what weighting your portfolio should have, Wealthyhood’s model will help you to statistically optimize it or you can do it manually.

Now, I’ll be honest, the range of investment options is small and there is no opportunity to purchase individual stocks. There is also currently no Stocks & Shares ISA or personal pension offered. But, with a commission-free service, a low monthly subscription of £1 and the ability to invest like a professional without knowing a thing about investing, Wealthyhood is a great option for those looking to grow their wealth over the long term in a hands-free way.

What About Customer Support?

When it comes to customer support, Wealthyhood is like most other online trading platforms in that the only way to contact them is online. Although currently, the only way to reach out for help is through email. This can be a bit of a drag for those who prefer more immediate assistance, as there is no live chat feature within the app or phone number to call. However, the response times to emails have been prompt and the FAQ section on the website is quite extensive and helpful.

It is worth mentioning that the team behind Wealthyhood is reputable, with a wealth of experience from their past tenures in companies such as Morgan Stanley and PlayStation. The co-founders, Alexandros Christodoulakis and Konstantinos Faliagkas lead the company from their base in London.

Overall, while the customer support may not be the strongest aspect of Wealthyhood, the team behind the app and the helpful FAQ section can provide some peace of mind.

Wealthyhood Features Summary

Customization:

One of the best things about Wealthyhood is the ability to customize your portfolio to suit your individual needs and goals. Upon opening an account, you’ll be guided through a series of questions to determine your preferred asset class, geographical location, and industry sectors for investment. This includes options for stocks, bonds, commodities, and real estate, as well as the ability to invest globally or solely in the US. Additionally, you can select additional ETFs from any asset class or industry, and even have the option to manually weight your portfolio or use Wealthyhood’s model for statistical optimization.

Auto Investment and Portfolio Rebalancing:

Once you’ve set up your personalized portfolio, Wealthyhood offers the convenience of auto-investment and portfolio rebalancing. The auto-investment feature allows you to automatically split your money between all investments in your portfolio, saving you the hassle of individually buying each one. As your portfolio grows, the weighting may change due to some investments growing faster than others. To ensure your portfolio stays aligned with your original strategy, Wealthyhood offers automatic portfolio rebalancing, buying or selling investments as needed to maintain the desired ratio.

Range of Investments:

Wealthyhood offers a good range of investment options, including investment funds (ETFs) in global stocks, UK stocks, US stocks, and various industry sectors such as technology, healthcare, and financial services. Additionally, there is a good selection of bonds from around the world, and the option to invest in gold as a commodity. While the platform does not currently offer the ability to invest in individual stocks, shares, or property, the investment fund options provide a diverse and safer option for long-term investing.

Investment Account Options:

Currently, Wealthyhood only offers the option to invest within a General Investment Account (GIA), which is the standard investment account available to anyone. However, the platform does not offer tax-free benefits such as a Stocks & Shares ISA or personal pension. Additionally, it does not have a live chat feature for support. But with the low monthly subscription fee of only £1, and the ability to earn a free share worth up to £200 upon signing up, the benefits of using Wealthyhood far outweigh these limitations – Sign up here with our Wealthyhood referral LINK

Wealthyhood pros and cons

When it comes to Wealthyhood, there are certainly some pros and cons to consider before signing up. Let’s dive in and take a closer look at what the platform has to offer.

Pros:

- Perfect for beginners: If you’re new to investing and not sure where to start, Wealthyhood is a great option. The platform is user-friendly and offers plenty of guidance to help you build a custom professional investment portfolio that suits your goals.

- Commission-free: One of the biggest perks of Wealthyhood is that it’s completely commission-free. This means that you can invest without worrying about fees eating into your returns.

- Create a custom professional investment portfolio: Wealthyhood allows you to create a custom portfolio tailored to your needs and goals. The platform offers a range of investment options and helps you pick the best options for your portfolio and it is fully automated!

Cons:

- Small range of investment options: While the platform offers a good range of options for beginners, it’s not as comprehensive as some other platforms. For example, you can’t buy individual stocks or shares, which can be a limitation for some investors.

- No Stocks & Shares ISA: Wealthyhood doesn’t offer a Stocks & Shares ISA, which is a tax-efficient account that allows you to hold shares and other investments. This can be a downside for some investors who are looking to take advantage of tax breaks.

- No personal pension: Similarly, Wealthyhood doesn’t offer a personal pension plan, which can be a limitation for those who are looking to save for retirement.

- No live-chat feature: The customer support at Wealthyhood is limited to email, and there’s no live-chat feature available. This can be a bit of a disadvantage if you need quick help or have a question that can’t be answered by the FAQ section.

Overall experience with Wealthyhood

And don’t forget the Wealthyhood Referral.

In conclusion, Wealthyhood is a user-friendly and affordable investment platform that offers a wide range of resources and tools for making informed investment decisions. As someone who has used it – I would recommend it to beginner investors looking to get started on their investment journey but with a guiding hand at the wheel. Don’t forget to use our Wealthyhood referral link to help keep the lights on at Referandsave HQ and earn yourself a share worth up to £200 in the process. Use the link above or here.

Recent Comments